Navigating the world of life insurance can be a daunting task, especially when dealing with the complexities of filing a claim. As a policyholder, it's essential to understand the process to ensure a smooth and stress-free experience. In this article, we will delve into the New York Life AARP life insurance claim form guide, providing you with a comprehensive understanding of the process and what to expect.

Understanding New York Life AARP Life Insurance

Before we dive into the claim form guide, it's crucial to understand the basics of New York Life AARP life insurance. The American Association of Retired Persons (AARP) partners with New York Life Insurance Company to offer life insurance policies exclusively to AARP members. These policies are designed to provide financial protection and peace of mind for members and their loved ones.

Types of Life Insurance Policies Offered by New York Life AARP

New York Life AARP offers a range of life insurance policies, including:

- Level Benefit Term Life Insurance

- Permanent Life Insurance

- Guaranteed Acceptance Life Insurance

Each policy type has its unique features, benefits, and requirements. It's essential to understand the specifics of your policy to navigate the claim process effectively.

The Claim Process: A Step-by-Step Guide

Filing a claim with New York Life AARP involves several steps. Here's a step-by-step guide to help you through the process:

- Notify New York Life AARP: Inform the company about the passing of the insured person as soon as possible. You can call their customer service number or submit a claim notification form on their website.

- Gather Required Documents: You'll need to provide documentation to support your claim, including:

- Death certificate

- Policy documents

- Identification (driver's license, passport, or state ID)

- Proof of relationship to the insured person (birth certificate, marriage certificate, or divorce decree)

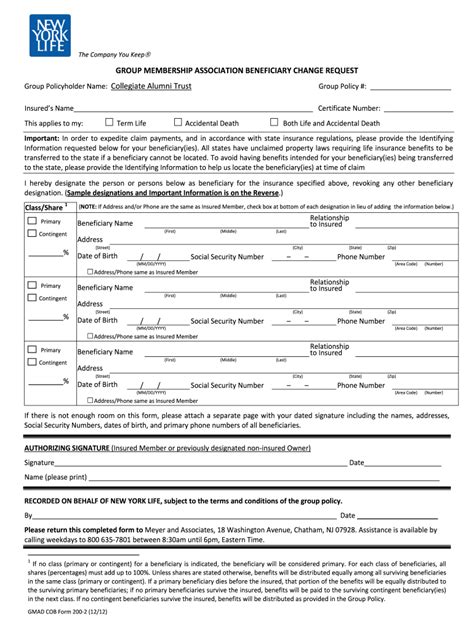

- Complete the Claim Form: Download and complete the claim form from the New York Life AARP website or request one by mail. Ensure you fill out the form accurately and thoroughly.

- Submit the Claim: Send the completed claim form and supporting documents to New York Life AARP via mail or fax.

What to Expect After Submitting Your Claim

After submitting your claim, New York Life AARP will review and process your application. This may take several weeks, depending on the complexity of the claim. You can expect:

- A claims examiner to review your application and verify the information provided

- A request for additional documentation or information, if required

- A notification of the claim decision, including the payment amount and any next steps

Tips for Filing a Successful Claim

To ensure a smooth claim process, keep the following tips in mind:

- Act promptly: Notify New York Life AARP as soon as possible after the passing of the insured person.

- Gather all required documents: Ensure you have all necessary documentation to avoid delays in the claim process.

- Complete the claim form accurately: Double-check your form for errors or omissions to prevent delays or rejections.

- Keep records: Maintain a record of all correspondence and communication with New York Life AARP.

Common Mistakes to Avoid When Filing a Claim

When filing a claim with New York Life AARP, avoid the following common mistakes:

- Inaccurate or incomplete information: Ensure all information provided is accurate and complete to avoid delays or rejections.

- Insufficient documentation: Failing to provide required documentation can lead to claim rejection or delays.

- Missed deadlines: Missing deadlines or failing to submit the claim form on time can result in claim rejection.

Conclusion: Taking Control of Your Claim

Filing a claim with New York Life AARP can be a complex and overwhelming process. However, by understanding the claim form guide and following the steps outlined in this article, you can navigate the process with confidence. Remember to act promptly, gather all required documents, and complete the claim form accurately to ensure a smooth and stress-free experience.

How long does it take to process a claim with New York Life AARP?

+The claim process typically takes several weeks, depending on the complexity of the claim. You can expect to receive a notification of the claim decision within 2-4 weeks after submitting your claim.

What documentation is required to support my claim?

+You'll need to provide a death certificate, policy documents, identification, and proof of relationship to the insured person. Additional documentation may be required, depending on the specific policy and circumstances.

Can I submit my claim online?

+No, New York Life AARP does not currently offer online claim submission. You can download and complete the claim form from their website or request one by mail.