The world of small business loans can be overwhelming, especially when it comes to navigating the complexities of the Small Business Administration (SBA). One crucial document that plays a significant role in the SBA loan application process is Form 1150, also known as the SBA Form 1150. In this article, we will delve into the essential facts about SBA Form 1150, helping you better understand its purpose, significance, and requirements.

What is SBA Form 1150?

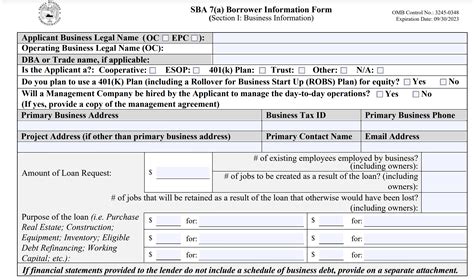

SBA Form 1150 is a standardized document required by the Small Business Administration (SBA) as part of the loan application process for its 7(a) loan program. The form serves as a means for lenders to collect essential information about the borrower's business, which is then used to evaluate the creditworthiness of the loan applicant.

Why is SBA Form 1150 Important?

SBA Form 1150 is a critical component of the SBA loan application process. The information provided in the form helps lenders assess the borrower's creditworthiness, financial stability, and ability to repay the loan. The form also enables lenders to evaluate the borrower's business plan, management team, and market potential.

Key Components of SBA Form 1150

SBA Form 1150 consists of several sections, each requiring specific information about the borrower's business. Some of the key components of the form include:

- Business information: name, address, type of business, and tax identification number

- Owner information: names, addresses, social security numbers, and ownership percentages

- Financial information: income statements, balance sheets, and cash flow statements

- Loan information: loan amount, interest rate, and repayment terms

- Collateral information: description of collateral offered to secure the loan

How to Complete SBA Form 1150

Completing SBA Form 1150 requires careful attention to detail and accuracy. Here are some tips to help you complete the form correctly:

- Read the instructions carefully: Before starting to fill out the form, read the instructions carefully to ensure you understand what information is required.

- Gather all necessary documents: Make sure you have all the necessary documents, including financial statements, tax returns, and business licenses.

- Fill out the form accurately: Double-check your answers to ensure accuracy and completeness.

- Seek professional help: If you're unsure about any aspect of the form, consider seeking the help of a financial advisor or accountant.

Common Mistakes to Avoid

When completing SBA Form 1150, there are several common mistakes to avoid:

- Incomplete or inaccurate information: Ensure that all sections of the form are completed accurately and thoroughly.

- Failure to provide supporting documentation: Make sure you provide all necessary supporting documentation, such as financial statements and tax returns.

- Inconsistent information: Ensure that the information provided on the form is consistent with other documents, such as tax returns and financial statements.

What Happens After Submitting SBA Form 1150?

After submitting SBA Form 1150, the lender will review the information provided and evaluate the borrower's creditworthiness. If the lender approves the loan, the SBA will guarantee a portion of the loan, typically up to 85%. The lender will then disburse the loan funds, and the borrower will begin making repayments.

Conclusion

SBA Form 1150 is a critical component of the SBA loan application process. By understanding the essential facts about SBA Form 1150, you can ensure that you complete the form accurately and increase your chances of securing an SBA loan. Remember to read the instructions carefully, gather all necessary documents, and seek professional help if needed.

Frequently Asked Questions

What is the purpose of SBA Form 1150?

+SBA Form 1150 is used to collect essential information about the borrower's business, which is then used to evaluate the creditworthiness of the loan applicant.

What are the key components of SBA Form 1150?

+The key components of SBA Form 1150 include business information, owner information, financial information, loan information, and collateral information.

What happens after submitting SBA Form 1150?

+After submitting SBA Form 1150, the lender will review the information provided and evaluate the borrower's creditworthiness. If the lender approves the loan, the SBA will guarantee a portion of the loan, and the lender will disburse the loan funds.

We hope this article has provided you with a comprehensive understanding of SBA Form 1150 and its significance in the SBA loan application process. If you have any further questions or concerns, please don't hesitate to reach out.