Donating a vehicle can be a generous act, but it's essential to understand the process and its implications. A Rmv Gift Form, specifically, is used for gifting vehicle registrations in certain jurisdictions. This article will delve into the world of vehicle gifting, exploring the benefits, requirements, and steps involved in the process.

Vehicle donations can be a win-win for both parties. On one hand, the recipient receives a valuable asset, while the donor may be eligible for tax deductions or other benefits. However, it's crucial to navigate the process correctly to avoid any potential pitfalls.

Benefits of Gifting Vehicle Registrations

Gifting vehicle registrations can have several advantages, including:

- Reduced administrative burden: Transferring ownership through a gift form can be less complicated than a traditional sale.

- Tax benefits: Donors may be eligible for tax deductions, depending on the jurisdiction and the recipient's status.

- Supporting a good cause: Vehicle donations can help support charitable organizations or individuals in need.

Requirements for Gifting Vehicle Registrations

Before proceeding with a Rmv Gift Form, it's essential to ensure that the following requirements are met:

- Eligible recipient: The recipient must be eligible to receive a gifted vehicle, which may include individuals, organizations, or charities.

- Vehicle eligibility: The vehicle must meet specific requirements, such as being registered in the donor's name and having no outstanding loans or liens.

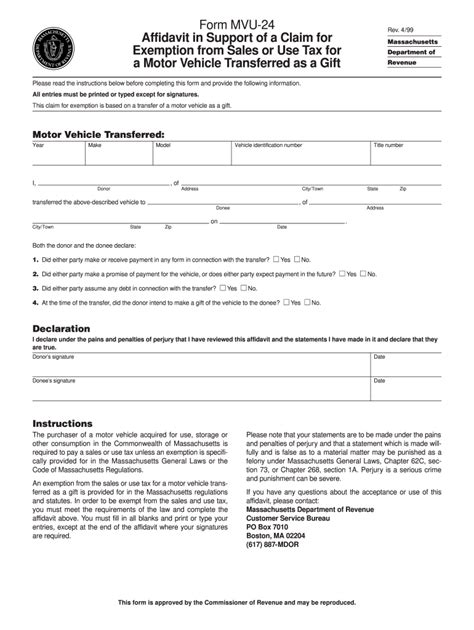

- Documentation: The donor and recipient must provide required documentation, including proof of identity, vehicle registration, and a completed gift form.

Steps to Complete a Rmv Gift Form

To complete a Rmv Gift Form, follow these steps:

- Gather required documentation: Ensure that both the donor and recipient have the necessary documents, including proof of identity and vehicle registration.

- Complete the gift form: Fill out the Rmv Gift Form, including the vehicle's details, the donor's and recipient's information, and the date of the gift.

- Sign and notarize the form: Both the donor and recipient must sign the gift form in the presence of a notary public.

- Submit the form: File the completed gift form with the relevant authorities, along with any supporting documentation.

Tax Implications of Gifting Vehicle Registrations

The tax implications of gifting vehicle registrations vary depending on the jurisdiction and the recipient's status. Donors may be eligible for tax deductions, while recipients may be subject to taxes on the gifted vehicle's value.

- Donor tax benefits: Donors may claim a tax deduction for the vehicle's fair market value, depending on the recipient's status and the jurisdiction's tax laws.

- Recipient tax implications: Recipients may be subject to taxes on the gifted vehicle's value, including sales tax, registration fees, and other charges.

Common Mistakes to Avoid When Gifting Vehicle Registrations

When gifting vehicle registrations, it's essential to avoid common mistakes, including:

- Incomplete or inaccurate documentation: Ensure that all required documentation is complete and accurate to avoid delays or rejections.

- Incorrect recipient information: Verify the recipient's information to avoid any issues with the gift form or tax implications.

- ** Failure to notify authorities**: Notify the relevant authorities of the gifted vehicle to avoid any potential penalties or fines.

Alternatives to Gifting Vehicle Registrations

If gifting vehicle registrations is not a viable option, consider alternative methods, such as:

- Selling the vehicle: Sell the vehicle to the recipient or a third party, which may provide a more straightforward process.

- Donating to charity: Donate the vehicle to a charitable organization, which may offer tax benefits and support a good cause.

- Trading-in the vehicle: Trade-in the vehicle for a new one, which may provide a more convenient option.

Conclusion

Gifting vehicle registrations can be a complex process, but understanding the requirements, benefits, and tax implications can help navigate the process successfully. By following the steps outlined in this article and avoiding common mistakes, donors and recipients can ensure a smooth transfer of ownership.

We invite you to share your experiences or ask questions about gifting vehicle registrations in the comments section below. Your feedback and insights can help others better understand this process.

What is a Rmv Gift Form?

+A Rmv Gift Form is a document used to transfer ownership of a vehicle as a gift in certain jurisdictions.

Who is eligible to receive a gifted vehicle?

+The recipient must meet specific requirements, such as being an individual, organization, or charity, and having no outstanding loans or liens on the vehicle.

What are the tax implications of gifting vehicle registrations?

+The tax implications vary depending on the jurisdiction and the recipient's status. Donors may be eligible for tax deductions, while recipients may be subject to taxes on the gifted vehicle's value.