As a business owner, navigating the complex world of tax filing can be overwhelming. One crucial form that corporations must complete is Form 1120, which includes Schedule L. In this article, we will delve into the Form 1120 Schedule L instructions, providing you with a comprehensive guide to help you accurately complete this essential form.

Understanding Form 1120 and Schedule L

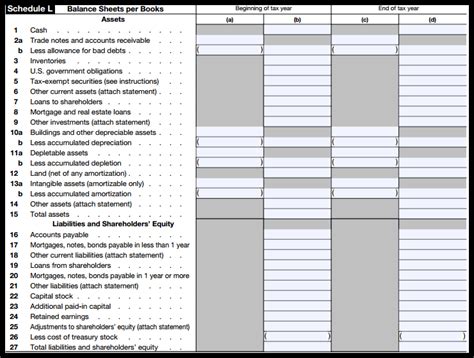

Form 1120 is the U.S. Corporation Income Tax Return, which is filed annually by domestic corporations. Schedule L, also known as the Balance Sheets per Books, is a supporting schedule that must be completed and attached to Form 1120. This schedule provides a snapshot of the corporation's financial position at the beginning and end of the tax year, allowing the IRS to verify the accuracy of the corporation's tax return.

Why is Schedule L Important?

Completing Schedule L accurately is crucial for several reasons:

- It helps the IRS to verify the corporation's financial position and ensures that the tax return is accurate.

- It provides a comprehensive picture of the corporation's assets, liabilities, and equity, which is essential for tax purposes.

- Inaccurate or incomplete information on Schedule L can lead to delays or even audits, resulting in additional costs and penalties for the corporation.

Form 1120 Schedule L Instructions

To complete Schedule L, follow these step-by-step instructions:

Section 1: Beginning of Year

- List the corporation's assets, liabilities, and equity as of the beginning of the tax year.

- Report the amounts in the following categories:

- Assets: cash, accounts receivable, inventory, property, and equipment, etc.

- Liabilities: accounts payable, loans payable, taxes owed, etc.

- Equity: common stock, retained earnings, etc.

Section 2: End of Year

- List the corporation's assets, liabilities, and equity as of the end of the tax year.

- Report the amounts in the same categories as Section 1.

Section 3: Reconciliation

- Reconcile the differences between the beginning and end of year amounts.

- Explain any significant changes or discrepancies in the corporation's financial position.

Tips for Accurate Completion

To ensure accurate completion of Schedule L:

- Use the corporation's financial statements, such as the balance sheet and income statement, to gather the necessary information.

- Verify that the amounts reported on Schedule L match the corporation's financial records.

- Use the same accounting method and period as the corporation's financial statements.

Common Mistakes to Avoid

- Inaccurate or incomplete information

- Failure to reconcile differences between beginning and end of year amounts

- Not using the same accounting method and period as the corporation's financial statements

By following these Form 1120 Schedule L instructions, you can ensure accurate completion of this essential form and avoid potential delays or penalties. Remember to take your time, verify the information, and seek professional help if needed.

Additional Resources

For more information on Form 1120 and Schedule L, refer to the IRS instructions and publications:

- IRS Form 1120 Instructions

- IRS Publication 542, Corporations

Conclusion

Completing Schedule L accurately is crucial for business tax filers. By following these instructions and tips, you can ensure that your corporation's financial position is accurately reported, reducing the risk of delays or penalties. If you have any questions or concerns, don't hesitate to seek professional help.

FAQ Section

What is the purpose of Schedule L?

+Schedule L provides a snapshot of the corporation's financial position at the beginning and end of the tax year, allowing the IRS to verify the accuracy of the corporation's tax return.

What information is required on Schedule L?

+Schedule L requires the corporation's assets, liabilities, and equity to be reported at the beginning and end of the tax year.

What are common mistakes to avoid on Schedule L?

+Inaccurate or incomplete information, failure to reconcile differences between beginning and end of year amounts, and not using the same accounting method and period as the corporation's financial statements.