CBP Form 3347, also known as the Declaration for Free Entry of Unaccompanied Articles, is a crucial document for individuals who want to bring unaccompanied articles into the United States. Whether you're a traveler, an online shopper, or a business owner, understanding the ins and outs of this form is essential to avoid any issues with U.S. Customs and Border Protection (CBP). In this article, we'll delve into the five essential facts about CBP Form 3347 that you need to know.

What is CBP Form 3347?

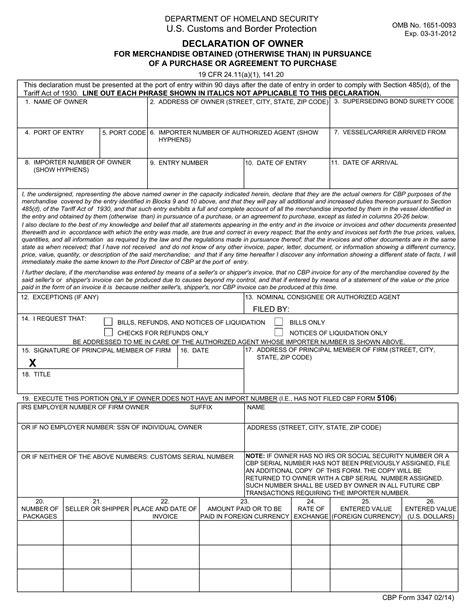

CBP Form 3347 is a document that allows individuals to declare the importation of unaccompanied articles, such as gifts, souvenirs, or personal effects, into the United States. The form is used to provide CBP with information about the articles being imported, including their value, country of origin, and intended use.

When is CBP Form 3347 Required?

CBP Form 3347 is required in several situations:

- When importing unaccompanied articles with a value exceeding $800

- When importing articles that are subject to quotas or restrictions

- When importing articles that require a license or permit

- When importing articles that are prohibited or restricted

It's essential to note that even if the value of the articles is below $800, CBP Form 3347 may still be required if the articles are subject to quotas or restrictions.

How to Fill Out CBP Form 3347

Filling out CBP Form 3347 requires careful attention to detail. Here are the steps to follow:

- Download and print the form: You can download CBP Form 3347 from the CBP website or obtain it from a CBP office.

- Fill out the form: Complete the form by providing the required information, including the article's description, value, country of origin, and intended use.

- Attach supporting documents: Attach any supporting documents, such as receipts, invoices, or certificates of origin.

- Sign and date the form: Sign and date the form to certify that the information provided is accurate and true.

What Information is Required on CBP Form 3347?

CBP Form 3347 requires the following information:

- Article description

- Value

- Country of origin

- Intended use

- Harmonized System (HS) code

- Country of export

- Port of entry

It's essential to provide accurate and complete information to avoid any issues with CBP.

Benefits of Using CBP Form 3347

Using CBP Form 3347 provides several benefits, including:

- Compliance with CBP regulations: By using CBP Form 3347, you ensure compliance with CBP regulations and avoid any potential penalties or fines.

- Faster processing: CBP Form 3347 helps CBP process your entry more efficiently, reducing the risk of delays or additional inspections.

- Accurate duty assessment: By providing accurate information on CBP Form 3347, you ensure that the correct duties and taxes are assessed on your importation.

Common Mistakes to Avoid When Filing CBP Form 3347

Here are some common mistakes to avoid when filing CBP Form 3347:

- Inaccurate or incomplete information: Ensure that you provide accurate and complete information on the form to avoid any issues with CBP.

- Failure to attach supporting documents: Attach all required supporting documents, such as receipts and invoices, to avoid any delays or issues with CBP.

- Failure to sign and date the form: Sign and date the form to certify that the information provided is accurate and true.

Conclusion: Taking Control of Your Importation Process

By understanding the essential facts about CBP Form 3347, you can take control of your importation process and avoid any issues with U.S. Customs and Border Protection. Remember to provide accurate and complete information, attach supporting documents, and sign and date the form to ensure a smooth and efficient process.

Now that you've learned about CBP Form 3347, we encourage you to share your thoughts and experiences in the comments below. If you have any questions or need further clarification on any of the topics discussed, feel free to ask!

What is the purpose of CBP Form 3347?

+CBP Form 3347 is used to declare the importation of unaccompanied articles into the United States.

When is CBP Form 3347 required?

+CBP Form 3347 is required when importing unaccompanied articles with a value exceeding $800, or when importing articles that are subject to quotas or restrictions.

What information is required on CBP Form 3347?

+CBP Form 3347 requires information such as article description, value, country of origin, intended use, Harmonized System (HS) code, country of export, and port of entry.