Oklahoma businesses play a vital role in the state's economy, and it's essential for them to stay on top of their tax obligations to avoid any penalties or fines. One crucial form that Oklahoma businesses need to file is the Form 200F, also known as the Oklahoma Business Activity Tax Return. In this article, we'll delve into the details of Form 200F, its purpose, benefits, and provide a step-by-step guide on how to file it accurately.

What is Oklahoma Form 200F?

Oklahoma Form 200F is a tax return form required by the Oklahoma Tax Commission (OTC) for businesses operating in the state. The form is used to report the business's activity, including income, deductions, and credits. The OTC uses the information provided on Form 200F to calculate the business's tax liability.

Who needs to file Oklahoma Form 200F?

All businesses operating in Oklahoma, including corporations, partnerships, limited liability companies (LLCs), and sole proprietorships, are required to file Form 200F. This includes businesses that are taxed as pass-through entities, such as S corporations and partnerships, as well as those that are taxed as C corporations.

Benefits of filing Oklahoma Form 200F

Filing Form 200F provides several benefits for Oklahoma businesses. Some of the benefits include:

- Compliance with state tax laws: Filing Form 200F ensures that businesses comply with Oklahoma's tax laws and regulations, avoiding any penalties or fines.

- Accurate tax calculation: The form helps businesses accurately calculate their tax liability, ensuring they don't overpay or underpay their taxes.

- Eligibility for tax credits: Businesses may be eligible for tax credits, such as the Oklahoma Quality Jobs Program, by filing Form 200F.

How to file Oklahoma Form 200F

Filing Form 200F can be a complex process, but by following these steps, businesses can ensure they file accurately:

- Gather necessary documents: Businesses will need to gather their financial statements, including their income statement and balance sheet, as well as any other relevant documents.

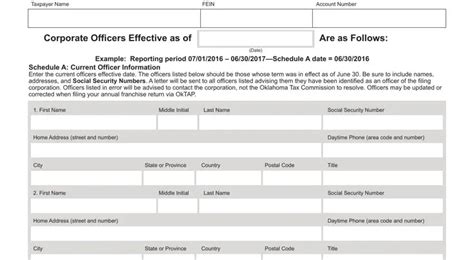

- Complete the form: The form can be completed online or by mail. Businesses will need to provide their business information, including their name, address, and tax identification number.

- Calculate tax liability: Businesses will need to calculate their tax liability using the information provided on the form.

- Submit the form: The form can be submitted online or by mail, along with any required supporting documentation.

Common mistakes to avoid when filing Oklahoma Form 200F

When filing Form 200F, businesses should avoid common mistakes, such as:

- Incomplete or inaccurate information: Ensure that all information provided on the form is complete and accurate.

- Failure to sign the form: The form must be signed by an authorized representative of the business.

- Missing supporting documentation: Ensure that all required supporting documentation is included with the form.

Tips for filing Oklahoma Form 200F

To ensure a smooth filing process, businesses can follow these tips:

- File electronically: Filing electronically can reduce errors and ensure faster processing.

- Use tax preparation software: Tax preparation software can help businesses accurately calculate their tax liability and ensure compliance with state tax laws.

- Consult a tax professional: If businesses are unsure about any aspect of the filing process, they should consult a tax professional.

Oklahoma Form 200F deadlines

The deadline for filing Form 200F varies depending on the business's tax year. The OTC provides a calendar of deadlines on their website.

Amending Oklahoma Form 200F

If a business needs to amend their Form 200F, they can do so by filing an amended return. The amended return must be filed within a certain timeframe, and businesses should consult the OTC's website for specific instructions.

Oklahoma Form 200F penalties

Businesses that fail to file Form 200F or pay their taxes on time may be subject to penalties and interest. The OTC provides a list of penalties on their website.

Oklahoma Form 200F exemptions

Certain businesses may be exempt from filing Form 200F. Businesses should consult the OTC's website to determine if they are eligible for an exemption.

Conclusion

Filing Oklahoma Form 200F is a crucial aspect of operating a business in the state. By understanding the purpose and benefits of the form, businesses can ensure they comply with state tax laws and regulations. By following the steps outlined in this article, businesses can accurately file their Form 200F and avoid any penalties or fines.

Frequently Asked Questions

What is the deadline for filing Oklahoma Form 200F?

+The deadline for filing Form 200F varies depending on the business's tax year. The OTC provides a calendar of deadlines on their website.

Can I file Oklahoma Form 200F electronically?

+Yes, businesses can file Form 200F electronically through the OTC's website.

What happens if I fail to file Oklahoma Form 200F?

+Businesses that fail to file Form 200F may be subject to penalties and interest. The OTC provides a list of penalties on their website.