Filing business tax returns can be a daunting task, especially for those who are new to the process. In New Jersey, the state requires businesses to file a specific form, known as the NJ Form CBT-2553, to report their tax liability. In this article, we will provide a comprehensive guide to help you understand the NJ Form CBT-2553, its requirements, and the steps to file it accurately.

Understanding the NJ Form CBT-2553

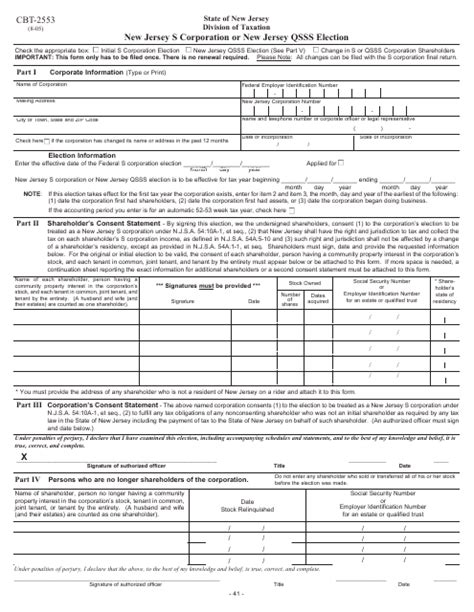

The NJ Form CBT-2553 is a business tax return form used by the New Jersey Division of Taxation to calculate the tax liability of businesses operating in the state. The form is required to be filed by all businesses, including corporations, partnerships, and limited liability companies (LLCs), that are subject to the New Jersey Corporation Business Tax Act.

Who Needs to File the NJ Form CBT-2553?

All businesses that are subject to the New Jersey Corporation Business Tax Act must file the NJ Form CBT-2553. This includes:

- Corporations, including S corporations and C corporations

- Partnerships, including limited partnerships and limited liability partnerships

- Limited liability companies (LLCs)

- Business trusts

What Information is Required on the NJ Form CBT-2553?

The NJ Form CBT-2553 requires businesses to provide specific information, including:

- Business name and address

- Federal Employer Identification Number (FEIN)

- Business type (corporation, partnership, LLC, etc.)

- Tax year and period

- Gross income and total revenue

- Deductions and exemptions

- Tax credits and net operating losses

- Tax liability and payment information

How to File the NJ Form CBT-2553

The NJ Form CBT-2553 can be filed electronically or by mail. Electronic filing is available through the New Jersey Division of Taxation's website, and it is recommended to file electronically to avoid delays and errors.

To file by mail, businesses can download the form from the New Jersey Division of Taxation's website or request a copy by phone or mail. The completed form should be mailed to the address listed on the form.

Deadline for Filing the NJ Form CBT-2553

The deadline for filing the NJ Form CBT-2553 is typically April 15th of each year, but it may vary depending on the business type and tax year. It is essential to check the New Jersey Division of Taxation's website or consult with a tax professional to determine the specific deadline for your business.

Penalties for Late Filing or Non-Filing

Failure to file the NJ Form CBT-2553 on time or not filing at all can result in penalties and interest. The penalties can range from 5% to 25% of the tax liability, depending on the length of time the return is late. Additionally, interest will be charged on the unpaid tax liability.

Amending the NJ Form CBT-2553

If a business needs to make changes to a previously filed NJ Form CBT-2553, they can file an amended return using Form CBT-2553A. The amended return should include the corrected information and an explanation of the changes.

Common Mistakes to Avoid

When filing the NJ Form CBT-2553, businesses should avoid common mistakes, such as:

- Inaccurate or incomplete information

- Failure to report all income

- Incorrect calculation of tax liability

- Missing or late payment

Tips for Filing the NJ Form CBT-2553

To ensure accurate and timely filing of the NJ Form CBT-2553, businesses can follow these tips:

- Consult with a tax professional or accountant

- Keep accurate and detailed records

- Use the correct form and instructions

- File electronically to avoid delays and errors

- Make timely payments to avoid penalties and interest

Conclusion

Filing the NJ Form CBT-2553 is a critical task for businesses operating in New Jersey. By understanding the requirements, deadlines, and common mistakes to avoid, businesses can ensure accurate and timely filing of their tax returns. If you have any questions or concerns, don't hesitate to reach out to a tax professional or the New Jersey Division of Taxation.

FAQ Section

What is the NJ Form CBT-2553 used for?

+The NJ Form CBT-2553 is used to report the tax liability of businesses operating in New Jersey.

Who needs to file the NJ Form CBT-2553?

+All businesses subject to the New Jersey Corporation Business Tax Act, including corporations, partnerships, and LLCs, must file the NJ Form CBT-2553.

What is the deadline for filing the NJ Form CBT-2553?

+The deadline for filing the NJ Form CBT-2553 is typically April 15th of each year, but it may vary depending on the business type and tax year.