As a California resident, it's essential to understand the importance of filing your taxes correctly to avoid any penalties or delays in receiving your refund. One crucial aspect of filing your taxes is submitting your estimated tax payments using the CA Form 540ES. In this article, we will explore the five ways to file CA Form 540ES correctly, ensuring you stay on top of your tax obligations.

Filing CA Form 540ES is a critical step in managing your tax liability, especially if you're self-employed, have investments, or receive income that's not subject to withholding. By making estimated tax payments, you can avoid penalties and interest on your tax bill. In this article, we will delve into the world of CA Form 540ES, discussing its importance, benefits, and the five ways to file it correctly.

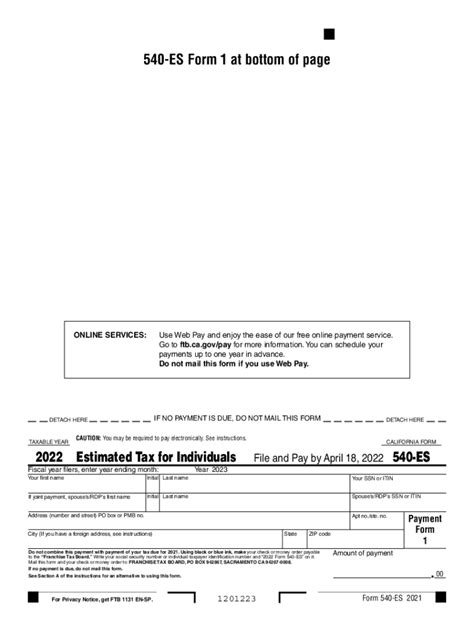

What is CA Form 540ES?

CA Form 540ES is the California Estimated Tax for Individuals voucher, used to make estimated tax payments to the California Franchise Tax Board (FTB). This form is designed for individuals who expect to owe $500 or more in taxes for the year, excluding withholding and refundable credits. By filing CA Form 540ES, you can make quarterly payments to the FTB, reducing your tax liability and avoiding penalties.

Benefits of Filing CA Form 540ES

Filing CA Form 540ES offers several benefits, including:

- Reduces your tax liability by making quarterly payments

- Avoids penalties and interest on your tax bill

- Helps you manage your cash flow by breaking down your tax payments into smaller, more manageable amounts

- Ensures you're meeting your tax obligations, reducing the risk of an audit or penalty

5 Ways to File CA Form 540ES Correctly

Now that we've covered the importance and benefits of filing CA Form 540ES, let's dive into the five ways to file it correctly:

1. E-File Using the California Franchise Tax Board (FTB) Website

The FTB website offers a convenient and secure way to e-file your CA Form 540ES. To e-file, you'll need to:

- Go to the FTB website at

- Log in to your MyFTB account or create a new account if you don't have one

- Select the "Make a Payment" option and follow the prompts to complete your estimated tax payment

2. Mail a Paper Voucher

If you prefer to mail a paper voucher, you can download and print the CA Form 540ES from the FTB website. To file by mail:

- Download and print the CA Form 540ES voucher

- Fill out the voucher, making sure to include your name, address, and Social Security number or Individual Taxpayer Identification Number (ITIN)

- Attach a check or money order payable to the "Franchise Tax Board" for the estimated tax amount

- Mail the voucher and payment to the address listed on the form

3. Use the FTB's Online Payment System

The FTB's online payment system allows you to make estimated tax payments using a credit card or e-check. To use this system:

- Go to the FTB website at

- Select the "Make a Payment" option and follow the prompts to complete your estimated tax payment

- Enter your payment information, including the amount and payment method

4. File Through a Tax Professional or Accountant

If you work with a tax professional or accountant, they can file your CA Form 540ES on your behalf. To file through a tax professional or accountant:

- Provide your tax professional or accountant with the necessary information, including your income, deductions, and credits

- Ensure your tax professional or accountant files the CA Form 540ES by the quarterly deadlines

5. Use Tax Preparation Software

Tax preparation software, such as TurboTax or H&R Block, can also help you file your CA Form 540ES. To file using tax preparation software:

- Purchase and download the tax preparation software

- Follow the prompts to complete your estimated tax payment

- Ensure the software files the CA Form 540ES by the quarterly deadlines

By following these five ways to file CA Form 540ES correctly, you can ensure you're meeting your tax obligations and avoiding any penalties or interest on your tax bill. Remember to file your CA Form 540ES by the quarterly deadlines to stay on top of your tax liability.

Quarterly Deadlines for CA Form 540ES

- April 15th for the first quarter (January 1 - March 31)

- June 15th for the second quarter (April 1 - May 31)

- September 15th for the third quarter (June 1 - August 31)

- January 15th of the following year for the fourth quarter (September 1 - December 31)

What is the purpose of CA Form 540ES?

+CA Form 540ES is used to make estimated tax payments to the California Franchise Tax Board (FTB) for individuals who expect to owe $500 or more in taxes for the year, excluding withholding and refundable credits.

How do I file CA Form 540ES?

+You can file CA Form 540ES online through the FTB website, by mail using a paper voucher, or through a tax professional or accountant.

What are the quarterly deadlines for CA Form 540ES?

+The quarterly deadlines for CA Form 540ES are April 15th, June 15th, September 15th, and January 15th of the following year.

We hope this article has provided you with a comprehensive understanding of CA Form 540ES and the five ways to file it correctly. By following these steps, you can ensure you're meeting your tax obligations and avoiding any penalties or interest on your tax bill. If you have any further questions or concerns, please don't hesitate to comment below.