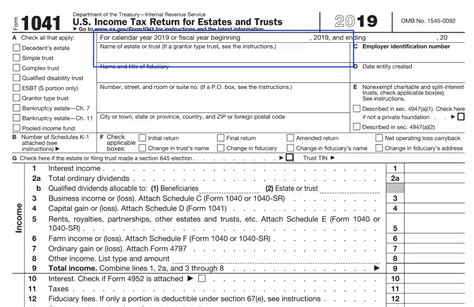

Filing tax returns can be a daunting task, especially when it comes to complex forms like the Form 1041. The Form 1041, also known as the U.S. Income Tax Return for Estates and Trusts, is used to report the income, deductions, and credits of an estate or trust. However, with the advancement of technology, filing taxes has become more accessible and convenient. In this article, we will explore the benefits of using fillable templates online to easily file Form 1041.

What is Form 1041 and Who Needs to File It?

The Form 1041 is an annual tax return that is required to be filed by estates and trusts that have gross income of $600 or more. This form is used to report the income, deductions, and credits of the estate or trust, as well as to calculate the tax liability. Estates and trusts that are required to file Form 1041 include:

- Estates of deceased individuals

- Trusts, including revocable and irrevocable trusts

- Grantor trusts

- Non-grantor trusts

Benefits of Using Fillable Templates Online

Using fillable templates online can make the process of filing Form 1041 much easier and more efficient. Here are some benefits of using fillable templates online:

- Convenience: Fillable templates online can be accessed from anywhere, at any time, as long as you have an internet connection. This makes it easy to work on your tax return at your own pace and on your own schedule.

- Accuracy: Fillable templates online can help reduce errors and ensure accuracy. The templates are designed to guide you through the process and ensure that you don't miss any important information.

- Time-saving: Fillable templates online can save you time and effort. You don't have to worry about searching for the right forms, printing, and filling them out by hand.

- Cost-effective: Fillable templates online can be cost-effective. You don't have to pay for software or printing costs, and you can often find free or low-cost templates online.

How to File Form 1041 with Fillable Templates Online

Filing Form 1041 with fillable templates online is a straightforward process. Here are the steps to follow:

- Choose a template: Search for a fillable Form 1041 template online and choose one that meets your needs. Make sure the template is from a reputable source and is up-to-date.

- Gather information: Gather all the necessary information and documents needed to complete the form. This includes financial statements, tax returns, and identification documents.

- Fill out the template: Fill out the template with the required information. Make sure to follow the instructions and guidelines provided.

- Review and edit: Review and edit the template to ensure accuracy and completeness.

- Submit: Submit the completed template to the IRS or your state tax authority, depending on the requirements.

Common Mistakes to Avoid When Filing Form 1041

When filing Form 1041, there are common mistakes to avoid. Here are some of them:

- Inaccurate or incomplete information: Make sure to provide accurate and complete information on the form. Inaccurate or incomplete information can lead to delays or rejection of your tax return.

- Failure to report income: Make sure to report all income earned by the estate or trust. Failure to report income can lead to penalties and interest.

- Failure to claim deductions and credits: Make sure to claim all eligible deductions and credits. Failure to claim deductions and credits can lead to overpayment of taxes.

Tips for Filing Form 1041 with Fillable Templates Online

Here are some tips for filing Form 1041 with fillable templates online:

- Use a reputable source: Make sure to use a reputable source for your fillable template. This will ensure that the template is accurate and up-to-date.

- Follow instructions: Follow the instructions provided with the template. This will ensure that you complete the form correctly and avoid mistakes.

- Seek professional help: If you are unsure or have complex tax situations, seek professional help. A tax professional can guide you through the process and ensure that your tax return is accurate and complete.

Conclusion

Filing Form 1041 with fillable templates online can make the process easier and more efficient. By following the steps and tips outlined in this article, you can ensure that your tax return is accurate and complete. Remember to use a reputable source, follow instructions, and seek professional help if needed. With fillable templates online, you can easily file Form 1041 and meet your tax obligations.

What is the deadline for filing Form 1041?

+The deadline for filing Form 1041 is April 15th of each year. However, if the estate or trust has a fiscal year-end that is not December 31st, the deadline is the 15th day of the 4th month after the end of the fiscal year.

Can I file Form 1041 electronically?

+Yes, you can file Form 1041 electronically through the IRS's Modernized e-File (MeF) system. However, you must meet certain requirements and use approved software.

Do I need to attach supporting documents to Form 1041?

+Yes, you may need to attach supporting documents to Form 1041, such as financial statements, tax returns, and identification documents. Make sure to check the instructions and guidelines provided with the form.