Are you considering surrendering your Transamerica insurance policy? Before making a decision, it's essential to understand the process and implications of surrendering your policy. In this article, we will guide you through the 6 steps to fill out the Transamerica surrender form.

Transamerica is a well-established insurance company that offers a range of life insurance and annuity products. However, circumstances may change, and you may need to surrender your policy. The surrender process can be complex, but we will break it down into simple steps to help you navigate the process.

Why Surrender Your Transamerica Policy?

Before we dive into the steps, let's understand why you might want to surrender your Transamerica policy. Some common reasons include:

- Financial constraints: If you're facing financial difficulties, surrendering your policy might provide a much-needed influx of cash.

- Changes in insurance needs: If your insurance needs have changed, you might want to surrender your policy and explore other options.

- Dissatisfaction with policy performance: If you're not satisfied with the performance of your policy, surrendering it might be a viable option.

Step 1: Review Your Policy Contract

Before filling out the surrender form, it's crucial to review your policy contract. Understand the terms and conditions, including any surrender charges, fees, or penalties. Check if there are any specific requirements or procedures for surrendering your policy.

Key Points to Consider:

- Surrender charges: Check if there are any surrender charges or fees associated with surrendering your policy.

- Policy value: Understand the current value of your policy and how it will be affected by surrendering.

- Tax implications: Consider the tax implications of surrendering your policy.

Step 2: Gather Required Documents

To fill out the surrender form, you'll need to gather specific documents. These may include:

- Policy contract

- Identification documents (driver's license, passport, etc.)

- Proof of address

- Bank account information (for direct deposit)

Tips:

- Ensure you have all the required documents before starting the surrender process.

- Make photocopies of your documents for your records.

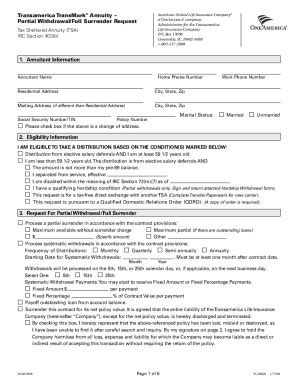

Step 3: Fill Out the Surrender Form

The surrender form is usually available on the Transamerica website or can be obtained by contacting their customer service. Fill out the form carefully, ensuring you provide accurate information.

Key Sections to Complete:

- Policy information: Provide your policy number, policy type, and other relevant details.

- Surrender amount: Specify the amount you want to surrender.

- Payment instructions: Indicate how you want to receive the surrender value (direct deposit, check, etc.).

Step 4: Review and Sign the Form

Carefully review the surrender form to ensure accuracy and completeness. Sign the form, and if required, have it notarized.

Important:

- Ensure you understand the implications of surrendering your policy.

- Review the form for any errors or omissions.

Step 5: Submit the Surrender Form

Submit the completed surrender form to Transamerica via mail, email, or fax. Ensure you keep a copy of the form for your records.

Submission Options:

- Mail: Send the form to the address specified on the Transamerica website.

- Email: Attach the form to an email and send it to the designated email address.

- Fax: Fax the form to the number provided on the Transamerica website.

Step 6: Confirm Surrender and Receive Payment

After submitting the surrender form, Transamerica will review and process your request. Once the surrender is confirmed, you'll receive the surrender value as per your instructions.

Next Steps:

- Receive payment: Expect to receive the surrender value within the specified timeframe.

- Review tax implications: Consider consulting a tax professional to understand the tax implications of surrendering your policy.

By following these 6 steps, you can fill out the Transamerica surrender form and initiate the surrender process. Remember to carefully review your policy contract, gather required documents, and understand the implications of surrendering your policy.

If you have any questions or concerns, don't hesitate to reach out to Transamerica customer service or a licensed insurance professional.

What are the consequences of surrendering my Transamerica policy?

+Surrendering your Transamerica policy may result in surrender charges, fees, or penalties. Additionally, you may be subject to tax implications. It's essential to review your policy contract and consult with a licensed insurance professional to understand the consequences of surrendering your policy.

Can I surrender my Transamerica policy online?

+Transamerica may not offer online surrender options. You may need to submit the surrender form via mail, email, or fax. Check the Transamerica website or contact their customer service to confirm their surrender process.

How long does it take to receive the surrender value?

+The timeframe for receiving the surrender value varies depending on the Transamerica policy and the surrender process. Typically, it can take several weeks to a few months to receive the payment. Check your policy contract or contact Transamerica customer service for more information.