OGE Form 278, also known as the "Executive Branch Personnel Public Financial Disclosure Report," is a crucial document that plays a significant role in ensuring transparency and accountability within the US government. As a fundamental aspect of the Ethics in Government Act of 1978, this form is designed to provide the public with access to financial information about high-ranking government officials. In this article, we will delve into five essential facts about OGE Form 278, exploring its purpose, requirements, and significance.

What is OGE Form 278?

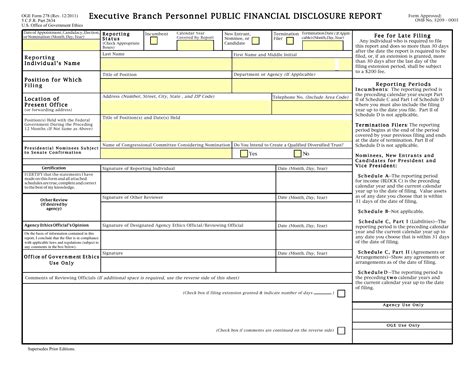

OGE Form 278 is a public financial disclosure report that certain high-ranking government officials are required to file with the US Office of Government Ethics (OGE). The form is designed to provide the public with information about the financial interests, assets, and liabilities of these officials, promoting transparency and accountability within the government.

Purpose of OGE Form 278

The primary purpose of OGE Form 278 is to provide the public with access to financial information about high-ranking government officials, including:

- Executive branch officials

- Congressional staff

- Federal judges

- Certain high-ranking military officers

By making this information publicly available, the OGE aims to:

- Promote transparency and accountability within the government

- Prevent conflicts of interest

- Ensure compliance with ethics laws and regulations

Who is Required to File OGE Form 278?

Not all government officials are required to file OGE Form 278. The following individuals are subject to filing requirements:

- Executive branch officials, including:

- Cabinet members

- Subcabinet members

- Senior White House staff

- High-ranking officials in executive branch agencies

- Congressional staff, including:

- Staff members with a salary above a certain threshold

- Certain committee staff

- Federal judges, including:

- Supreme Court justices

- Circuit court judges

- District court judges

- Certain high-ranking military officers, including:

- General officers

- Flag officers

What Information is Required on OGE Form 278?

OGE Form 278 requires filers to disclose a wide range of financial information, including:

- Assets, such as:

- Stocks and bonds

- Real estate

- Other investments

- Liabilities, such as:

- Loans

- Credit card debt

- Mortgages

- Income, including:

- Salary and bonuses

- Dividends and interest

- Other sources of income

- Transactions, including:

- Buying and selling of assets

- Exchanges of assets

How is OGE Form 278 Filed and Processed?

OGE Form 278 is typically filed electronically through the OGE's online filing system. Filers are required to submit their reports by a specified deadline, usually in May of each year. The OGE reviews and processes the reports, making them publicly available on its website.

Consequences of Non-Compliance

Failure to file OGE Form 278 or providing false information can result in serious consequences, including:

- Civil penalties

- Disciplinary action

- Loss of job or security clearance

Public Access to OGE Form 278

The OGE makes OGE Form 278 reports publicly available on its website, promoting transparency and accountability within the government. The public can access the reports by searching for a specific filer's name or by browsing through the OGE's online database.

Importance of Public Access

Public access to OGE Form 278 is crucial for promoting transparency and accountability within the government. By making this information publicly available, the OGE enables citizens to:

- Hold government officials accountable for their financial actions

- Identify potential conflicts of interest

- Make informed decisions about government policies and programs

What is the purpose of OGE Form 278?

+The primary purpose of OGE Form 278 is to provide the public with access to financial information about high-ranking government officials, promoting transparency and accountability within the government.

Who is required to file OGE Form 278?

+Executive branch officials, Congressional staff, federal judges, and certain high-ranking military officers are required to file OGE Form 278.

What information is required on OGE Form 278?

+OGE Form 278 requires filers to disclose a wide range of financial information, including assets, liabilities, income, and transactions.

In conclusion, OGE Form 278 is a crucial document that promotes transparency and accountability within the US government. By understanding the purpose, requirements, and significance of this form, citizens can hold government officials accountable for their financial actions and make informed decisions about government policies and programs.