As a taxpayer in Illinois, understanding and correctly filling out tax forms is crucial to avoid any penalties or delays in receiving your refund. The Illinois Rut 75 form is a vital document used by truckers and transportation companies to claim a refund on the gasoline taxes they've paid on their vehicles. However, for many, navigating this form can be a daunting task. In this article, we'll break down the process into 5 easy steps to help you unlock the Illinois Rut 75 form and ensure a smooth refund process.

Step 1: Gather Required Documents and Information

Before starting to fill out the Illinois Rut 75 form, it's essential to have all the necessary documents and information readily available. This includes:

- Your Illinois Department of Revenue taxpayer ID number

- Vehicle identification numbers (VINs) for all vehicles claiming a refund

- Fuel purchase receipts and invoices

- Mileage logs and records

- Proof of business use (if applicable)

Having these documents organized will save you time and reduce the likelihood of errors in your application.

Understanding the Illinois Rut 75 Form Structure

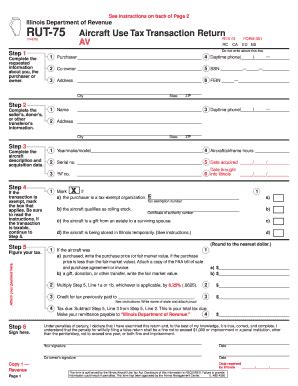

The Illinois Rut 75 form is divided into several sections, each requiring specific information about your vehicle, fuel purchases, and business use. Understanding the form's structure will help you navigate the process more efficiently.

Section 1: Taxpayer Information

In this section, you'll need to provide your taxpayer ID number, business name, and address. Make sure to double-check your information for accuracy.

Section 2: Vehicle Information

Here, you'll list the vehicles for which you're claiming a refund, including their VINs, make, model, and year. Ensure that all information matches your vehicle records.

Section 3: Fuel Purchases

In this section, you'll need to provide detailed information about your fuel purchases, including dates, amounts, and types of fuel. Attach receipts and invoices to support your claims.

Section 4: Business Use

If you're claiming a refund for business use, you'll need to provide proof of business use, such as mileage logs and records.

Step 2: Calculate Your Refund Amount

To calculate your refund amount, you'll need to determine the total amount of gasoline taxes paid on your vehicles. You can use the Illinois Department of Revenue's fuel tax rate schedule to help you calculate the correct amount.

- Multiply the total gallons of fuel purchased by the applicable fuel tax rate

- Subtract any previously claimed refunds or credits

- Add any additional fees or charges

Ensure that your calculations are accurate, as errors can delay your refund.

Step 3: Fill Out the Illinois Rut 75 Form

With all your documents and calculations ready, it's time to fill out the Illinois Rut 75 form. Follow these tips to ensure accuracy:

- Use black ink and print clearly

- Fill out all required sections completely

- Attach supporting documents and receipts

- Double-check your math and calculations

Step 4: Submit Your Application

Once you've completed the Illinois Rut 75 form, review it carefully for errors or omissions. Then, submit your application to the Illinois Department of Revenue by the designated deadline.

- Mail your application to the address listed on the form

- Ensure that your application is postmarked by the deadline to avoid penalties

Step 5: Track Your Refund Status

After submitting your application, you can track the status of your refund online or by contacting the Illinois Department of Revenue directly.

- Use the Illinois Department of Revenue's online refund status tool

- Contact the department by phone or email for assistance

By following these 5 easy steps, you'll be able to unlock the Illinois Rut 75 form and claim your refund with confidence.

We hope this article has helped you understand the Illinois Rut 75 form and the refund process. If you have any further questions or concerns, please don't hesitate to reach out.

What is the Illinois Rut 75 form used for?

+The Illinois Rut 75 form is used by truckers and transportation companies to claim a refund on the gasoline taxes they've paid on their vehicles.

What documents do I need to gather before filling out the form?

+You'll need to gather your Illinois Department of Revenue taxpayer ID number, vehicle identification numbers (VINs), fuel purchase receipts and invoices, mileage logs and records, and proof of business use (if applicable).

How do I calculate my refund amount?

+You'll need to calculate the total amount of gasoline taxes paid on your vehicles by multiplying the total gallons of fuel purchased by the applicable fuel tax rate, subtracting any previously claimed refunds or credits, and adding any additional fees or charges.