Tax season can be a daunting time for many individuals and businesses, especially when it comes to navigating the complex world of tax forms. One such form that may cause confusion is the IL Rut 50 form, which is required for certain types of vehicle registration in the state of Illinois. In this article, we will provide a comprehensive guide to the IL Rut 50 form, including its purpose, eligibility requirements, and step-by-step instructions on how to file.

What is the IL Rut 50 Form?

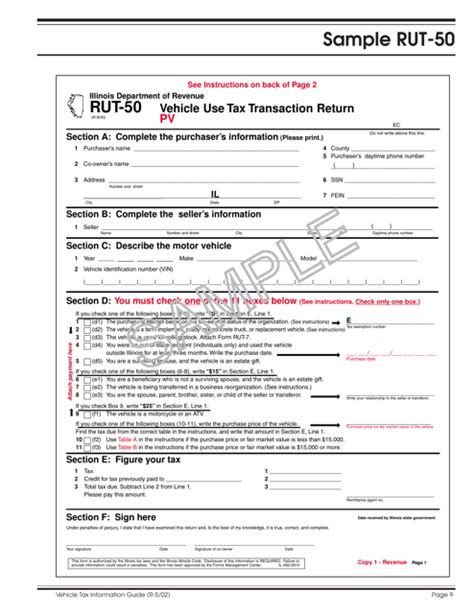

The IL Rut 50 form is a tax form required by the Illinois Department of Revenue for certain types of vehicle registration. The form is used to report and pay taxes on vehicles that are not subject to the standard registration fee, such as trucks, buses, and other commercial vehicles. The form is also used to report and pay taxes on vehicles that are registered under the International Registration Plan (IRP).

Who Needs to File the IL Rut 50 Form?

The IL Rut 50 form is required for individuals and businesses that own or operate vehicles that are subject to the Illinois vehicle tax. This includes:

- Trucks and buses with a gross vehicle weight rating (GVWR) of 16,001 pounds or more

- Commercial vehicles with a GVWR of 8,001 pounds or more

- Vehicles registered under the IRP

- Vehicles that are exempt from the standard registration fee

Eligibility Requirements

To be eligible to file the IL Rut 50 form, you must meet certain requirements, including:

- You must be a resident of Illinois or have a business located in Illinois

- You must own or operate a vehicle that is subject to the Illinois vehicle tax

- You must have a valid Illinois driver's license or state ID

- You must have a valid Federal Employer Identification Number (FEIN) or Social Security number

How to File the IL Rut 50 Form

Filing the IL Rut 50 form can be a complex process, but we have broken it down into step-by-step instructions to make it easier.

Step 1: Gather Required Documents

Before you can file the IL Rut 50 form, you will need to gather certain documents, including:

- Your vehicle registration

- Your driver's license or state ID

- Your FEIN or Social Security number

- Proof of insurance

- Proof of vehicle weight (for trucks and buses)

Step 2: Complete the IL Rut 50 Form

The IL Rut 50 form can be downloaded from the Illinois Department of Revenue website or obtained from your local county clerk's office. The form must be completed in its entirety and signed by the owner or operator of the vehicle.

Step 3: Calculate Your Tax Liability

To calculate your tax liability, you will need to determine the weight of your vehicle and the mileage it was driven during the reporting period. The tax rate is based on the weight of the vehicle and the number of miles driven.

Step 4: Pay Your Tax Liability

Once you have calculated your tax liability, you will need to pay the amount due. You can pay by check, money order, or electronic funds transfer.

Tips and Reminders

Here are some tips and reminders to keep in mind when filing the IL Rut 50 form:

- Make sure to file the form on time to avoid penalties and interest

- Use the correct form and follow the instructions carefully

- Keep a copy of the form and supporting documents for your records

- If you have any questions or concerns, contact the Illinois Department of Revenue or your local county clerk's office

Conclusion

Filing the IL Rut 50 form can be a complex process, but by following the step-by-step instructions outlined in this article, you can ensure that you are in compliance with Illinois tax laws. Remember to file the form on time, use the correct form, and keep a copy of the form and supporting documents for your records. If you have any questions or concerns, don't hesitate to contact the Illinois Department of Revenue or your local county clerk's office.

We hope this article has been informative and helpful. If you have any comments or questions, please feel free to share them below.

What is the IL Rut 50 form used for?

+The IL Rut 50 form is used to report and pay taxes on vehicles that are not subject to the standard registration fee, such as trucks, buses, and other commercial vehicles.

Who needs to file the IL Rut 50 form?

+The IL Rut 50 form is required for individuals and businesses that own or operate vehicles that are subject to the Illinois vehicle tax.

How do I calculate my tax liability?

+To calculate your tax liability, you will need to determine the weight of your vehicle and the mileage it was driven during the reporting period. The tax rate is based on the weight of the vehicle and the number of miles driven.