As a business owner or payroll professional in New York, understanding the intricacies of certified payroll form requirements is crucial for maintaining compliance with state and federal regulations. The New York Department of Labor requires employers to submit certified payroll forms for various types of projects, including public works projects, construction projects, and highway construction projects. In this article, we will delve into the world of certified payroll form requirements in New York, exploring the benefits, compliance guidelines, and best practices for submission.

Benefits of Certified Payroll Forms

Certified payroll forms serve as a critical tool for ensuring compliance with labor laws and regulations in New York. By submitting accurate and complete certified payroll forms, employers can:

- Demonstrate compliance with prevailing wage rates and benefits

- Ensure accurate payment of wages and benefits to employees

- Reduce the risk of audits and penalties

- Improve transparency and accountability in payroll practices

- Enhance their reputation as a responsible and compliant employer

Types of Certified Payroll Forms

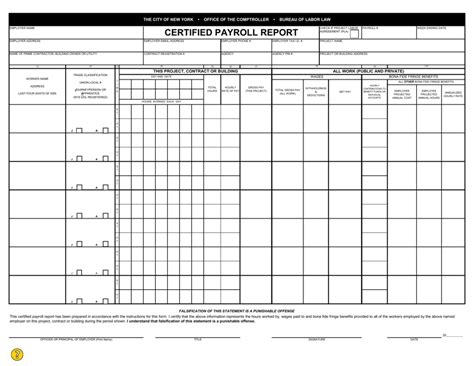

The New York Department of Labor requires different types of certified payroll forms for various projects, including:

- Form WH-347: Certified Payroll Form for Federal and State Construction Projects

- Form WH-348: Statement of Compliance for Federal and State Construction Projects

- Form LS-220: Certified Payroll Form for New York State Public Works Projects

Compliance Guidelines for Certified Payroll Forms

To ensure compliance with certified payroll form requirements, employers must adhere to the following guidelines:

- Submit certified payroll forms on a weekly basis for all employees working on covered projects

- Include accurate and complete information on employee names, social security numbers, job classifications, hourly rates, and total hours worked

- Certify that all employees have been paid the prevailing wage rates and benefits

- Maintain records of certified payroll forms for at least three years

Penalties for Non-Compliance

Failure to comply with certified payroll form requirements can result in severe penalties, including:

- Fines and penalties for non-compliance with prevailing wage rates and benefits

- Back pay and benefits for underpaid employees

- Debarment from participating in future public works projects

- Civil and criminal prosecution for willful non-compliance

Best Practices for Submitting Certified Payroll Forms

To ensure accurate and timely submission of certified payroll forms, employers should follow these best practices:

- Use the correct certified payroll form for the specific project

- Verify employee information and job classifications before submission

- Submit certified payroll forms electronically to reduce errors and improve efficiency

- Maintain accurate and complete records of certified payroll forms

- Review and audit certified payroll forms regularly to ensure compliance

Common Mistakes to Avoid

Employers should avoid the following common mistakes when submitting certified payroll forms:

- Inaccurate or incomplete employee information

- Incorrect job classifications or hourly rates

- Failure to certify compliance with prevailing wage rates and benefits

- Late or incomplete submission of certified payroll forms

Conclusion: Ensuring Compliance with Certified Payroll Form Requirements

Certified payroll form requirements are an essential aspect of maintaining compliance with labor laws and regulations in New York. By understanding the benefits, compliance guidelines, and best practices for submission, employers can ensure accurate and timely submission of certified payroll forms. By avoiding common mistakes and penalties for non-compliance, employers can protect their reputation, reduce the risk of audits, and maintain a competitive edge in the market.

FAQs

What is the purpose of certified payroll forms in New York?

+Certified payroll forms serve as a critical tool for ensuring compliance with labor laws and regulations in New York, demonstrating compliance with prevailing wage rates and benefits, and ensuring accurate payment of wages and benefits to employees.

What types of certified payroll forms are required in New York?

+The New York Department of Labor requires different types of certified payroll forms for various projects, including Form WH-347, Form WH-348, and Form LS-220.

What are the penalties for non-compliance with certified payroll form requirements?

+Failure to comply with certified payroll form requirements can result in severe penalties, including fines and penalties for non-compliance with prevailing wage rates and benefits, back pay and benefits for underpaid employees, debarment from participating in future public works projects, and civil and criminal prosecution for willful non-compliance.