The Prudential Hardship Withdrawal Form is a crucial document for individuals who need to access their retirement savings due to unforeseen financial difficulties. Filling out this form can be a daunting task, especially when you're already dealing with financial stress. In this article, we will guide you through the process of completing the Prudential Hardship Withdrawal Form, highlighting the essential steps and requirements to ensure a smooth and successful submission.

Understanding the Prudential Hardship Withdrawal Form

Before we dive into the completion process, it's essential to understand the purpose of the Prudential Hardship Withdrawal Form. This form is designed for individuals who need to withdraw funds from their Prudential retirement account due to financial hardship. The form requires detailed information about your financial situation, the reason for the withdrawal, and the amount you're requesting.

Step 1: Gather Required Documents and Information

To complete the Prudential Hardship Withdrawal Form, you'll need to gather specific documents and information. These may include:

- Your Prudential account number

- Proof of income (pay stubs, W-2 forms, etc.)

- Proof of expenses (bills, invoices, etc.)

- Documentation of your financial hardship (medical bills, divorce or separation papers, etc.)

- A detailed explanation of your financial situation and the reason for the withdrawal

Step 2: Complete the Form

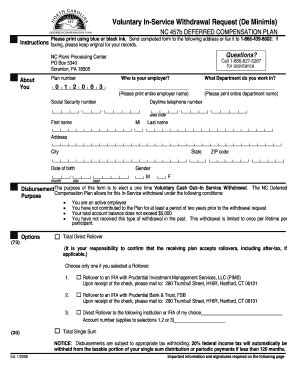

Once you have gathered all the necessary documents and information, you can start filling out the Prudential Hardship Withdrawal Form. The form typically consists of several sections, including:

- Section 1: Account Information

- Enter your Prudential account number

- Verify your account details (name, address, etc.)

- Section 2: Financial Hardship Information

- Explain the reason for the withdrawal (medical expenses, divorce, etc.)

- Provide documentation supporting your financial hardship

- Section 3: Withdrawal Request

- Specify the amount you're requesting to withdraw

- Indicate the purpose of the withdrawal (paying medical bills, etc.)

- Section 4: Certification and Signature

- Sign and date the form

- Certify that the information provided is accurate and true

Step 3: Review and Edit the Form

Carefully review the form to ensure that all information is accurate and complete. Make any necessary edits or corrections before proceeding.

Step 4: Attach Supporting Documentation

Attach all supporting documentation, including proof of income, expenses, and financial hardship, to the form. Make sure to keep a copy of the form and supporting documents for your records.

Step 5: Submit the Form

Finally, submit the completed Prudential Hardship Withdrawal Form to Prudential. You can usually do this via mail, fax, or online portal, depending on your account settings.

Additional Tips and Considerations

When completing the Prudential Hardship Withdrawal Form, keep the following tips and considerations in mind:

- Understand the rules and regulations: Familiarize yourself with the IRS rules and regulations regarding hardship withdrawals.

- Be aware of the tax implications: Hardship withdrawals may be subject to income tax and penalties.

- Consider alternative options: Before withdrawing from your retirement account, explore alternative options, such as loans or emergency assistance programs.

- Seek professional advice: If you're unsure about the process or have complex financial situations, consider consulting a financial advisor.

Conclusion

Completing the Prudential Hardship Withdrawal Form can be a challenging and time-consuming process. However, by following these steps and considering the additional tips and considerations, you can ensure a smooth and successful submission. Remember to take your time, be thorough, and seek professional advice if needed. If you have any questions or concerns, please don't hesitate to comment below.

FAQs

What is a Prudential Hardship Withdrawal Form?

+A Prudential Hardship Withdrawal Form is a document used to request a withdrawal from a Prudential retirement account due to financial hardship.

What documentation is required to complete the form?

+Required documentation may include proof of income, expenses, and financial hardship, as well as a detailed explanation of your financial situation.

Are there any tax implications associated with hardship withdrawals?

+Yes, hardship withdrawals may be subject to income tax and penalties. It's essential to understand the tax implications before submitting the form.