Filling out the NJ Refunding Bond and Release form can be a daunting task, especially for those who are not familiar with the process. However, with the right guidance, it can be a straightforward and efficient process. In this article, we will break down the steps to fill out the NJ Refunding Bond and Release form, providing you with a comprehensive guide to ensure you complete it accurately and effectively.

Understanding the NJ Refunding Bond and Release Form

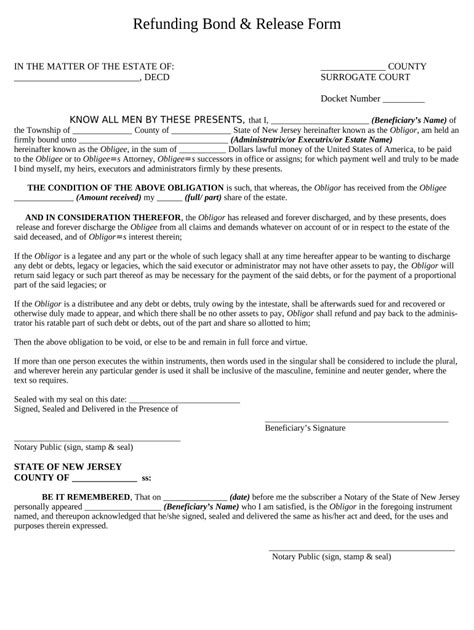

Before we dive into the steps, it's essential to understand the purpose of the NJ Refunding Bond and Release form. This form is used to release a property from a mortgage or lien, allowing the homeowner to receive any remaining funds after the mortgage or lien has been satisfied. The form requires specific information and documentation, which we will outline in the steps below.

Step 1: Gather Required Documents and Information

To fill out the NJ Refunding Bond and Release form, you will need to gather the following documents and information:

- The original mortgage or lien document

- The satisfaction of mortgage or lien document

- The property deed

- The homeowner's identification

- The lender's information (if applicable)

Make sure you have all the necessary documents and information before starting the process.

Step 2: Fill Out the Top Section of the Form

The top section of the form requires the following information:

- The property's block and lot number

- The property's address

- The county where the property is located

- The date of the mortgage or lien

Fill out this section accurately, using the information from the original mortgage or lien document.

Step 3: Fill Out the Middle Section of the Form

The middle section of the form requires the following information:

- The name of the homeowner

- The name of the lender (if applicable)

- The amount of the mortgage or lien

- The date of the satisfaction of mortgage or lien

Fill out this section accurately, using the information from the satisfaction of mortgage or lien document.

Step 4: Fill Out the Bottom Section of the Form

The bottom section of the form requires the following information:

- The signature of the homeowner

- The signature of the lender (if applicable)

- The date of the signatures

Fill out this section accurately, making sure to sign the form in the presence of a notary public.

Step 5: Attach Required Documents

Attach the following documents to the NJ Refunding Bond and Release form:

- The original mortgage or lien document

- The satisfaction of mortgage or lien document

- The property deed

Make sure the documents are attached securely and in the correct order.

Step 6: Submit the Form

Submit the completed NJ Refunding Bond and Release form to the relevant authorities, such as the county clerk's office or the department of treasury. Make sure to follow the correct submission procedures and deadlines.

Conclusion

Filling out the NJ Refunding Bond and Release form can be a complex process, but by following these steps, you can ensure that it is completed accurately and efficiently. Remember to gather all required documents and information, fill out the form carefully, and attach the necessary documents. By doing so, you can successfully release your property from a mortgage or lien and receive any remaining funds.

Encouragement to Engage

We hope this article has been helpful in guiding you through the process of filling out the NJ Refunding Bond and Release form. If you have any questions or need further clarification, please don't hesitate to comment below. Share this article with others who may find it useful, and don't forget to like and subscribe for more informative content.

What is the purpose of the NJ Refunding Bond and Release form?

+The NJ Refunding Bond and Release form is used to release a property from a mortgage or lien, allowing the homeowner to receive any remaining funds after the mortgage or lien has been satisfied.

What documents do I need to gather to fill out the form?

+You will need to gather the original mortgage or lien document, the satisfaction of mortgage or lien document, the property deed, the homeowner's identification, and the lender's information (if applicable).

Where do I submit the completed form?

+You should submit the completed form to the relevant authorities, such as the county clerk's office or the department of treasury. Make sure to follow the correct submission procedures and deadlines.