As we age, our health insurance needs change. Medicare Supplement plans, also known as Medigap plans, are designed to help cover the out-of-pocket costs associated with Medicare. AARP (American Association of Retired Persons) is a well-known organization that offers a range of Medicare Supplement plans to its members. If you're considering enrolling in an AARP Medicare Supplement plan, this article will guide you through the application process.

Understanding Medicare Supplement Plans

Before we dive into the application process, it's essential to understand what Medicare Supplement plans are and how they work. Medicare Supplement plans are designed to help cover the gaps in Medicare coverage, including deductibles, copays, and coinsurance. There are ten standardized Medicare Supplement plans, labeled A through N, each offering different levels of coverage. AARP offers several of these plans, including Plan A, Plan F, Plan G, and Plan N.

Benefits of AARP Medicare Supplement Plans

AARP Medicare Supplement plans offer several benefits, including:

- Coverage for Medicare Part A and Part B deductibles

- Coverage for Medicare Part B copays and coinsurance

- Coverage for skilled nursing facility care

- Coverage for foreign travel emergency care

- Guaranteed renewable for life, as long as premiums are paid

AARP Medicare Supplement Plan Application Process

Now that you understand the benefits of AARP Medicare Supplement plans, let's walk through the application process.

Step 1: Determine Your Eligibility

To be eligible for an AARP Medicare Supplement plan, you must:

- Be a U.S. citizen or lawfully present in the United States

- Be 65 or older (or under 65 with a disability)

- Be enrolled in Medicare Part A and Part B

- Live in the state where the plan is offered

Step 2: Choose Your Plan

AARP offers several Medicare Supplement plans, each with different levels of coverage. You can choose from:

- Plan A: Basic coverage, including Medicare Part A and Part B copays and coinsurance

- Plan F: Comprehensive coverage, including Medicare Part A and Part B deductibles, copays, and coinsurance

- Plan G: High-deductible plan, with lower premiums and higher deductibles

- Plan N: Basic coverage, with lower premiums and higher copays

Step 3: Gather Required Documents

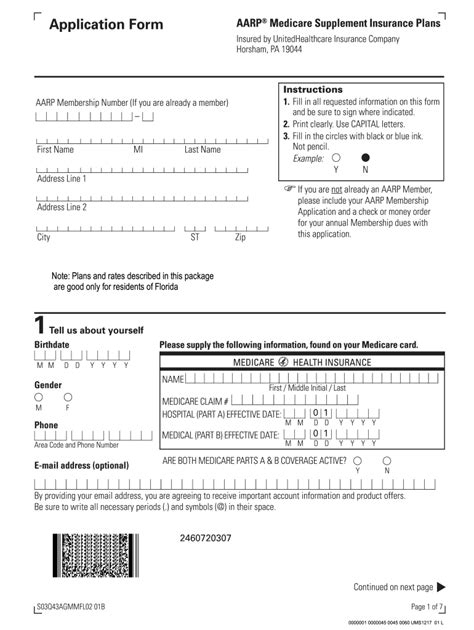

To apply for an AARP Medicare Supplement plan, you'll need to provide the following documents:

- Proof of Medicare enrollment (Medicare card or letter)

- Proof of age (driver's license, passport, or birth certificate)

- Proof of residency (utility bill, lease agreement, or driver's license)

Step 4: Complete the Application

You can apply for an AARP Medicare Supplement plan online, by phone, or by mail.

- Online: Visit the AARP website and fill out the online application form.

- Phone: Call the AARP customer service number (1-800-523-5800) to speak with a representative.

- Mail: Download and complete the application form, then mail it to the address listed on the form.

Step 5: Review and Sign the Application

Before submitting your application, review it carefully to ensure all information is accurate and complete. Sign and date the application, then submit it to AARP.

Step 6: Receive Your Policy Documents

Once your application is approved, AARP will send you a policy document package, including:

- Policy certificate

- Rate sheet

- Outline of coverage

Review your policy documents carefully to ensure you understand your coverage and any exclusions or limitations.

Tips for Completing the Application Form

- Read the application form carefully and answer all questions truthfully.

- Make sure to sign and date the application form.

- Attach all required documents to the application form.

- Review your policy documents carefully to ensure you understand your coverage.

FAQs

Q: Can I apply for an AARP Medicare Supplement plan if I have a pre-existing condition?

A: Yes, you can apply for an AARP Medicare Supplement plan even if you have a pre-existing condition. However, you may be subject to a pre-existing condition waiting period.

Q: How long does it take to process my application?

A: Processing times may vary, but most applications are processed within 1-2 weeks.

Q: Can I cancel my policy if I'm not satisfied?

A: Yes, you can cancel your policy at any time. However, you may be subject to a penalty for early cancellation.

Q: Are AARP Medicare Supplement plans available in all states?

A: No, AARP Medicare Supplement plans are not available in all states. Check the AARP website to see if plans are available in your state.

What is the difference between Medicare Supplement Plan F and Plan G?

+Medicare Supplement Plan F and Plan G are both comprehensive plans, but they differ in their coverage of the Medicare Part B deductible. Plan F covers the Medicare Part B deductible, while Plan G does not.

Can I enroll in an AARP Medicare Supplement plan if I have a Medicare Advantage plan?

+No, you cannot enroll in an AARP Medicare Supplement plan if you have a Medicare Advantage plan. Medicare Supplement plans are designed to supplement Original Medicare, not Medicare Advantage plans.

Are AARP Medicare Supplement plans renewable?

+Yes, AARP Medicare Supplement plans are guaranteed renewable for life, as long as premiums are paid.

In conclusion, applying for an AARP Medicare Supplement plan is a straightforward process that requires careful consideration of your coverage needs and budget. By following the steps outlined in this guide, you can ensure a smooth application process and find the right plan for your healthcare needs. Share your thoughts on Medicare Supplement plans in the comments below!