New York State's tax laws require certain individuals and businesses to file the IT-203-B form, which can be a complex and time-consuming process. As a taxpayer, it's essential to understand the requirements and procedures for filing this form to avoid penalties and ensure compliance with state tax regulations.

For many taxpayers, the IT-203-B form is a necessary evil, but it doesn't have to be a daunting task. With the right guidance, you can navigate the filing process with ease and confidence. In this article, we'll provide a comprehensive guide to help you understand the IT-203-B form, its requirements, and the step-by-step process for filing.

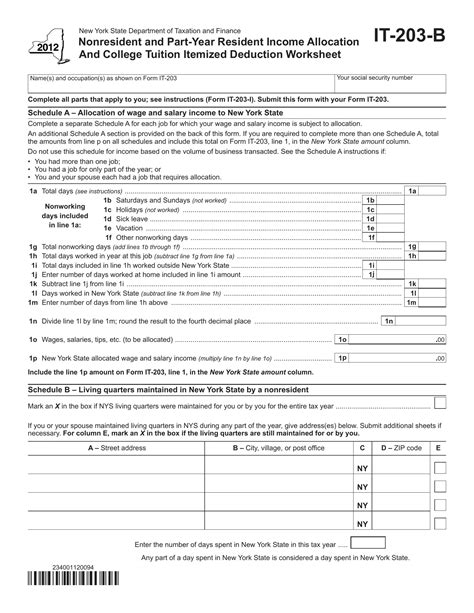

What is the IT-203-B Form?

The IT-203-B form is a tax return form required by the New York State Department of Taxation and Finance for certain individuals and businesses. The form is used to report income, deductions, and credits, and to calculate the taxpayer's tax liability. The IT-203-B form is a crucial component of the state's tax system, and it's essential to file it accurately and on time to avoid penalties and interest.

Who Needs to File the IT-203-B Form?

Not all taxpayers are required to file the IT-203-B form. The following individuals and businesses must file this form:

- Individuals who are residents of New York State and have a gross income of $10,000 or more

- Non-resident individuals who have income from New York State sources and have a gross income of $10,000 or more

- Estates and trusts with a gross income of $10,000 or more

- Businesses with a gross income of $100,000 or more

What is the Filing Deadline for the IT-203-B Form?

The filing deadline for the IT-203-B form is typically April 15th of each year. However, if you need more time to file, you can request an automatic six-month extension by filing Form IT-370. The extension will give you an additional six months to file, but you'll still need to pay any estimated taxes by the original deadline to avoid penalties and interest.

How to File the IT-203-B Form

Filing the IT-203-B form involves several steps:

- Gather all necessary documentation, including:

- W-2 forms for employment income

- 1099 forms for self-employment income

- Interest and dividend statements

- Charitable donation receipts

- Medical expense receipts

- Complete the form accurately and thoroughly, making sure to:

- Report all income, including employment income, self-employment income, and investment income

- Claim all eligible deductions, including charitable donations and medical expenses

- Calculate your tax liability and apply for any credits you're eligible for

- Submit the form to the New York State Department of Taxation and Finance by the filing deadline

What are the Penalties for Not Filing or Late Filing?

Failure to file or late filing of the IT-203-B form can result in penalties and interest. The penalties can range from 5% to 10% of the tax due, depending on the severity of the infraction. In addition to penalties, you'll also be charged interest on the tax due, which can add up quickly.

Tips for Filing the IT-203-B Form

Here are some tips to help you file the IT-203-B form accurately and on time:

- Start early and give yourself plenty of time to gather documentation and complete the form

- Use tax preparation software or consult a tax professional to ensure accuracy and compliance

- Take advantage of e-filing, which can reduce errors and speed up processing

- Keep accurate records and documentation, including receipts and statements

- Stay informed about changes to tax laws and regulations that may affect your filing requirements

Common Mistakes to Avoid When Filing the IT-203-B Form

When filing the IT-203-B form, it's essential to avoid common mistakes that can lead to penalties and delays. Here are some mistakes to watch out for:

- Inaccurate or incomplete information

- Failure to report all income

- Incorrect or missed deductions and credits

- Failure to sign and date the form

- Incomplete or missing documentation

Conclusion

Filing the IT-203-B form can be a complex and time-consuming process, but with the right guidance, you can navigate it with ease and confidence. By understanding the requirements and procedures for filing, you can avoid penalties and ensure compliance with state tax regulations. Remember to start early, use tax preparation software or consult a tax professional, and stay informed about changes to tax laws and regulations.

What is the purpose of the IT-203-B form?

+The IT-203-B form is used to report income, deductions, and credits, and to calculate the taxpayer's tax liability.

Who needs to file the IT-203-B form?

+Individuals and businesses with a gross income of $10,000 or more must file the IT-203-B form.

What is the filing deadline for the IT-203-B form?

+The filing deadline for the IT-203-B form is typically April 15th of each year.