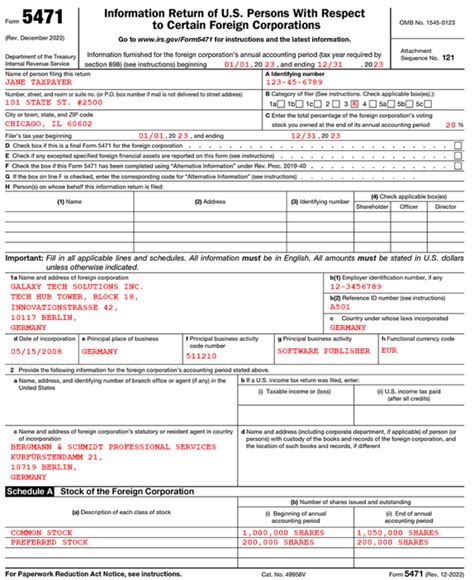

The Form 5471 Schedule B is a crucial component of the Form 5471, which is used by the Internal Revenue Service (IRS) to report information about foreign corporations. As a U.S. person with interests in foreign corporations, it is essential to understand the requirements and implications of filing this form. In this article, we will delve into the world of foreign corporation reporting and provide a comprehensive guide to Form 5471 Schedule B.

Importance of Form 5471 Schedule B

The Form 5471 Schedule B is used to report the balance sheet and income statement of a foreign corporation. This information is crucial for the IRS to determine the taxable income of the corporation and to ensure compliance with U.S. tax laws. As a U.S. person with interests in foreign corporations, it is essential to file this form accurately and on time to avoid penalties and fines.

Who Needs to File Form 5471 Schedule B?

The Form 5471 Schedule B is required to be filed by U.S. persons who have interests in foreign corporations. This includes:

- U.S. shareholders of foreign corporations

- U.S. citizens and residents who are officers or directors of foreign corporations

- U.S. persons who have control over foreign corporations

Understanding Form 5471 Schedule B

The Form 5471 Schedule B consists of two main parts: the balance sheet and the income statement.

Balance Sheet

The balance sheet is used to report the assets, liabilities, and equity of the foreign corporation. This includes:

- Cash and cash equivalents

- Accounts receivable and payable

- Inventory and property, plant, and equipment

- Intangible assets and goodwill

- Debt and other liabilities

- Equity and retained earnings

Income Statement

The income statement is used to report the revenues and expenses of the foreign corporation. This includes:

- Revenue from sales and services

- Cost of goods sold and operating expenses

- Gross profit and operating income

- Non-operating income and expenses

- Net income and retained earnings

How to Complete Form 5471 Schedule B

Completing Form 5471 Schedule B requires careful attention to detail and accuracy. Here are some steps to help you complete the form:

- Gather all necessary financial statements and records of the foreign corporation.

- Convert the financial statements to U.S. dollars using the appropriate exchange rate.

- Complete the balance sheet and income statement sections of the form.

- Ensure that all information is accurate and consistent with the financial statements.

- Sign and date the form.

Penalties and Fines for Non-Compliance

Failure to file Form 5471 Schedule B or filing an inaccurate or incomplete form can result in penalties and fines. These can include:

- A penalty of $10,000 or more for failure to file

- A penalty of $10,000 or more for filing an inaccurate or incomplete form

- Interest on any unpaid tax liabilities

- Potential loss of foreign tax credits

Conclusion

Form 5471 Schedule B is a critical component of foreign corporation reporting. As a U.S. person with interests in foreign corporations, it is essential to understand the requirements and implications of filing this form. By following the steps outlined in this guide, you can ensure that you complete the form accurately and on time, avoiding penalties and fines.

We hope this guide has been informative and helpful. If you have any further questions or concerns, please do not hesitate to comment below. Share this article with others who may find it useful, and stay tuned for more informative articles on tax-related topics.

What is the purpose of Form 5471 Schedule B?

+Form 5471 Schedule B is used to report the balance sheet and income statement of a foreign corporation.

Who needs to file Form 5471 Schedule B?

+U.S. persons with interests in foreign corporations, including U.S. shareholders, officers, and directors, and U.S. persons with control over foreign corporations.

What are the penalties for non-compliance with Form 5471 Schedule B?

+Penalties for non-compliance can include a penalty of $10,000 or more for failure to file, a penalty of $10,000 or more for filing an inaccurate or incomplete form, interest on any unpaid tax liabilities, and potential loss of foreign tax credits.