Filing taxes can be a daunting task, especially for partnerships in California. The California Partnership Tax Return Form 568 is a critical document that partnerships must file annually with the California Franchise Tax Board (FTB). In this article, we will provide a comprehensive guide to help you understand the California Partnership Tax Return Form 568, its requirements, and the steps to file it accurately.

What is the California Partnership Tax Return Form 568?

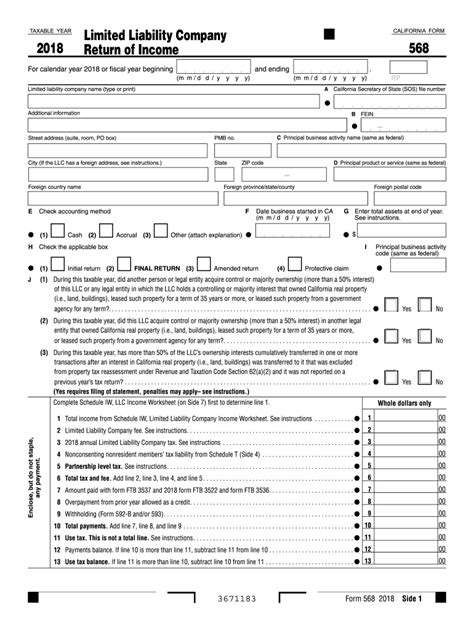

The California Partnership Tax Return Form 568 is a tax return form that partnerships must file with the California Franchise Tax Board (FTB) to report their income, deductions, and credits. The form is used to calculate the partnership's tax liability and to report the distributive shares of income, deductions, and credits to each partner.

Who must file the California Partnership Tax Return Form 568?

All partnerships that are required to file a federal partnership tax return (Form 1065) must also file the California Partnership Tax Return Form 568. This includes:

- General partnerships

- Limited partnerships

- Limited liability partnerships (LLPs)

- Limited liability companies (LLCs) that are treated as partnerships for tax purposes

What information is required on the California Partnership Tax Return Form 568?

The California Partnership Tax Return Form 568 requires partnerships to report the following information:

- Partnership name, address, and taxpayer identification number (EIN)

- Partnership type (e.g., general partnership, limited partnership, etc.)

- Fiscal year end

- Total income

- Total deductions

- Net income

- Distributive shares of income, deductions, and credits to each partner

- Tax credits and deductions claimed by the partnership

How to file the California Partnership Tax Return Form 568

To file the California Partnership Tax Return Form 568, follow these steps:

- Gather required documents: Collect all necessary documents, including the partnership's federal tax return (Form 1065), financial statements, and any supporting schedules or forms.

- Complete the form: Fill out the California Partnership Tax Return Form 568 accurately and completely, ensuring that all required information is included.

- Calculate the partnership's tax liability: Use the form to calculate the partnership's tax liability, taking into account any tax credits and deductions claimed.

- Report distributive shares: Report the distributive shares of income, deductions, and credits to each partner on Schedule K-1 (Form 568).

- Submit the form: File the completed California Partnership Tax Return Form 568 with the FTB by the deadline (usually April 15th for calendar-year partnerships).

Schedule K-1 (Form 568)

Schedule K-1 (Form 568) is a critical component of the California Partnership Tax Return Form 568. This schedule is used to report the distributive shares of income, deductions, and credits to each partner. Partnerships must provide a copy of Schedule K-1 to each partner by the deadline (usually April 15th for calendar-year partnerships).

Tips for accurately filing the California Partnership Tax Return Form 568

- Ensure accurate and complete reporting of all required information.

- Use the correct partnership type and fiscal year end.

- Calculate the partnership's tax liability accurately, taking into account any tax credits and deductions claimed.

- Report distributive shares to each partner accurately and completely on Schedule K-1 (Form 568).

- File the form and supporting schedules by the deadline to avoid penalties and interest.

Common mistakes to avoid

- Failing to report all required information.

- Using incorrect partnership type or fiscal year end.

- Calculating the partnership's tax liability incorrectly.

- Failing to report distributive shares to each partner accurately and completely.

- Filing the form and supporting schedules late.

Conclusion

Filing the California Partnership Tax Return Form 568 can be a complex process, but with the right guidance, partnerships can ensure accurate and timely filing. By understanding the requirements and following the steps outlined in this guide, partnerships can avoid common mistakes and ensure compliance with California tax laws.

What's next?

If you have any questions or concerns about filing the California Partnership Tax Return Form 568, consult with a tax professional or contact the California Franchise Tax Board (FTB) for guidance. Remember to file the form and supporting schedules by the deadline to avoid penalties and interest.

Additional Resources

For more information on the California Partnership Tax Return Form 568, consult the following resources:

- California Franchise Tax Board (FTB) website:

- IRS website:

- California Tax Service Center:

FAQs

What is the deadline for filing the California Partnership Tax Return Form 568?

+The deadline for filing the California Partnership Tax Return Form 568 is usually April 15th for calendar-year partnerships.

Do I need to file the California Partnership Tax Return Form 568 if I have no income?

+Yes, you must file the California Partnership Tax Return Form 568 even if the partnership has no income. Failure to file may result in penalties and interest.

Can I file the California Partnership Tax Return Form 568 electronically?

+Yes, you can file the California Partnership Tax Return Form 568 electronically through the California Franchise Tax Board's (FTB) e-file system.

We hope this article has provided you with valuable insights into the California Partnership Tax Return Form 568. If you have any further questions or concerns, please don't hesitate to comment below.