The Health Savings Account (HSA) has become a popular tax-advantaged savings account for individuals with high-deductible health plans (HDHPs). One of the most important aspects of HSA management is compliance with the IRS's rules and regulations, particularly when it comes to filing Form 8889. In this article, we will explore the specifics of Form 8889 Line 3 compliance and provide valuable tips to help you navigate this complex process.

Understanding Form 8889 and Line 3

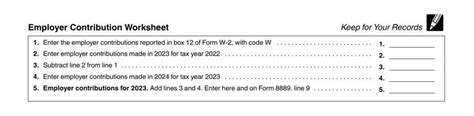

Form 8889 is used to report HSA contributions, distributions, and balance information to the IRS. Line 3 of Form 8889 specifically requires the reporting of HSA contributions, including those made by the account holder, their employer, and others. Accurate reporting of these contributions is crucial to avoid any potential penalties or fines.

Tip 1: Verify Eligibility and Qualifying High-Deductible Health Plan (HDHP)

To contribute to an HSA, you must have a qualifying HDHP. This means that your health insurance plan must meet certain deductible and out-of-pocket expense limits set by the IRS. Before reporting contributions on Line 3, ensure that your HDHP meets these requirements. You can check the IRS website for the current year's limits.

Tip 2: Keep Accurate Records of Contributions

To accurately complete Line 3, you must keep track of all HSA contributions made throughout the year. This includes contributions made by you, your employer, and others, such as family members or friends. Ensure that you have records of each contribution, including the date, amount, and type of contribution.

Tip 3: Understand the Contribution Limits

The IRS sets annual contribution limits for HSAs. For 2022, the individual contribution limit is $3,650, and the family contribution limit is $7,300. If you are 55 or older, you may also make catch-up contributions. Be sure to check the current year's limits and ensure that your contributions do not exceed these amounts.

Tip 4: Report Employer Contributions Correctly

If your employer contributes to your HSA, you must report these contributions on Line 3. Employer contributions are generally excluded from your income and are not subject to federal income tax. However, you must still report them on your tax return. Ensure that you have accurate records of employer contributions and report them correctly on Line 3.

Tip 5: Seek Professional Help if Needed

Completing Form 8889 and accurately reporting HSA contributions can be complex. If you are unsure about any aspect of the process, consider seeking help from a tax professional or financial advisor. They can provide guidance on eligibility, contribution limits, and reporting requirements to ensure that you are in compliance with the IRS's rules and regulations.

By following these tips, you can ensure compliance with Form 8889 Line 3 requirements and avoid any potential penalties or fines. Remember to verify your eligibility, keep accurate records of contributions, understand the contribution limits, report employer contributions correctly, and seek professional help if needed.

In conclusion, managing an HSA requires careful attention to detail and compliance with the IRS's rules and regulations. By following these tips and staying informed, you can maximize the benefits of your HSA and ensure a smooth tax-filing process.

What is the purpose of Form 8889?

+Form 8889 is used to report HSA contributions, distributions, and balance information to the IRS.

What are the contribution limits for HSAs?

+The individual contribution limit for 2022 is $3,650, and the family contribution limit is $7,300. If you are 55 or older, you may also make catch-up contributions.

Why is it important to keep accurate records of HSA contributions?

+Accurate records of HSA contributions are necessary to complete Form 8889 correctly and avoid any potential penalties or fines.