As a homeowner or business owner, you may have heard of the ACORD Statement of No Loss form, but do you know what it's used for and why it's important? In this article, we'll break down the ACORD Statement of No Loss form in simple terms, so you can understand its purpose and how it affects your insurance claims.

What is the ACORD Statement of No Loss Form?

The ACORD Statement of No Loss form is a document used by insurance companies to verify that a policyholder has not suffered a loss or damage to their property during a specific period. ACORD (Association for Cooperative Operations Research and Development) is a non-profit organization that develops standardized forms for the insurance industry.

The Statement of No Loss form is typically used when a policyholder is applying for a new insurance policy or renewing an existing one. The form requires the policyholder to declare that they have not suffered any losses or damages to their property during a specified period, usually the previous 12 months.

Why is the ACORD Statement of No Loss Form Important?

The ACORD Statement of No Loss form is important because it helps insurance companies to:

- Verify the accuracy of the policyholder's claims history: By requiring policyholders to declare any losses or damages, insurance companies can verify the accuracy of their claims history.

- Assess the risk of insuring the policyholder: The form helps insurance companies to assess the risk of insuring the policyholder, which affects the premium rates they charge.

- Prevent insurance fraud: The form helps to prevent insurance fraud by requiring policyholders to disclose any losses or damages, which can help to detect fraudulent claims.

How Does the ACORD Statement of No Loss Form Work?

Here's how the ACORD Statement of No Loss form typically works:

- Policyholder receives the form: The policyholder receives the ACORD Statement of No Loss form from their insurance company, usually as part of the application or renewal process.

- Policyholder completes the form: The policyholder completes the form, declaring whether they have suffered any losses or damages to their property during the specified period.

- Policyholder signs and returns the form: The policyholder signs and returns the form to their insurance company.

- Insurance company reviews the form: The insurance company reviews the form to verify the accuracy of the policyholder's claims history and assess the risk of insuring them.

What Happens if I Don't Sign the ACORD Statement of No Loss Form?

If you don't sign the ACORD Statement of No Loss form, your insurance company may not be able to process your application or renewal. In some cases, your insurance company may cancel your policy or refuse to pay claims if they discover that you have not disclosed a loss or damage.

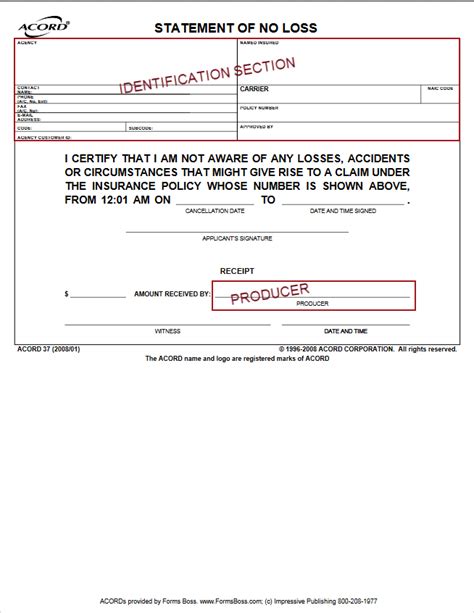

Example of an ACORD Statement of No Loss Form

Here's an example of what an ACORD Statement of No Loss form might look like:

Tips for Completing the ACORD Statement of No Loss Form

Here are some tips for completing the ACORD Statement of No Loss form:

- Read the form carefully: Read the form carefully and make sure you understand what you're being asked to declare.

- Be honest: Be honest and accurate when completing the form. If you have suffered a loss or damage, disclose it on the form.

- Keep records: Keep records of any losses or damages you've suffered, in case you need to provide proof to your insurance company.

Benefits of the ACORD Statement of No Loss Form

The ACORD Statement of No Loss form provides several benefits to policyholders, including:

- Simplified application process: The form simplifies the application process by providing a standardized way for policyholders to declare their claims history.

- Accurate premium rates: The form helps to ensure that policyholders are charged accurate premium rates based on their claims history.

- Reduced risk of insurance fraud: The form helps to reduce the risk of insurance fraud by requiring policyholders to disclose any losses or damages.

Common Questions About the ACORD Statement of No Loss Form

Here are some common questions about the ACORD Statement of No Loss form:

What is the purpose of the ACORD Statement of No Loss form?

The purpose of the ACORD Statement of No Loss form is to verify that a policyholder has not suffered a loss or damage to their property during a specific period.Why do I need to sign the ACORD Statement of No Loss form?

You need to sign the ACORD Statement of No Loss form to verify the accuracy of your claims history and to assess the risk of insuring you.What happens if I don't sign the ACORD Statement of No Loss form?

If you don't sign the ACORD Statement of No Loss form, your insurance company may not be able to process your application or renewal.Conclusion

In conclusion, the ACORD Statement of No Loss form is an important document that helps insurance companies to verify the accuracy of policyholders' claims history and assess the risk of insuring them. By understanding how the form works and what it's used for, you can ensure that you're providing accurate information to your insurance company and avoiding any potential issues with your policy.

FAQ Section

What is the ACORD Statement of No Loss form used for?

+The ACORD Statement of No Loss form is used to verify that a policyholder has not suffered a loss or damage to their property during a specific period.

Why do I need to sign the ACORD Statement of No Loss form?

+You need to sign the ACORD Statement of No Loss form to verify the accuracy of your claims history and to assess the risk of insuring you.

What happens if I don't sign the ACORD Statement of No Loss form?

+If you don't sign the ACORD Statement of No Loss form, your insurance company may not be able to process your application or renewal.