Filing taxes can be a daunting task, but with the right guidance, it can be a breeze. The MO 1040 tax form is a crucial document for Missouri residents, and understanding how to fill it out correctly is essential to avoid any errors or delays in receiving your tax refund. In this article, we will provide you with six essential tips for filing the MO 1040 tax form, ensuring that you navigate the process with ease.

Tip 1: Gather All Necessary Documents

Before starting the filing process, it's crucial to gather all the necessary documents. This includes your social security number, driver's license, W-2 forms from your employer, 1099 forms for any freelance work or self-employment, and any other relevant tax-related documents. Having all these documents readily available will save you time and reduce the likelihood of errors.

What to Include:

- Social security number

- Driver's license

- W-2 forms

- 1099 forms

- Other relevant tax-related documents

Tip 2: Choose the Correct Filing Status

Choosing the correct filing status is essential to ensure you're eligible for the right deductions and credits. Missouri offers several filing statuses, including single, married filing jointly, married filing separately, head of household, and qualifying widow(er). Take the time to review each status and choose the one that best suits your situation.

Filing Status Options:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Tip 3: Report All Income

Reporting all income is crucial to avoid any discrepancies or penalties. This includes income from employment, self-employment, investments, and any other sources. Make sure to include all relevant income documents, such as W-2 and 1099 forms.

Types of Income to Report:

- Employment income

- Self-employment income

- Investment income

- Other sources of income

Tip 4: Claim Credits and Deductions

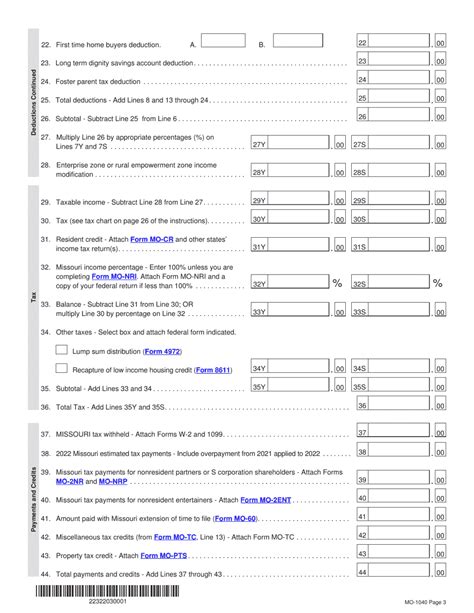

Missouri offers several credits and deductions that can help reduce your tax liability. These include the Missouri low-income housing tax credit, the Missouri historic preservation tax credit, and the Missouri charitable contributions deduction. Take the time to review the eligibility criteria for each credit and deduction to ensure you're taking advantage of the ones you're eligible for.

Credits and Deductions to Claim:

- Missouri low-income housing tax credit

- Missouri historic preservation tax credit

- Missouri charitable contributions deduction

Tip 5: File Electronically or by Mail

Missouri offers two filing options: electronic filing and paper filing by mail. Electronic filing is a faster and more efficient option, allowing you to receive your refund quicker. However, if you prefer to file by mail, make sure to follow the correct mailing instructions to avoid any delays.

Filing Options:

- Electronic filing

- Paper filing by mail

Tip 6: Seek Professional Help If Needed

If you're unsure about any aspect of the filing process, don't hesitate to seek professional help. Tax professionals can guide you through the process, ensuring you're taking advantage of all the credits and deductions you're eligible for.

Benefits of Seeking Professional Help:

- Guidance through the filing process

- Ensuring eligibility for credits and deductions

- Reducing the likelihood of errors or penalties

By following these six essential tips for filing the MO 1040 tax form, you'll be well on your way to a stress-free tax filing experience. Remember to gather all necessary documents, choose the correct filing status, report all income, claim credits and deductions, file electronically or by mail, and seek professional help if needed.

We hope this article has provided you with the necessary guidance to navigate the MO 1040 tax form with ease. Don't hesitate to comment below if you have any questions or concerns.

What is the deadline for filing the MO 1040 tax form?

+The deadline for filing the MO 1040 tax form is typically April 15th of each year.

Can I file the MO 1040 tax form electronically?

+Yes, Missouri offers electronic filing options for the MO 1040 tax form.

What is the penalty for late filing of the MO 1040 tax form?

+The penalty for late filing of the MO 1040 tax form varies depending on the circumstances, but it can range from 5% to 47.6% of the unpaid tax.