Transaction Code Form 4 is a crucial document that publicly traded companies in the United States must file with the Securities and Exchange Commission (SEC). The form is used to disclose insider transactions, such as the buying or selling of company securities by executives, directors, and other key personnel. Here are five essential facts about Transaction Code Form 4 that you should know:

What is Transaction Code Form 4?

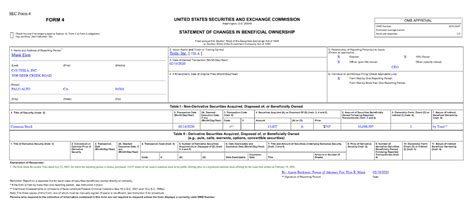

Transaction Code Form 4 is a document that publicly traded companies must file with the SEC to disclose insider transactions. The form provides detailed information about the transaction, including the type of security, the number of shares bought or sold, the price per share, and the date of the transaction.

Why is Transaction Code Form 4 important?

Transaction Code Form 4 is important because it provides transparency into the transactions of company insiders. By disclosing this information, the SEC aims to prevent insider trading and promote fairness in the securities market. The form also helps investors make informed decisions about buying or selling company securities.

Who is required to file Transaction Code Form 4?

Company insiders, including executives, directors, and certain employees, are required to file Transaction Code Form 4. This includes:

- Officers of the company, including the CEO, CFO, and other executives

- Directors of the company

- 10% shareholders of the company

- Certain employees, including those who have access to confidential information

What information is required on Transaction Code Form 4?

Transaction Code Form 4 requires the following information:

- The name of the company insider

- The type of security being bought or sold

- The number of shares being bought or sold

- The price per share

- The date of the transaction

- The code for the transaction type (e.g., P for purchase, S for sale)

How is Transaction Code Form 4 filed?

Transaction Code Form 4 must be filed electronically with the SEC through the EDGAR (Electronic Data Gathering, Analysis, and Retrieval) system. The form must be filed within two business days of the transaction date.

What are the consequences of not filing Transaction Code Form 4?

Failure to file Transaction Code Form 4 can result in serious consequences, including:

- Civil penalties

- Injunctions

- Suspension or revocation of trading privileges

- reputational damage

What are the benefits of Transaction Code Form 4?

The benefits of Transaction Code Form 4 include:

- Transparency into insider transactions

- Prevention of insider trading

- Fairness in the securities market

- Informed investment decisions

- Accountability of company insiders

How can investors use Transaction Code Form 4?

Investors can use Transaction Code Form 4 to make informed decisions about buying or selling company securities. By analyzing the form, investors can:

- Identify trends in insider transactions

- Determine if company insiders are buying or selling securities

- Evaluate the company's financial health

- Make informed investment decisions

Conclusion: The Importance of Transaction Code Form 4

In conclusion, Transaction Code Form 4 is an essential document that provides transparency into insider transactions. By understanding the importance of this form, investors can make informed decisions about buying or selling company securities. Remember to always check the form for any company you are considering investing in.

We hope this article has provided you with valuable insights into Transaction Code Form 4. If you have any questions or comments, please feel free to share them below.

FAQ:

What is the purpose of Transaction Code Form 4?

+The purpose of Transaction Code Form 4 is to disclose insider transactions, such as the buying or selling of company securities by executives, directors, and other key personnel.

Who is required to file Transaction Code Form 4?

+Company insiders, including executives, directors, and certain employees, are required to file Transaction Code Form 4.

What is the deadline for filing Transaction Code Form 4?

+The form must be filed within two business days of the transaction date.