As a business owner in Virginia, filing the correct tax forms is crucial to avoid penalties and ensure compliance with state regulations. One of the essential forms you need to file is the Virginia Form ST-10, also known as the Sales Tax Return. In this article, we will explore five ways to fill out Virginia Form ST-10 accurately and efficiently.

Understanding the Importance of Virginia Form ST-10

Before we dive into the ways to fill out the form, it's essential to understand the importance of Virginia Form ST-10. This form is used to report and pay sales tax to the Virginia Department of Taxation. As a business owner, you are required to file this form if you have a sales tax account with the state of Virginia.

Method 1: Filing Online through the Virginia Department of Taxation Website

The most convenient way to fill out Virginia Form ST-10 is by filing online through the Virginia Department of Taxation website. To do this, you will need to create an account on the website and follow these steps:

- Log in to your account and select the "File a Return" option

- Choose the tax period for which you want to file

- Enter your sales tax account information

- Report your sales tax liability and make a payment

- Submit your return

Method 2: Using Tax Preparation Software

Another way to fill out Virginia Form ST-10 is by using tax preparation software. These software programs, such as QuickBooks or Xero, can help you accurately calculate your sales tax liability and generate the necessary forms.

To use tax preparation software, follow these steps:

- Import your sales data into the software

- Configure the software to calculate your sales tax liability

- Review and verify the accuracy of the calculations

- Generate the Virginia Form ST-10

- Print or e-file the form

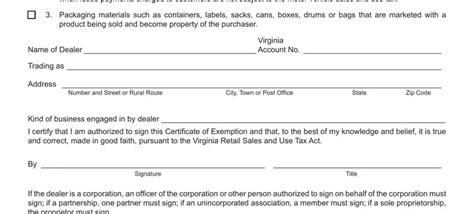

Method 3: Filing by Mail

If you prefer to file by mail, you can download the Virginia Form ST-10 from the Virginia Department of Taxation website or pick one up from a local office. To file by mail, follow these steps:

- Complete the form accurately and legibly

- Attach any required supporting documentation

- Make a check or money order payable to the Virginia Department of Taxation

- Mail the form and payment to the address listed on the form

Method 4: Hiring a Tax Professional

If you are not comfortable filling out the Virginia Form ST-10 yourself, you can hire a tax professional to do it for you. A tax professional can help you accurately calculate your sales tax liability and ensure that you are in compliance with all state regulations.

To hire a tax professional, follow these steps:

- Research and find a reputable tax professional

- Provide them with your sales data and other necessary information

- Review and verify the accuracy of the calculations

- Sign and date the form

Method 5: Using a Third-Party Filing Service

Finally, you can use a third-party filing service to fill out and file the Virginia Form ST-10. These services, such as TaxJar or Avalara, can help you accurately calculate your sales tax liability and file the necessary forms.

To use a third-party filing service, follow these steps:

- Sign up for an account with the service

- Import your sales data into the service

- Configure the service to calculate your sales tax liability

- Review and verify the accuracy of the calculations

- File the form through the service

Best Practices for Filling Out Virginia Form ST-10

Regardless of which method you choose, there are several best practices to keep in mind when filling out Virginia Form ST-10:

- Ensure accuracy: Double-check your calculations and ensure that all information is accurate and complete.

- Use the correct form: Make sure you are using the most up-to-date version of the form.

- File on time: File your return by the due date to avoid penalties and interest.

- Keep records: Keep a copy of your return and supporting documentation for your records.

By following these best practices and using one of the methods outlined above, you can ensure that you fill out Virginia Form ST-10 accurately and efficiently.

Get Ready to File Your Virginia Form ST-10

Filing Virginia Form ST-10 is a crucial part of maintaining compliance with state regulations. By understanding the importance of this form and using one of the methods outlined above, you can ensure that you fill out the form accurately and efficiently.

If you have any questions or concerns about filling out Virginia Form ST-10, don't hesitate to reach out to a tax professional or the Virginia Department of Taxation. They can provide you with the guidance and support you need to ensure that you are in compliance with all state regulations.

What is the due date for filing Virginia Form ST-10?

+The due date for filing Virginia Form ST-10 is the 20th day of the month following the end of the tax period.

Can I file Virginia Form ST-10 online?

+Yes, you can file Virginia Form ST-10 online through the Virginia Department of Taxation website.

What is the penalty for late filing of Virginia Form ST-10?

+The penalty for late filing of Virginia Form ST-10 is 6% of the tax due, plus interest at the rate of 1% per month or fraction of a month.