Applying for an auto loan can be a daunting task, especially for first-time car buyers. Ally Auto Loan is one of the most popular auto loan providers, offering competitive rates and flexible terms. However, navigating the application process can be overwhelming without proper guidance. In this article, we will break down the 5 essential steps to complete an Ally Auto Loan application, making it easier for you to secure the financing you need for your dream car.

Understanding Ally Auto Loan Requirements

Before diving into the application process, it's crucial to understand the basic requirements for an Ally Auto Loan. These include:

- A valid Social Security number or Individual Taxpayer Identification Number (ITIN)

- A minimum income of $1,500 per month

- A credit score of at least 620 (although some exceptions may apply)

- A down payment of at least 10% of the vehicle's purchase price

- A maximum debt-to-income ratio of 50%

Step 1: Check Your Credit Score and History

Your credit score plays a significant role in determining the interest rate and terms of your auto loan. Ally Auto Loan requires a minimum credit score of 620, but having a higher score can lead to better loan offers. You can check your credit score for free on various websites, such as Credit Karma or Credit Sesame. Review your credit report to ensure there are no errors or negative marks that could affect your loan application.

Step 2: Gather Required Documents and Information

To complete your Ally Auto Loan application, you'll need to provide the following documents and information:

- Proof of income (pay stubs, W-2 forms, or tax returns)

- Proof of identity (driver's license, passport, or state ID)

- Proof of insurance (insurance card or policy documents)

- Vehicle information (make, model, year, and Vehicle Identification Number (VIN))

- Down payment information (if applicable)

Make sure you have all the necessary documents ready before starting the application process.

Step 3: Choose Your Loan Options and Terms

Ally Auto Loan offers various loan options and terms to fit your needs. You can choose from:

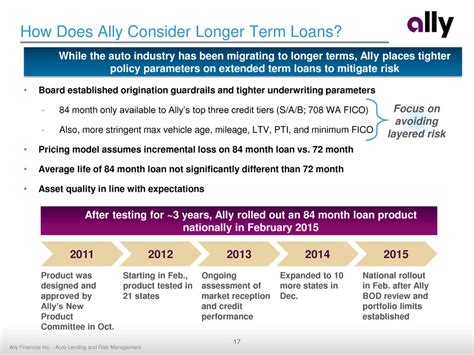

- Fixed-rate loans with terms ranging from 24 to 84 months

- Variable-rate loans with terms ranging from 24 to 60 months

- Leasing options with terms ranging from 24 to 39 months

Consider your budget, credit score, and financial goals when selecting your loan options and terms.

Step 4: Submit Your Application and Review Loan Offers

Once you've gathered all the necessary documents and information, you can submit your Ally Auto Loan application online or through a participating dealership. You'll receive a loan offer, which will include the interest rate, loan term, and monthly payment amount.

Carefully review the loan offer to ensure it meets your needs and budget. You can also compare loan offers from other lenders to find the best deal.

Step 5: Finalize Your Loan and Purchase Your Vehicle

If you're satisfied with your loan offer, you can finalize your loan and purchase your vehicle. Ally Auto Loan will provide you with a loan contract, which you'll need to sign and return. Once the loan is finalized, you can pick up your new vehicle and start making monthly payments.

Additional Tips and Considerations

- Consider adding a co-signer if you have a limited credit history or low credit score.

- Make timely payments to avoid late fees and negative credit reporting.

- Review your loan contract carefully before signing to ensure you understand the terms and conditions.

By following these 5 steps, you'll be well on your way to completing an Ally Auto Loan application and securing the financing you need for your dream car.

What is the minimum credit score required for an Ally Auto Loan?

+The minimum credit score required for an Ally Auto Loan is 620.

Can I apply for an Ally Auto Loan online?

+Yes, you can apply for an Ally Auto Loan online or through a participating dealership.

What is the maximum debt-to-income ratio for an Ally Auto Loan?

+The maximum debt-to-income ratio for an Ally Auto Loan is 50%.

We hope this article has provided you with a comprehensive guide to completing an Ally Auto Loan application. If you have any further questions or concerns, feel free to comment below or share your experience with others.