New Jersey employers are required to provide their employees with a notification of their eligibility for benefits under the New Jersey unemployment compensation law. This notification is typically provided on a form known as the NJ Form L-9. However, the process of understanding and completing this form can be daunting, especially for new employers. In this article, we will break down the NJ Form L-9 into 5 easy steps, providing a comprehensive guide on how to navigate this crucial document.

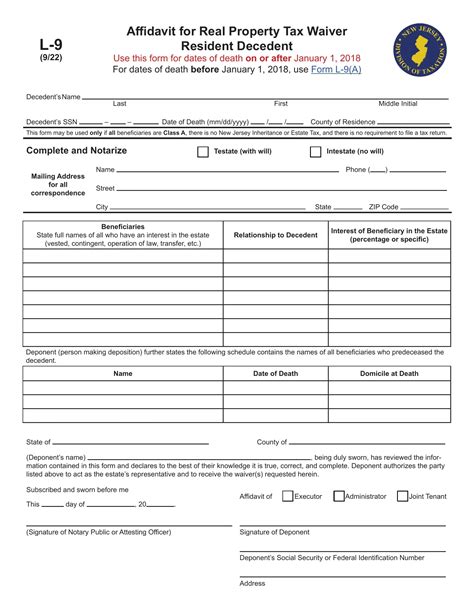

What is the NJ Form L-9?

The NJ Form L-9, also known as the "Notice of Employment Status," is a document that employers in New Jersey must provide to their employees at the time of hire, termination, or when there is a change in employment status. The form serves as a notification to the employee of their eligibility for benefits under the New Jersey unemployment compensation law.

Step 1: Gathering Required Information

Before completing the NJ Form L-9, employers must gather the required information. This includes:

- The employee's name and address

- The employer's name and address

- The employee's job title and department

- The employee's start date and, if applicable, end date

- The reason for the employee's termination (if applicable)

- The employee's eligibility for benefits under the New Jersey unemployment compensation law

Step 2: Determining Eligibility for Benefits

The next step is to determine the employee's eligibility for benefits under the New Jersey unemployment compensation law. This includes:

- The employee's work history and earnings

- The employee's reason for leaving the company (if applicable)

- The employee's availability for work

Employers must use this information to determine whether the employee is eligible for benefits and, if so, the amount of benefits they are entitled to receive.

Completing the NJ Form L-9

Step 3: Filling Out the Form

Once the required information has been gathered and the employee's eligibility for benefits has been determined, the employer can begin filling out the NJ Form L-9. The form consists of several sections, including:

- Section 1: Employee Information

- Section 2: Employer Information

- Section 3: Employment Status

- Section 4: Eligibility for Benefits

Employers must complete each section accurately and thoroughly, using the information gathered in steps 1 and 2.

Step 4: Reviewing and Signing the Form

Once the NJ Form L-9 has been completed, the employer must review the form for accuracy and completeness. The employer must also sign the form, certifying that the information provided is true and accurate.

Step 5: Providing the Form to the Employee

The final step is to provide the completed NJ Form L-9 to the employee. This must be done at the time of hire, termination, or when there is a change in employment status. Employers must also keep a copy of the form on file for their records.

Tips and Reminders

- Employers must provide the NJ Form L-9 to employees in a timely manner, as required by law.

- Employers must keep accurate records of the form, including the date it was provided to the employee.

- Employers must provide the employee with a copy of the form, as well as keep a copy on file for their records.

By following these 5 easy steps, employers can ensure that they are in compliance with the requirements of the NJ Form L-9. Remember to always review and update your records to ensure accuracy and compliance.

Common Mistakes to Avoid

- Failure to provide the NJ Form L-9 to employees in a timely manner

- Inaccurate or incomplete information on the form

- Failure to keep accurate records of the form

- Failure to provide the employee with a copy of the form

By avoiding these common mistakes, employers can ensure that they are in compliance with the requirements of the NJ Form L-9 and avoid any potential penalties or fines.

What is the purpose of the NJ Form L-9?

+The purpose of the NJ Form L-9 is to notify employees of their eligibility for benefits under the New Jersey unemployment compensation law.

Who is required to complete the NJ Form L-9?

+Employers in New Jersey are required to complete the NJ Form L-9 for their employees.

What information is required on the NJ Form L-9?

+The NJ Form L-9 requires information such as the employee's name and address, the employer's name and address, the employee's job title and department, and the employee's eligibility for benefits under the New Jersey unemployment compensation law.

We hope this article has provided a comprehensive guide to understanding the NJ Form L-9 in 5 easy steps. If you have any further questions or concerns, please don't hesitate to comment below. Share this article with your friends and colleagues who may find it helpful.