Tax season can be a daunting time for many individuals and businesses, especially when it comes to navigating the complexities of state tax returns. For residents of Georgia, one crucial form that requires attention to detail is the Georgia Form 500 Schedule 1 Adjustments. In this article, we will delve into the world of Schedule 1 adjustments, exploring their significance, the types of adjustments that can be made, and providing practical examples to help you better understand this often-misunderstood aspect of tax preparation.

What is Georgia Form 500 Schedule 1?

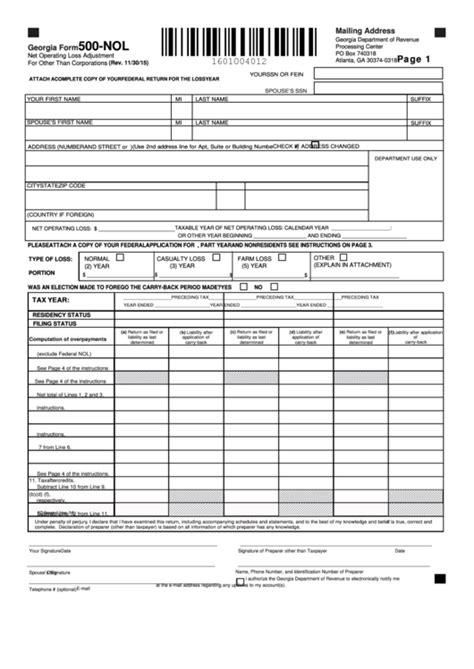

Georgia Form 500 Schedule 1 is a supplementary form to the main Georgia Form 500, which is used to report income and claim deductions and credits. Schedule 1 is specifically designed to allow taxpayers to report adjustments to their income, which may affect their overall tax liability. These adjustments can be either additions or subtractions to the taxpayer's federal adjusted gross income (AGI), and they play a critical role in determining the taxpayer's Georgia taxable income.

Why are Schedule 1 Adjustments Important?

Schedule 1 adjustments are essential because they enable taxpayers to accurately report their income and claim the correct amount of deductions and credits. By making these adjustments, taxpayers can ensure that their Georgia state tax return is accurate and complete, which can help to avoid potential penalties and interest charges. Moreover, Schedule 1 adjustments can also help taxpayers to reduce their tax liability, which can result in a larger refund or a lower tax bill.

Types of Schedule 1 Adjustments

There are several types of adjustments that can be made on Schedule 1, including:

- Additions to federal AGI:

- Interest income from certain types of bonds

- Dividend income from certain types of stocks

- Certain types of business income

- Subtractions from federal AGI:

- Contributions to certain types of retirement accounts

- Alimony payments

- Certain types of medical expenses

How to Complete Schedule 1 Adjustments

To complete Schedule 1 adjustments, taxpayers will need to gather certain information and follow a series of steps. Here's a step-by-step guide to help you get started:

- Gather all necessary documents, including your federal tax return, W-2 forms, 1099 forms, and any other relevant documentation.

- Review the instructions for Schedule 1 and identify the types of adjustments that apply to your situation.

- Complete the necessary lines on Schedule 1, making sure to report all required information accurately.

- Calculate the total amount of adjustments, either additions or subtractions, and report this amount on Line 1 of Schedule 1.

- Transfer the total amount of adjustments to Line 1 of Form 500, which will affect your Georgia taxable income.

Examples of Schedule 1 Adjustments

Here are a few examples of Schedule 1 adjustments to help illustrate how they work:

- Example 1: Additions to federal AGI

- John, a resident of Georgia, receives interest income from a municipal bond in the amount of $1,000. This amount is reported on his federal tax return, but it is not subject to Georgia state tax. To report this income on Schedule 1, John would add $1,000 to his federal AGI.

- Example 2: Subtractions from federal AGI

- Jane, a resident of Georgia, contributes $5,000 to her 401(k) retirement account. This amount is deducted from her federal AGI, but it is not subject to Georgia state tax. To report this deduction on Schedule 1, Jane would subtract $5,000 from her federal AGI.

Common Mistakes to Avoid

When completing Schedule 1 adjustments, there are several common mistakes to avoid. Here are a few:

- Failing to report all required adjustments

- Reporting incorrect amounts or calculations

- Forgetting to transfer the total amount of adjustments to Form 500

- Not keeping accurate records or documentation

By avoiding these common mistakes, taxpayers can ensure that their Schedule 1 adjustments are accurate and complete, which can help to minimize the risk of errors or penalties.

Conclusion

In conclusion, Georgia Form 500 Schedule 1 adjustments are an essential part of the tax preparation process for residents of Georgia. By understanding the types of adjustments that can be made and following the necessary steps, taxpayers can ensure that their tax return is accurate and complete. Remember to avoid common mistakes and keep accurate records to minimize the risk of errors or penalties. If you have any questions or concerns about Schedule 1 adjustments, it's always a good idea to consult with a tax professional or seek guidance from the Georgia Department of Revenue.

We hope this article has provided you with a comprehensive understanding of Georgia Form 500 Schedule 1 adjustments. If you have any further questions or would like to share your own experiences with Schedule 1 adjustments, please leave a comment below. Don't forget to share this article with others who may find it helpful, and follow us for more informative content on tax-related topics.

What is the purpose of Georgia Form 500 Schedule 1?

+The purpose of Georgia Form 500 Schedule 1 is to report adjustments to federal adjusted gross income (AGI) that affect Georgia taxable income.

What types of adjustments can be made on Schedule 1?

+Adjustments on Schedule 1 can include additions to federal AGI, such as interest income from certain types of bonds, and subtractions from federal AGI, such as contributions to certain types of retirement accounts.

How do I complete Schedule 1 adjustments?

+To complete Schedule 1 adjustments, gather all necessary documents, review the instructions for Schedule 1, identify the types of adjustments that apply to your situation, and complete the necessary lines on Schedule 1.