Traveling for work can be a significant part of many jobs, and for those working in the healthcare industry, particularly in-home supportive services (IHSS), it's essential to understand the regulations surrounding travel time pay. In this article, we will delve into the world of IHSS travel time pay, exploring the requirements, forms, and procedures involved in claiming reimbursement for travel expenses.

IHSS Travel Time Pay: Understanding the Basics

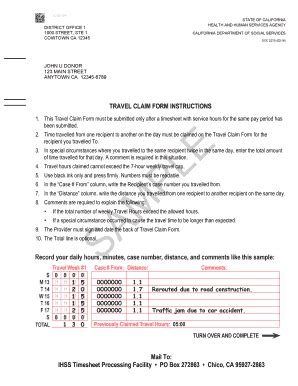

IHSS providers, also known as caregivers or home care workers, are entitled to receive reimbursement for their travel expenses incurred while traveling between clients' homes or other work-related destinations. The IHSS travel time pay form is a crucial document that enables providers to claim reimbursement for these expenses. The form, also known as the IHSS Travel Claim Form, is used to document the mileage, time, and expenses related to travel.

Eligibility Requirements for IHSS Travel Time Pay

To be eligible for IHSS travel time pay, providers must meet specific requirements. These include:

- Being an IHSS provider or caregiver

- Traveling between clients' homes or other work-related destinations

- Using a personal vehicle for travel

- Maintaining accurate records of mileage, time, and expenses

- Submitting the IHSS travel time pay form within the designated timeframe

The IHSS Travel Time Pay Form: A Step-by-Step Guide

The IHSS travel time pay form is a straightforward document that requires providers to enter specific information. Here's a step-by-step guide to completing the form:

- Provider Information: Enter your name, address, and IHSS provider number.

- Travel Dates: List the dates you traveled between clients' homes or other work-related destinations.

- Mileage: Record the total mileage traveled for each day.

- Time: Enter the start and end times for each travel segment.

- Expenses: List any expenses related to travel, such as fuel, tolls, or parking fees.

- Total Reimbursement: Calculate the total reimbursement amount based on the mileage, time, and expenses.

- Certification: Sign and date the form to certify that the information is accurate.

Submission Requirements for the IHSS Travel Time Pay Form

Once the form is completed, providers must submit it to the IHSS office within the designated timeframe, usually within 30 days of the travel dates. The form can be submitted via mail, email, or in-person, depending on the IHSS office's requirements.

Calculating IHSS Travel Time Pay: Understanding the Reimbursement Rates

The reimbursement rates for IHSS travel time pay vary depending on the location and type of travel. Providers can claim reimbursement for mileage, time, and expenses. The current reimbursement rates are as follows:

- Mileage: $0.58 per mile (effective January 2022)

- Time: $15 per hour (effective January 2022)

- Expenses: Providers can claim reimbursement for fuel, tolls, parking fees, and other expenses related to travel.

Tips for Accurate Record-Keeping and Claiming IHSS Travel Time Pay

To ensure accurate record-keeping and claim reimbursement for IHSS travel time pay, providers should:

- Maintain a logbook or spreadsheet to track mileage, time, and expenses

- Keep receipts for fuel, tolls, parking fees, and other expenses

- Use a GPS device or mapping app to track mileage and travel time

- Submit the IHSS travel time pay form within the designated timeframe

Common Mistakes to Avoid When Claiming IHSS Travel Time Pay

When claiming IHSS travel time pay, providers should avoid common mistakes that can result in delayed or denied reimbursement. These include:

- Failing to submit the IHSS travel time pay form within the designated timeframe

- Inaccurate or incomplete information on the form

- Failure to maintain accurate records of mileage, time, and expenses

- Claiming reimbursement for non-work-related travel

Conclusion and Next Steps

In conclusion, the IHSS travel time pay form is a crucial document that enables providers to claim reimbursement for travel expenses. By following the steps outlined in this guide and avoiding common mistakes, providers can ensure accurate record-keeping and claim reimbursement for IHSS travel time pay.

If you have any questions or concerns about the IHSS travel time pay form or reimbursement rates, contact your local IHSS office for assistance.

What is the current reimbursement rate for IHSS travel time pay?

+The current reimbursement rate for IHSS travel time pay is $0.58 per mile (effective January 2022) and $15 per hour (effective January 2022).

How do I submit the IHSS travel time pay form?

+The IHSS travel time pay form can be submitted via mail, email, or in-person, depending on the IHSS office's requirements.

What expenses can I claim reimbursement for on the IHSS travel time pay form?

+Providers can claim reimbursement for fuel, tolls, parking fees, and other expenses related to travel.