Dissolving a business in Michigan can be a complex process, but having the right guidance can make all the difference. For those looking to dissolve their Michigan-based limited liability company (LLC), the Certificate of Dissolution Form 531 is a crucial document to navigate. In this article, we will delve into the world of business dissolution, exploring the importance of the Certificate of Dissolution Form 531, its requirements, and a step-by-step guide on how to fill it out.

Understanding the Certificate of Dissolution Form 531

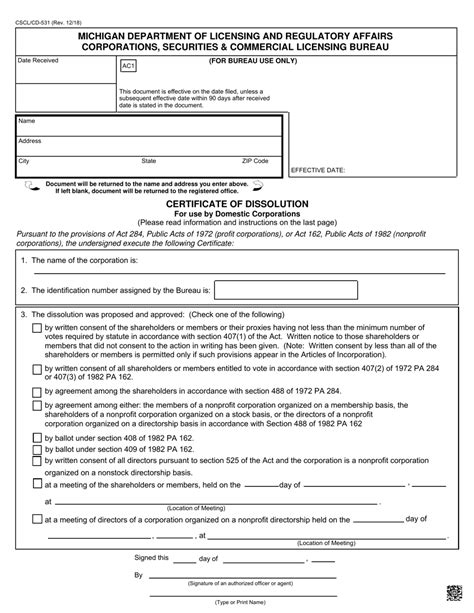

The Certificate of Dissolution Form 531 is a document filed with the Michigan Department of Licensing and Regulatory Affairs (LARA) to officially dissolve an LLC. This form is a critical component of the dissolution process, as it provides the state with formal notice of the LLC's intention to cease operations.

Why is the Certificate of Dissolution Form 531 Important?

Filing the Certificate of Dissolution Form 531 is essential for several reasons:

- It notifies the state of the LLC's intention to dissolve, which helps to avoid any potential penalties or fines.

- It provides a formal record of the LLC's dissolution, which can be useful for tax purposes and other business matters.

- It helps to protect the LLC's members and managers from personal liability by officially terminating the business.

Requirements for Filing the Certificate of Dissolution Form 531

Before filing the Certificate of Dissolution Form 531, the LLC must meet certain requirements:

- The LLC must be in good standing with the state of Michigan.

- The LLC must have a valid name and a registered agent.

- The LLC must have filed all required annual reports and paid all fees.

- The LLC must have resolved all outstanding debts and obligations.

Step-by-Step Guide to Filling Out the Certificate of Dissolution Form 531

Filling out the Certificate of Dissolution Form 531 can seem daunting, but by following these steps, you can ensure that your LLC's dissolution is handled correctly:

- Download the form: Obtain the Certificate of Dissolution Form 531 from the Michigan Department of Licensing and Regulatory Affairs (LARA) website.

- Fill out the header: Enter the LLC's name, address, and registered agent information.

- Section 1: Statement of Dissolution: Check the box indicating that the LLC is being dissolved.

- Section 2: Effective Date of Dissolution: Enter the date on which the LLC is being dissolved.

- Section 3: Mailing Address: Enter the LLC's mailing address.

- Section 4: Registered Agent Information: Enter the registered agent's name and address.

- Section 5: Signature: Sign the form as the LLC's authorized representative.

Additional Requirements and Considerations

In addition to filing the Certificate of Dissolution Form 531, the LLC must also:

- Publish notice of dissolution: Publish a notice of dissolution in a newspaper of general circulation in the county where the LLC's principal place of business is located.

- Notify creditors: Notify all creditors of the LLC's dissolution.

- File final tax returns: File final tax returns with the state of Michigan and the IRS.

Common Mistakes to Avoid

When filling out the Certificate of Dissolution Form 531, avoid the following common mistakes:

- Inaccurate information: Ensure that all information entered on the form is accurate and up-to-date.

- Missing signatures: Ensure that the form is signed by the LLC's authorized representative.

- Incomplete filing: Ensure that all required documents and fees are submitted with the form.

Conclusion

Dissolving a Michigan-based LLC requires careful attention to detail and compliance with state regulations. By following the step-by-step guide outlined in this article, you can ensure that your LLC's dissolution is handled correctly and efficiently.

Call to Action

If you're looking to dissolve your Michigan-based LLC, don't hesitate to reach out to a qualified business attorney or accountant for guidance. With the right support, you can navigate the dissolution process with confidence.

What is the purpose of the Certificate of Dissolution Form 531?

+The Certificate of Dissolution Form 531 is a document filed with the Michigan Department of Licensing and Regulatory Affairs (LARA) to officially dissolve an LLC.

What are the requirements for filing the Certificate of Dissolution Form 531?

+The LLC must be in good standing with the state of Michigan, have a valid name and registered agent, and have filed all required annual reports and paid all fees.

What are the consequences of not filing the Certificate of Dissolution Form 531?

+Failing to file the Certificate of Dissolution Form 531 can result in penalties, fines, and ongoing liability for the LLC's members and managers.