As a taxpayer, accurately completing Form 2210 is essential to ensure you're in compliance with the IRS's estimated tax payment requirements. One of the most critical parts of this form is Line D, which deals with the computation of the annualized income installment method. In this article, we'll delve into the world of Form 2210 and provide you with five valuable tips to help you accurately complete Line D.

Understanding Form 2210 and Line D

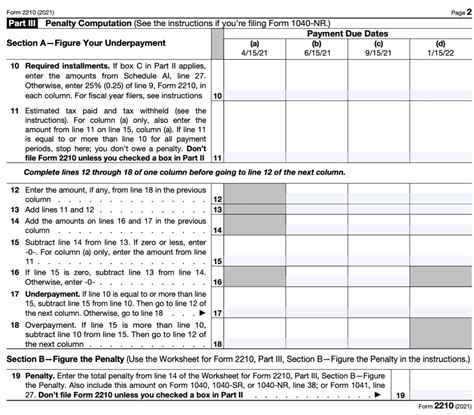

Form 2210 is used to calculate the underpayment of estimated tax and to determine if you're subject to a penalty. The form is divided into several sections, with Line D being part of the annualized income installment method. This method allows you to annualize your income to reduce or eliminate the underpayment penalty.

Tip 1: Determine Your Eligibility for the Annualized Income Installment Method

To complete Line D, you must first determine if you're eligible for the annualized income installment method. You can use this method if you receive income that's not subject to withholding, such as self-employment income, capital gains, or prizes and awards. However, if you have a prior year's tax liability or owe a penalty for the prior year, you may not be eligible for this method.

Calculating Your Annualized Estimated Tax

To complete Line D, you'll need to calculate your annualized estimated tax. This involves determining your total tax liability for the year and then applying the annualized income installment method. You'll need to complete Form 2210, Schedule AI, to calculate your annualized estimated tax.

Tip 2: Use the Correct Worksheet to Calculate Your Annualized Estimated Tax

To calculate your annualized estimated tax, you'll need to use the correct worksheet. The IRS provides a worksheet in the Form 2210 instructions that you can use to calculate your annualized estimated tax. Make sure to use the correct worksheet for your specific situation, as the calculations can be complex.

Completing Line D

Once you've calculated your annualized estimated tax, you can complete Line D. Line D requires you to enter the total amount of your annualized estimated tax. Make sure to enter the correct amount, as this will affect your underpayment penalty.

Tip 3: Review Your Calculations Carefully

Before completing Line D, review your calculations carefully to ensure accuracy. Double-check your math and make sure you've used the correct worksheet. A simple mistake can lead to an incorrect calculation, which can result in a penalty.

Avoiding Common Mistakes

Completing Line D can be complex, and it's easy to make mistakes. Some common mistakes to avoid include:

- Using the wrong worksheet or calculations

- Failing to annualize your income correctly

- Not considering all sources of income

- Not accounting for changes in income throughout the year

Tip 4: Consider Consulting a Tax Professional

If you're unsure about completing Line D or have complex tax situations, consider consulting a tax professional. A tax professional can help you navigate the complex calculations and ensure you're in compliance with the IRS's estimated tax payment requirements.

Conclusion

Completing Form 2210 Line D requires careful attention to detail and a solid understanding of the annualized income installment method. By following these five tips, you can accurately complete Line D and avoid potential penalties. Remember to review your calculations carefully, use the correct worksheet, and consider consulting a tax professional if you're unsure.

Tip 5: Stay Organized and Keep Accurate Records

Finally, stay organized and keep accurate records throughout the year. This will help you accurately complete Line D and ensure you're in compliance with the IRS's estimated tax payment requirements. Keep track of your income, expenses, and tax payments throughout the year, and make sure to review your records carefully before completing Form 2210.

What is Form 2210 used for?

+Form 2210 is used to calculate the underpayment of estimated tax and to determine if you're subject to a penalty.

Who is eligible for the annualized income installment method?

+You can use the annualized income installment method if you receive income that's not subject to withholding, such as self-employment income, capital gains, or prizes and awards.

How do I calculate my annualized estimated tax?

+You'll need to complete Form 2210, Schedule AI, to calculate your annualized estimated tax. Make sure to use the correct worksheet for your specific situation.