The Form 1120-W is a crucial document for corporate tax filers, particularly for estimating their quarterly tax payments. In this article, we will delve into the world of corporate taxation, exploring the importance of Form 1120-W, its components, and the instructions for completing it accurately.

Understanding the Purpose of Form 1120-W

The Form 1120-W is used by corporations to estimate their quarterly tax payments. It is essential to file this form to avoid penalties and ensure compliance with the Internal Revenue Service (IRS) regulations. The form helps corporations calculate their estimated tax liability, which is then used to determine the amount of tax payments due throughout the year.

Who Needs to File Form 1120-W?

Any corporation that expects to owe $500 or more in taxes for the year must file Form 1120-W. This includes:

- C corporations

- S corporations (although they are generally exempt from paying federal income tax)

- Personal Service Corporations (PSCs)

- Tax-exempt organizations with unrelated business income

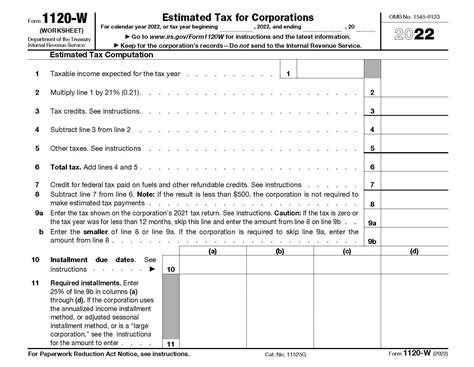

Components of Form 1120-W

The Form 1120-W consists of three main sections:

- Section 1: Estimated Tax Liability

- This section requires corporations to estimate their total tax liability for the year.

- Corporations must consider their expected income, deductions, and credits to calculate their estimated tax liability.

- Section 2: Quarterly Payments

- In this section, corporations must calculate their quarterly estimated tax payments based on their estimated tax liability.

- The due dates for quarterly payments are April 15th, June 15th, September 15th, and January 15th of the following year.

- Section 3: Annualized Estimated Tax Worksheet

- This section is optional and allows corporations to annualize their income to reduce their estimated tax liability.

Instructions for Completing Form 1120-W

To complete Form 1120-W accurately, follow these steps:

- Determine Your Estimated Tax Liability

- Use Form 1120, U.S. Corporation Income Tax Return, to estimate your total tax liability for the year.

- Consider your expected income, deductions, and credits.

- Calculate Your Quarterly Payments

- Divide your estimated tax liability by 4 to determine your quarterly payment amount.

- Round your quarterly payment amount to the nearest whole dollar.

- Complete Section 1

- Report your estimated tax liability in Section 1.

- Include your corporation's name, address, and Employer Identification Number (EIN).

- Complete Section 2

- Report your quarterly payment amounts in Section 2.

- Ensure you include the correct due dates for each quarterly payment.

- Complete Section 3 (Optional)

- If you choose to annualize your income, complete the Annualized Estimated Tax Worksheet in Section 3.

- This may help reduce your estimated tax liability.

Tips and Reminders

- File Form 1120-W electronically: The IRS encourages corporations to file Form 1120-W electronically to reduce errors and ensure timely processing.

- Make timely payments: Corporations must make quarterly payments by the due dates to avoid penalties and interest.

- Keep accurate records: Maintain accurate records of your estimated tax liability and quarterly payments to ensure compliance with IRS regulations.

Common Errors to Avoid

- Underestimating tax liability: Failing to accurately estimate your tax liability can result in penalties and interest.

- Missing quarterly payments: Missing a quarterly payment can result in penalties and interest.

- Inaccurate reporting: Reporting incorrect information on Form 1120-W can lead to delays or rejection of your return.

By following these instructions and tips, corporate tax filers can ensure accurate completion of Form 1120-W and avoid common errors. Remember to file electronically, make timely payments, and maintain accurate records to ensure compliance with IRS regulations.

We hope this article has provided valuable insights into the world of corporate taxation and the importance of Form 1120-W. If you have any questions or concerns, please feel free to ask in the comments below.

What is the purpose of Form 1120-W?

+The Form 1120-W is used by corporations to estimate their quarterly tax payments.

Who needs to file Form 1120-W?

+Any corporation that expects to owe $500 or more in taxes for the year must file Form 1120-W.

What are the due dates for quarterly payments?

+The due dates for quarterly payments are April 15th, June 15th, September 15th, and January 15th of the following year.