Canceling a life insurance policy can be a daunting task, especially when dealing with a large insurance company like Gerber Life Insurance. However, there are situations where policyholders may need to cancel their policy, and having a clear understanding of the process can make it less overwhelming. In this article, we will guide you through the Gerber Life Insurance cancellation process, making it easier for you to navigate.

Life insurance is an essential investment for many individuals, providing financial protection for loved ones in the event of the policyholder's passing. However, circumstances can change, and policyholders may need to cancel their policy due to various reasons such as financial constraints, change in marital status, or simply no longer needing the coverage.

Understanding Gerber Life Insurance Cancellation Policy

Before proceeding with the cancellation process, it is essential to understand Gerber Life Insurance's cancellation policy. Gerber Life Insurance allows policyholders to cancel their policy at any time, but there may be certain conditions and fees associated with the cancellation. It is crucial to review your policy contract to understand the specific terms and conditions of your policy.

Reasons for Canceling Gerber Life Insurance

There are various reasons why policyholders may want to cancel their Gerber Life Insurance policy. Some of the common reasons include:

- Financial constraints: Policyholders may no longer be able to afford the premium payments.

- Change in marital status: Policyholders may no longer need the coverage after a divorce or the death of a spouse.

- Change in employment status: Policyholders may have changed jobs or retired, and their new employer provides life insurance coverage.

- No longer needing the coverage: Policyholders may have paid off their mortgage or other debts, and no longer need the coverage.

Steps to Cancel Gerber Life Insurance

Canceling a Gerber Life Insurance policy involves several steps, which are outlined below:

- Review your policy contract: Before canceling your policy, review your policy contract to understand the terms and conditions of your policy, including any fees associated with cancellation.

- Contact Gerber Life Insurance: Reach out to Gerber Life Insurance's customer service department to inform them of your intention to cancel your policy. You can contact them by phone or mail.

- Provide required documentation: Gerber Life Insurance may require you to provide certain documentation, such as your policy number, name, and address, to process the cancellation.

- Confirm the cancellation: Once Gerber Life Insurance receives your request, they will confirm the cancellation in writing.

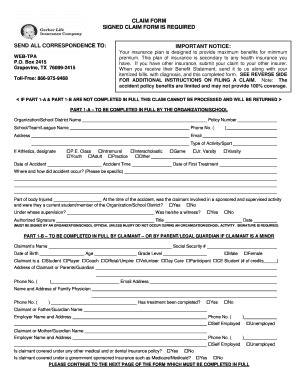

Gerber Life Insurance Cancellation Form

To cancel your Gerber Life Insurance policy, you will need to complete a cancellation form. The form will require you to provide certain information, such as:

- Policy number

- Name and address

- Reason for cancellation

- Signature

You can obtain the cancellation form by contacting Gerber Life Insurance's customer service department or by downloading it from their website.

Fees Associated with Cancellation

Gerber Life Insurance may charge certain fees when canceling a policy, including:

- Surrender charge: A fee charged when you cancel your policy, which can be a percentage of the policy's cash value.

- Administrative fee: A fee charged for processing the cancellation.

It is essential to review your policy contract to understand the specific fees associated with cancellation.

Alternative Options

Before canceling your Gerber Life Insurance policy, consider alternative options, such as:

- Reducing coverage: If you can no longer afford the premium payments, consider reducing the coverage amount to lower your premiums.

- Changing payment frequency: If you are having trouble making monthly payments, consider changing the payment frequency to quarterly or annually.

- Converting to a different policy: If you no longer need the coverage, consider converting to a different policy, such as a term life insurance policy.

Conclusion

Canceling a Gerber Life Insurance policy can be a complex process, but understanding the steps involved and the fees associated with cancellation can make it easier. Before canceling your policy, review your policy contract and consider alternative options. If you do decide to cancel your policy, follow the steps outlined above, and contact Gerber Life Insurance's customer service department for assistance.

What to Do Next

If you have decided to cancel your Gerber Life Insurance policy, take the following steps:

- Contact Gerber Life Insurance's customer service department to inform them of your intention to cancel your policy.

- Provide the required documentation, including your policy number, name, and address.

- Confirm the cancellation in writing.

- Review your policy contract to understand the specific fees associated with cancellation.

By following these steps, you can ensure a smooth cancellation process and avoid any potential issues.

Can I cancel my Gerber Life Insurance policy at any time?

+Yes, you can cancel your Gerber Life Insurance policy at any time. However, there may be certain conditions and fees associated with the cancellation.

What is the surrender charge for canceling a Gerber Life Insurance policy?

+The surrender charge for canceling a Gerber Life Insurance policy can vary depending on the policy terms and conditions. Review your policy contract to understand the specific fees associated with cancellation.

Can I convert my Gerber Life Insurance policy to a different policy?

+Yes, you may be able to convert your Gerber Life Insurance policy to a different policy, such as a term life insurance policy. Contact Gerber Life Insurance's customer service department to discuss your options.