The Form 2210 is a crucial document for individuals who are required to make estimated tax payments throughout the year. Failure to comply with these payments can result in penalties and interest. In this article, we will delve into the world of Form 2210 instructions, providing a step-by-step guide for filers to ensure they are meeting their tax obligations.

As we navigate the complexities of the tax system, it's essential to understand the importance of estimated tax payments. The Internal Revenue Service (IRS) requires certain individuals to make these payments on a quarterly basis. This includes self-employed individuals, freelancers, and those with investment income. By making these payments, individuals can avoid penalties and interest that may accrue if they fail to pay their tax liability in full.

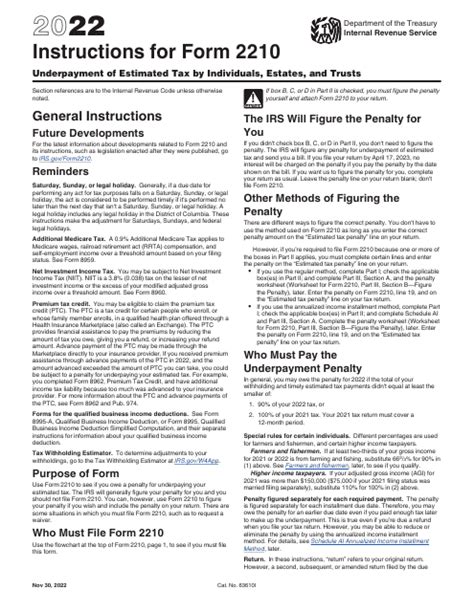

For those who are new to estimated tax payments, the process can seem daunting. That's why it's crucial to understand the Form 2210 instructions. This form is used to calculate the amount of penalties and interest owed for underpayment or late payment of estimated taxes. In the following sections, we will break down the Form 2210 instructions, providing a step-by-step guide for filers.

Understanding the Form 2210 Instructions

The Form 2210 instructions are designed to help filers calculate the amount of penalties and interest owed for underpayment or late payment of estimated taxes. The form consists of three main sections: Part I, Part II, and Part III.

Part I: Calculation of Underpayment

In Part I of the Form 2210 instructions, filers are required to calculate the amount of underpayment for each quarter. This is done by subtracting the amount of estimated tax payments made from the total tax liability for the year.

Part II: Calculation of Penalty

In Part II, filers are required to calculate the penalty for underpayment or late payment of estimated taxes. This is done by multiplying the amount of underpayment by the applicable penalty rate.

Part III: Calculation of Interest

In Part III, filers are required to calculate the interest on the amount of underpayment or late payment of estimated taxes. This is done by multiplying the amount of underpayment by the applicable interest rate.

Step-by-Step Guide to Filing Form 2210

Filing Form 2210 can seem overwhelming, but by following these steps, filers can ensure they are meeting their tax obligations.

- Determine if you are required to file Form 2210: If you are required to make estimated tax payments and have underpaid or made late payments, you will need to file Form 2210.

- Gather necessary documents: You will need to gather your tax return, estimated tax payment vouchers, and any other relevant documents.

- Complete Part I: Calculation of Underpayment: Calculate the amount of underpayment for each quarter by subtracting the amount of estimated tax payments made from the total tax liability for the year.

- Complete Part II: Calculation of Penalty: Calculate the penalty for underpayment or late payment of estimated taxes by multiplying the amount of underpayment by the applicable penalty rate.

- Complete Part III: Calculation of Interest: Calculate the interest on the amount of underpayment or late payment of estimated taxes by multiplying the amount of underpayment by the applicable interest rate.

- Attach supporting documentation: Attach your tax return, estimated tax payment vouchers, and any other relevant documents to Form 2210.

- File Form 2210: File Form 2210 with the IRS by the designated deadline.

Common Mistakes to Avoid

When filing Form 2210, it's essential to avoid common mistakes that can result in delays or penalties.

- Failing to calculate underpayment correctly: Ensure you calculate the amount of underpayment correctly to avoid underpayment or overpayment of penalties and interest.

- Failing to attach supporting documentation: Ensure you attach all necessary documentation to Form 2210 to avoid delays or penalties.

- Failing to file Form 2210 on time: Ensure you file Form 2210 by the designated deadline to avoid late payment penalties and interest.

Conclusion

In conclusion, Form 2210 instructions are a crucial guide for filers who are required to make estimated tax payments. By understanding the Form 2210 instructions and following the step-by-step guide, filers can ensure they are meeting their tax obligations and avoiding penalties and interest. Remember to avoid common mistakes and seek professional advice if needed.

Additional Resources

For more information on Form 2210 instructions and estimated tax payments, visit the IRS website or consult with a tax professional.

FAQ Section

What is Form 2210?

+Form 2210 is a document used to calculate the amount of penalties and interest owed for underpayment or late payment of estimated taxes.

Who is required to file Form 2210?

+Individuals who are required to make estimated tax payments and have underpaid or made late payments are required to file Form 2210.

What is the deadline for filing Form 2210?

+The deadline for filing Form 2210 is typically April 15th of each year, but this may vary depending on individual circumstances.