Filing state taxes can be a daunting task, but understanding the process and having the right guidance can make it manageable. Connecticut residents are required to file their state tax returns annually, and using the correct form is essential. In this article, we will provide a comprehensive step-by-step guide on how to file the Connecticut state tax form.

Importance of Filing Connecticut State Tax Return

Filing a Connecticut state tax return is crucial for residents who earn income within the state. The state government uses the tax revenue to fund various public services and infrastructure projects. Moreover, failing to file a state tax return can result in penalties and interest on the owed amount. By understanding the process and filing correctly, you can avoid any unnecessary issues and ensure you receive any refund due.

Who Needs to File a Connecticut State Tax Return?

Not all Connecticut residents are required to file a state tax return. The state requires individuals to file if their gross income meets certain thresholds. For the 2022 tax year, the thresholds are:

- Single filers with a gross income of $12,000 or more

- Joint filers with a gross income of $19,000 or more

- Head of household filers with a gross income of $19,000 or more

Additionally, if you have any Connecticut-sourced income, such as rental income or self-employment income, you are required to file a state tax return, regardless of your gross income.

Connecticut State Tax Forms

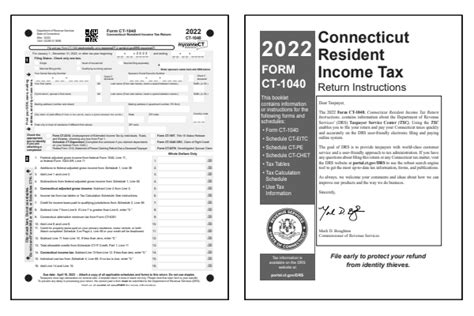

The Connecticut Department of Revenue Services (DRS) provides various tax forms for different filing situations. The most common forms include:

- Form CT-1040: Individual Income Tax Return

- Form CT-1040NR/PY: Non-Resident/Part-Year Resident Income Tax Return

- Form CT-1120: Corporation Business Tax Return

In this article, we will focus on the individual income tax return, Form CT-1040.

Step 1: Gather Required Documents

Before starting the filing process, it's essential to gather all the necessary documents. These include:

- W-2 forms from your employer

- 1099 forms for any self-employment or freelance income

- Interest statements from banks and investments

- Dividend statements from investments

- Charitable donation receipts

- Medical expense receipts

Step 2: Choose Filing Status

Your filing status determines your tax rates and the number of exemptions you can claim. Connecticut recognizes the following filing statuses:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Filing Status Exemptions

Each filing status has specific exemptions. For example, married filing jointly and head of household have a higher exemption amount than single filers.

- Single filers: $12,000 exemption

- Married filing jointly: $19,000 exemption

- Head of household: $19,000 exemption

Step 3: Calculate Income

Report all your income on Form CT-1040, including:

- Wages, salaries, and tips

- Self-employment income

- Interest and dividend income

- Capital gains and losses

- Rental income

Adjustments to Income

You can also claim adjustments to income, such as:

- Alimony paid

- Student loan interest

- Educator expenses

- Moving expenses

Step 4: Claim Deductions and Credits

Connecticut allows various deductions and credits to reduce your tax liability.

- Standard deduction: $12,000 for single filers and $19,000 for joint filers

- Itemized deductions: medical expenses, mortgage interest, charitable donations

- Earned Income Tax Credit (EITC)

- Child Tax Credit

Itemized Deductions

If you choose to itemize deductions, you can claim:

- Medical expenses

- Mortgage interest

- Charitable donations

- State and local taxes

Step 5: File Your Return

Once you have completed Form CT-1040, you can file your return electronically or by mail.

- Electronic filing: use the Connecticut DRS website or a tax software provider

- Mail filing: send your return to the Connecticut Department of Revenue Services

Payment Options

If you owe taxes, you can pay online, by phone, or by mail.

- Online payment: use the Connecticut DRS website

- Phone payment: call the Connecticut DRS phone number

- Mail payment: send a check or money order with your return

Step 6: Check Refund Status

If you are due a refund, you can check the status online or by phone.

- Online refund status: use the Connecticut DRS website

- Phone refund status: call the Connecticut DRS phone number

Refund Options

You can choose to receive your refund by:

- Direct deposit

- Check

- Prepaid debit card

Filing your Connecticut state tax return may seem overwhelming, but breaking it down into steps and using the correct form can make the process more manageable. Remember to gather all necessary documents, choose the correct filing status, calculate your income, claim deductions and credits, file your return, and check your refund status. If you have any questions or concerns, you can contact the Connecticut Department of Revenue Services for assistance.

What is the deadline for filing the Connecticut state tax return?

+The deadline for filing the Connecticut state tax return is typically April 15th, but it may be extended in certain circumstances.

Can I file my Connecticut state tax return electronically?

+Yes, you can file your Connecticut state tax return electronically using the Connecticut DRS website or a tax software provider.

How do I check the status of my Connecticut state tax refund?

+You can check the status of your Connecticut state tax refund online using the Connecticut DRS website or by calling the Connecticut DRS phone number.

We hope this guide has been helpful in understanding the process of filing the Connecticut state tax form. If you have any further questions or concerns, please don't hesitate to reach out.