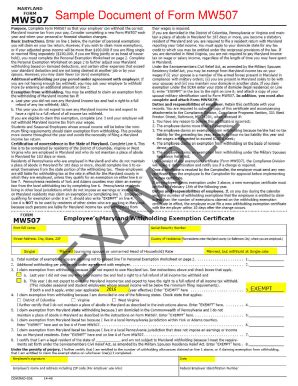

As a Maryland resident, you may be required to file a MW507 form with the state's Comptroller's Office. This form is used to report and pay taxes on income earned as a resident of Maryland. Filling out the MW507 form can seem daunting, but it doesn't have to be. In this article, we'll break down the process into 5 easy steps to help you complete the form accurately and efficiently.

Step 1: Gather Required Documents and Information

Before you start filling out the MW507 form, make sure you have all the necessary documents and information. You'll need:

- Your Maryland tax account number

- Your social security number or federal employer identification number (FEIN)

- Your business name and address

- Your tax year-end date

- Your total Maryland income

- Your total Maryland tax withheld

- Any supporting documentation, such as W-2s, 1099s, or K-1s

Understanding the MW507 Form

The MW507 form is a crucial document for Maryland residents who need to report and pay taxes on their income. It's essential to understand the different sections of the form and what information is required.

Step 2: Fill Out Section 1 - Business Information

Section 1 of the MW507 form requires you to provide your business information. This includes:

- Your Maryland tax account number

- Your business name and address

- Your tax year-end date

Make sure to fill out this section accurately, as any errors may delay the processing of your form.

Important: Verify Your Tax Account Number

Before filling out the MW507 form, verify your Maryland tax account number. You can find this number on your Maryland tax return or by contacting the Comptroller's Office.

Step 3: Complete Section 2 - Income and Tax Withholding

Section 2 of the MW507 form requires you to report your total Maryland income and tax withheld. You'll need to:

- Report your total Maryland income from all sources

- Report your total Maryland tax withheld

Make sure to include all income earned in Maryland, including wages, salaries, and tips.

Tip: Report All Income Earned in Maryland

Don't forget to report all income earned in Maryland, including income from freelance work or self-employment.

Step 4: Calculate Your Tax Liability

Section 3 of the MW507 form requires you to calculate your tax liability. You'll need to:

- Calculate your total tax liability based on your Maryland income

- Calculate any tax credits or deductions you're eligible for

Make sure to use the correct tax rates and formulas to calculate your tax liability accurately.

Important: Use the Correct Tax Rates and Formulas

Use the correct tax rates and formulas to calculate your tax liability. You can find this information on the Comptroller's Office website or by contacting a tax professional.

Step 5: Sign and Date the Form

Once you've completed the MW507 form, make sure to sign and date it. This is an important step, as the form won't be processed without your signature.

Tip: Double-Check Your Form for Accuracy

Before signing and dating the form, double-check it for accuracy. Make sure you've filled out all sections correctly and included all required documentation.

Now that you've completed the 5 easy steps to fill out the MW507 form, you're ready to submit it to the Comptroller's Office. Remember to double-check your form for accuracy and include all required documentation to avoid any delays.

What's Next?

Once you've submitted the MW507 form, you'll receive a confirmation letter from the Comptroller's Office. This letter will indicate that your form has been processed and will provide information on any additional steps you need to take.

What is the deadline for filing the MW507 form?

+The deadline for filing the MW507 form is typically April 15th of each year. However, this deadline may vary depending on your specific situation. It's best to check with the Comptroller's Office or a tax professional for the most up-to-date information.

What if I need an extension to file the MW507 form?

+If you need an extension to file the MW507 form, you can file Form 510C, Maryland Extension Request. This form must be filed by the original deadline of the MW507 form. You can find more information on the Comptroller's Office website.

Can I file the MW507 form electronically?

+Yes, you can file the MW507 form electronically through the Comptroller's Office website. This is a convenient and efficient way to file your form and receive confirmation of receipt.