Understanding the Public Service Loan Forgiveness (PSLF) Program

The Public Service Loan Forgiveness (PSLF) program is a federal initiative designed to help borrowers working in public service fields, such as government, non-profit organizations, and education, manage their student loan debt. The program offers a unique opportunity for borrowers to have their remaining loan balance forgiven after making 120 qualifying payments. However, navigating the PSLF program can be complex, and understanding the requirements and application process is crucial to achieving loan forgiveness.

What is the PSLF Program?

The PSLF program was introduced in 2007 as part of the College Cost Reduction and Access Act. The program is designed to encourage borrowers to pursue careers in public service by offering loan forgiveness after a specified period. To be eligible for the PSLF program, borrowers must meet specific requirements, including working in a qualifying public service job, having a qualifying loan, and making 120 qualifying payments.

Eligibility Requirements for the PSLF Program

To be eligible for the PSLF program, borrowers must meet the following requirements:

- Work in a qualifying public service job: This includes working for a government agency, non-profit organization, or other qualifying employer.

- Have a qualifying loan: Only Direct Loans are eligible for the PSLF program.

- Make 120 qualifying payments: Borrowers must make 120 qualifying payments while working in a public service job to be eligible for loan forgiveness.

Qualifying Public Service Jobs

To qualify for the PSLF program, borrowers must work in a public service job. Qualifying jobs include:

- Government agencies: Federal, state, local, and tribal government agencies are considered qualifying employers.

- Non-profit organizations: 501(c)(3) organizations and other non-profit organizations are considered qualifying employers.

- Public education: Teachers and other education professionals working in public schools are considered qualifying employers.

- Public health: Healthcare professionals working in public hospitals and clinics are considered qualifying employers.

The PSLF Application Process

The PSLF application process involves several steps:

- Determine eligibility: Borrowers must determine if they meet the eligibility requirements for the PSLF program.

- Gather required documents: Borrowers must gather required documents, including proof of employment and loan documents.

- Submit the application: Borrowers must submit the PSLF application, which can be done online or by mail.

- Review and certification: The application will be reviewed and certified by the employer and loan servicer.

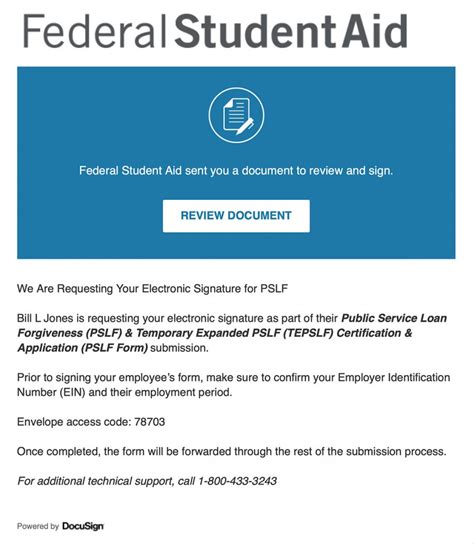

The Fillable PSLF Form

The fillable PSLF form is a convenient way for borrowers to apply for the PSLF program. The form can be downloaded from the Federal Student Aid website and completed electronically. The form requires borrowers to provide information about their employment, loan, and payment history.

Benefits of Using a Fillable PSLF Form

Using a fillable PSLF form can simplify the application process and reduce errors. The benefits of using a fillable PSLF form include:

- Convenience: The form can be completed electronically, making it easier to apply for the PSLF program.

- Accuracy: The form helps ensure that borrowers provide accurate information, reducing errors and delays.

- Efficiency: The form streamlines the application process, making it faster and more efficient.

Tips for Completing the Fillable PSLF Form

When completing the fillable PSLF form, borrowers should:

- Read the instructions carefully: Make sure to read the instructions carefully before starting the application.

- Gather required documents: Gather all required documents, including proof of employment and loan documents.

- Complete the form accurately: Complete the form accurately and thoroughly to avoid errors and delays.

Conclusion

The PSLF program is a valuable resource for borrowers working in public service fields. By understanding the eligibility requirements and application process, borrowers can simplify their student loan forgiveness journey. Using a fillable PSLF form can help streamline the application process and reduce errors. By following the tips and guidelines outlined in this article, borrowers can increase their chances of achieving loan forgiveness through the PSLF program.

What is the PSLF program?

+The Public Service Loan Forgiveness (PSLF) program is a federal initiative designed to help borrowers working in public service fields, such as government, non-profit organizations, and education, manage their student loan debt.

What are the eligibility requirements for the PSLF program?

+To be eligible for the PSLF program, borrowers must work in a qualifying public service job, have a qualifying loan, and make 120 qualifying payments.

How do I apply for the PSLF program?

+Borrowers can apply for the PSLF program by submitting the fillable PSLF form, which can be downloaded from the Federal Student Aid website.