In the state of Maryland, the Form 502 is a crucial document that individuals and businesses must file to report their income tax. The Maryland Form 502 is the state's equivalent of the federal Form 1040, and it is used to report an individual's or business's income, deductions, and tax credits. Filing the Maryland Form 502 can seem like a daunting task, but with the right guidance, it can be a straightforward process.

For many Maryland residents, the Form 502 is a mysterious document that only comes out once a year, during tax season. However, it is essential to understand the purpose and content of the Form 502 to ensure accurate and timely filing. In this article, we will provide a comprehensive guide to the Maryland Form 502, including its instructions, requirements, and deadlines.

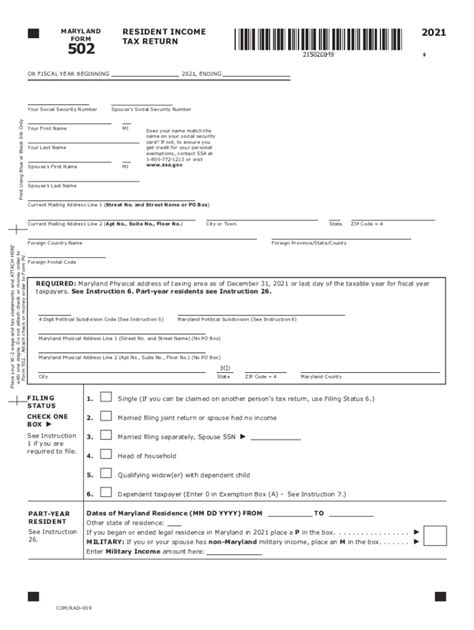

Understanding the Maryland Form 502

The Maryland Form 502 is the state's income tax return form, which must be filed by all residents and non-residents who have earned income in Maryland. The form is used to report an individual's or business's income from various sources, including employment, self-employment, investments, and more. The Form 502 also allows filers to claim deductions and credits, such as the standard deduction, itemized deductions, and tax credits for education expenses.

Who Must File the Maryland Form 502?

The following individuals and businesses are required to file the Maryland Form 502:

- Residents of Maryland who have earned income in the state

- Non-residents who have earned income in Maryland

- Businesses that operate in Maryland, including corporations, partnerships, and sole proprietorships

- Estates and trusts that have earned income in Maryland

Filing Requirements and Deadlines

The Maryland Form 502 must be filed by the following deadlines:

- April 15th for individual filers

- March 15th for partnership filers

- April 15th for corporate filers

In addition to the filing deadline, filers must also meet the following requirements:

- Filers must have a valid Social Security number or Individual Taxpayer Identification Number (ITIN)

- Filers must report all income earned in Maryland, including wages, tips, and self-employment income

- Filers must claim all eligible deductions and credits, such as the standard deduction and tax credits for education expenses

Preparing to File the Maryland Form 502

Before filing the Maryland Form 502, filers should gather the following documents and information:

- W-2 forms from employers

- 1099 forms for freelance or self-employment income

- Interest statements from banks and financial institutions

- Dividend statements from investments

- Charitable donation receipts

- Education expense receipts

Filers should also ensure that they have the correct software or forms to file the Maryland Form 502. The Maryland Comptroller's Office offers free e-filing software for individual filers, as well as paper forms for those who prefer to file by mail.

Filing the Maryland Form 502

The Maryland Form 502 can be filed electronically or by mail. Electronic filing is the fastest and most convenient way to file, and it also reduces the risk of errors and delays.

To file electronically, filers can use the Maryland Comptroller's Office e-filing software or third-party tax preparation software. To file by mail, filers can print and mail the paper forms to the Maryland Comptroller's Office.

Tips for Filing the Maryland Form 502

- Ensure accurate and complete information, including Social Security numbers and addresses

- Claim all eligible deductions and credits to minimize tax liability

- Keep records of charitable donations and education expenses

- File electronically to reduce errors and delays

Common Mistakes to Avoid When Filing the Maryland Form 502

When filing the Maryland Form 502, filers should avoid the following common mistakes:

- Inaccurate or incomplete information, including Social Security numbers and addresses

- Failure to claim eligible deductions and credits

- Failure to report all income earned in Maryland

- Failure to sign and date the form

By avoiding these common mistakes, filers can ensure accurate and timely filing of the Maryland Form 502.

Conclusion

Filing the Maryland Form 502 can seem like a daunting task, but with the right guidance, it can be a straightforward process. By understanding the purpose and content of the Form 502, filers can ensure accurate and timely filing. Remember to gather all necessary documents and information, prepare the form carefully, and file electronically or by mail. By following these steps, filers can minimize tax liability and avoid common mistakes.

We encourage you to share your experiences with filing the Maryland Form 502 in the comments below. Have you encountered any challenges or obstacles while filing? Do you have any tips or advice for fellow filers? Share your thoughts and help others navigate the process.

What is the deadline for filing the Maryland Form 502?

+The deadline for filing the Maryland Form 502 is April 15th for individual filers, March 15th for partnership filers, and April 15th for corporate filers.

Who must file the Maryland Form 502?

+The following individuals and businesses are required to file the Maryland Form 502: residents of Maryland who have earned income in the state, non-residents who have earned income in Maryland, businesses that operate in Maryland, and estates and trusts that have earned income in Maryland.

What documents do I need to file the Maryland Form 502?

+Filers should gather the following documents and information: W-2 forms from employers, 1099 forms for freelance or self-employment income, interest statements from banks and financial institutions, dividend statements from investments, charitable donation receipts, and education expense receipts.