The UIC W2 form is a crucial document for both employees and employers, as it plays a significant role in the tax filing process. As an employee, receiving a correct W2 form from your employer is essential for accurately reporting your income and claiming the right amount of taxes. On the other hand, employers are responsible for providing their employees with a W2 form by the deadline, and for submitting the necessary documents to the Social Security Administration (SSA). In this article, we will delve into the details of the UIC W2 form, its importance, and provide a comprehensive guide for both employees and employers.

What is the UIC W2 Form?

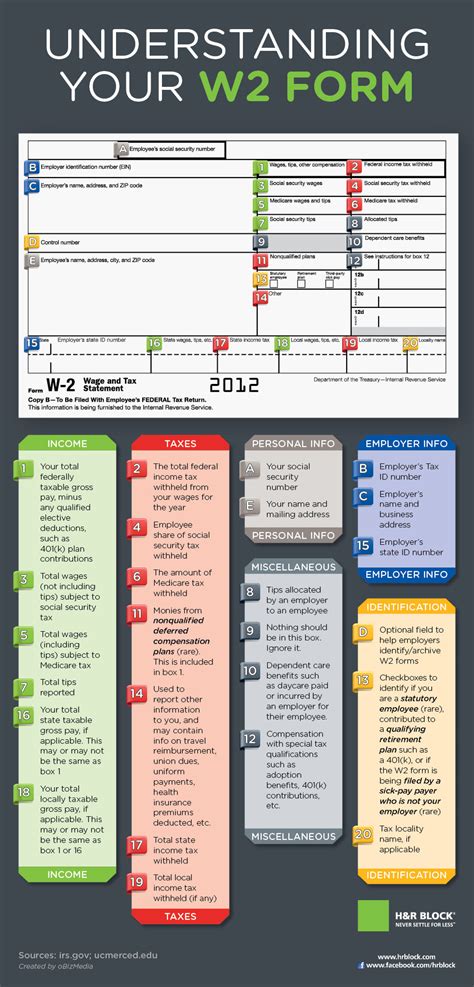

The UIC W2 form, also known as the Wage and Tax Statement, is a document that employers must provide to their employees and the SSA by the end of January each year. The form reports an employee's income, taxes withheld, and other relevant information. It is a critical document for tax purposes, as it helps the SSA and the Internal Revenue Service (IRS) track income and ensure that employees and employers are meeting their tax obligations.

Why is the UIC W2 Form Important?

The UIC W2 form is essential for several reasons:

- Tax Filing: The W2 form is necessary for employees to accurately report their income and claim the right amount of taxes. Without a correct W2 form, employees may face difficulties when filing their tax returns.

- Social Security Benefits: The SSA uses the information on the W2 form to calculate an employee's Social Security benefits. Inaccurate or missing information can lead to incorrect benefit calculations.

- Employer Compliance: Employers are required to provide W2 forms to their employees and submit the necessary documents to the SSA. Failure to comply with these regulations can result in penalties and fines.

Benefits for Employees

- Accurate Tax Reporting: The W2 form ensures that employees accurately report their income and claim the right amount of taxes.

- Social Security Benefits: The SSA uses the information on the W2 form to calculate an employee's Social Security benefits.

Benefits for Employers

- Compliance with Regulations: Providing W2 forms to employees and submitting the necessary documents to the SSA helps employers comply with tax regulations.

- Avoid Penalties and Fines: Failure to provide W2 forms or submit documents to the SSA can result in penalties and fines.

How to Complete the UIC W2 Form

Completing the UIC W2 form requires careful attention to detail. Here are the steps to follow:

- Gather Necessary Information: Employers need to gather the necessary information, including employee names, addresses, Social Security numbers, and income details.

- Complete the Form: Fill out the W2 form accurately, ensuring that all information is correct and complete.

- Provide to Employees: Provide the completed W2 form to employees by the end of January each year.

- Submit to SSA: Submit the necessary documents to the SSA by the deadline.

Common Errors to Avoid

- Inaccurate Information: Ensure that all information on the W2 form is accurate and complete.

- Missed Deadlines: Provide W2 forms to employees and submit documents to the SSA by the deadline to avoid penalties and fines.

UIC W2 Form FAQs

Here are some frequently asked questions about the UIC W2 form:

- What is the deadline for providing W2 forms to employees? Employers must provide W2 forms to employees by January 31st each year.

- What is the deadline for submitting W2 forms to the SSA? Employers must submit W2 forms to the SSA by January 31st each year.

- What information is required on the W2 form? The W2 form requires employee names, addresses, Social Security numbers, and income details.

What is the purpose of the UIC W2 form?

+The UIC W2 form is used to report an employee's income, taxes withheld, and other relevant information to the Social Security Administration (SSA) and the Internal Revenue Service (IRS).

What are the consequences of not providing a correct W2 form?

+Failure to provide a correct W2 form can result in penalties and fines for employers. Employees may also face difficulties when filing their tax returns.

How can I obtain a copy of my W2 form?

+Contact your employer to obtain a copy of your W2 form. If you are unable to obtain a copy from your employer, you can contact the SSA for assistance.

In conclusion, the UIC W2 form is a critical document for both employees and employers. It plays a significant role in the tax filing process and ensures that employees and employers are meeting their tax obligations. By understanding the importance of the W2 form and following the steps to complete it accurately, employers can avoid penalties and fines, and employees can ensure accurate tax reporting and Social Security benefits.

We hope this article has provided you with a comprehensive guide to the UIC W2 form. If you have any further questions or concerns, please don't hesitate to comment below. Share this article with others to help them understand the importance of the W2 form.