As a homeowner or a lender, you may have come across Fannie Mae Form 1005, but do you understand its significance and the role it plays in the mortgage process? This form is a crucial document in the lending industry, and its accuracy can make or break a mortgage application. In this article, we will delve into the world of Fannie Mae Form 1005, exploring its purpose, contents, and importance in the mortgage landscape.

The Importance of Fannie Mae Form 1005

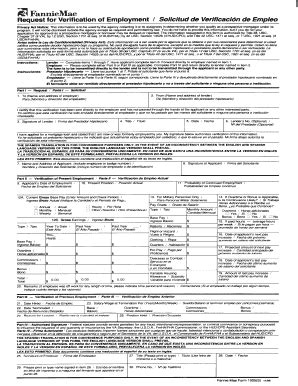

Fannie Mae Form 1005, also known as the Uniform Residential Loan Application, is a standardized form used by lenders to collect information from borrowers. The form is designed to provide a comprehensive overview of the borrower's financial situation, credit history, and employment status. This information is crucial in determining the borrower's creditworthiness and their ability to repay the loan.

The contents of Fannie Mae Form 1005 are carefully crafted to ensure that lenders collect all the necessary information to make an informed decision. The form is divided into several sections, each focusing on a specific aspect of the borrower's financial profile. From employment history to credit obligations, the form provides a detailed snapshot of the borrower's financial situation.

Understanding Fannie Mae Form 1005

To appreciate the significance of Fannie Mae Form 1005, it's essential to understand its contents and the information it collects. The form is divided into the following sections:

Section 1: Borrower Information

This section collects basic information about the borrower, including their name, address, and social security number.

Section 2: Employment Information

This section collects information about the borrower's employment history, including their current job title, income, and length of employment.

Section 3: Income Information

This section collects information about the borrower's income, including their gross income, net income, and any additional sources of income.

Section 4: Assets and Liabilities

This section collects information about the borrower's assets, including their bank accounts, investments, and retirement accounts. It also collects information about their liabilities, including their credit card debt, student loans, and other financial obligations.

Section 5: Credit Information

This section collects information about the borrower's credit history, including their credit score, credit accounts, and any past credit issues.

The Role of Fannie Mae Form 1005 in the Mortgage Process

Fannie Mae Form 1005 plays a critical role in the mortgage process, serving as a standardized framework for lenders to collect information from borrowers. The form helps lenders to:

- Assess the borrower's creditworthiness and their ability to repay the loan

- Determine the borrower's debt-to-income ratio and their ability to manage their debt

- Evaluate the borrower's employment history and income stability

- Review the borrower's credit history and identify potential credit risks

By providing a comprehensive overview of the borrower's financial situation, Fannie Mae Form 1005 helps lenders to make informed decisions and reduce the risk of default.

Benefits of Using Fannie Mae Form 1005

The use of Fannie Mae Form 1005 offers several benefits to lenders and borrowers alike. Some of the key benefits include:

- Streamlined Application Process: The form provides a standardized framework for lenders to collect information, making the application process faster and more efficient.

- Improved Accuracy: The form helps to reduce errors and inaccuracies, ensuring that lenders have a clear understanding of the borrower's financial situation.

- Enhanced Credit Assessment: The form provides a comprehensive overview of the borrower's credit history, enabling lenders to make more informed decisions.

- Increased Transparency: The form promotes transparency, providing borrowers with a clear understanding of the information required and the lending process.

Common Mistakes to Avoid When Completing Fannie Mae Form 1005

While Fannie Mae Form 1005 is designed to be user-friendly, there are several common mistakes that borrowers can make when completing the form. Some of the most common mistakes include:

- Inaccurate Information: Providing inaccurate or incomplete information can lead to delays or even rejection of the mortgage application.

- Insufficient Documentation: Failing to provide sufficient documentation to support the information provided on the form can lead to delays or additional requests for information.

- Incomplete Sections: Failing to complete all sections of the form can lead to delays or rejection of the mortgage application.

Best Practices for Completing Fannie Mae Form 1005

To ensure a smooth and efficient mortgage application process, it's essential to follow best practices when completing Fannie Mae Form 1005. Some of the best practices include:

- Carefully Review the Form: Take the time to carefully review the form and ensure that all information is accurate and complete.

- Provide Sufficient Documentation: Ensure that all necessary documentation is provided to support the information on the form.

- Complete All Sections: Complete all sections of the form, even if the information is not applicable.

Conclusion: A Final Word on Fannie Mae Form 1005

Fannie Mae Form 1005 is a critical document in the mortgage process, providing a standardized framework for lenders to collect information from borrowers. By understanding the form's contents and the information it collects, borrowers can ensure a smooth and efficient mortgage application process. By following best practices and avoiding common mistakes, borrowers can increase their chances of approval and achieve their dream of homeownership.

What is Fannie Mae Form 1005?

+Fannie Mae Form 1005, also known as the Uniform Residential Loan Application, is a standardized form used by lenders to collect information from borrowers.

What is the purpose of Fannie Mae Form 1005?

+The purpose of Fannie Mae Form 1005 is to provide a comprehensive overview of the borrower's financial situation, credit history, and employment status.

What are the benefits of using Fannie Mae Form 1005?

+The benefits of using Fannie Mae Form 1005 include a streamlined application process, improved accuracy, enhanced credit assessment, and increased transparency.