The IRS Form 433-D is a crucial document for individuals and businesses seeking to establish an installment agreement with the Internal Revenue Service (IRS) to settle their tax debt. This form, also known as the Installment Agreement, allows taxpayers to make monthly payments towards their tax liability, rather than paying the full amount at once. In this article, we will delve into the details of the IRS Form 433-D, its importance, and provide a step-by-step guide on how to fill it out.

What is IRS Form 433-D?

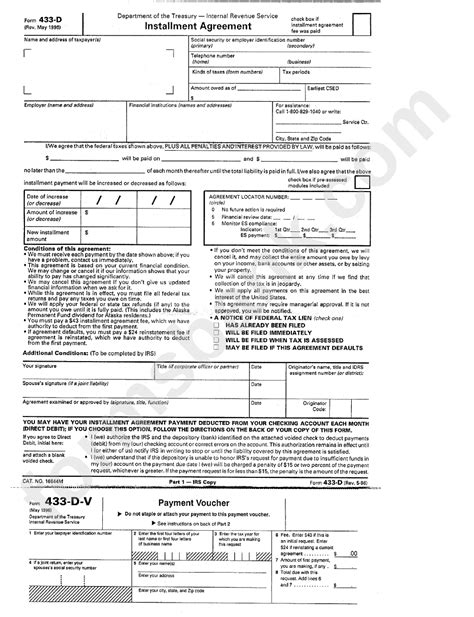

The IRS Form 433-D is a fillable form that taxpayers use to apply for an installment agreement. This agreement allows taxpayers to make monthly payments towards their tax debt, rather than paying the full amount at once. The form requires taxpayers to provide financial information, including income, expenses, and assets, to determine the amount of the monthly payment.

Who Needs to Fill Out IRS Form 433-D?

Taxpayers who owe taxes to the IRS and are unable to pay the full amount at once may need to fill out Form 433-D. This includes individuals and businesses with unpaid tax liabilities, such as:

- Individual taxpayers with unpaid income taxes

- Businesses with unpaid payroll taxes or other business taxes

- Taxpayers who have received a notice from the IRS stating that they owe taxes

Benefits of Filing IRS Form 433-D

Filing Form 433-D offers several benefits to taxpayers, including:

- Avoiding additional penalties and interest on unpaid taxes

- Establishing a manageable monthly payment plan

- Preventing wage garnishment or bank levies

- Reducing the risk of tax liens being filed against the taxpayer's property

How to Fill Out IRS Form 433-D

To fill out Form 433-D, taxpayers will need to gather financial information, including:

- Income statements, such as pay stubs and W-2 forms

- Expense statements, such as utility bills and rent receipts

- Asset statements, such as bank statements and investment accounts

Here is a step-by-step guide to filling out Form 433-D:

- Section 1: Taxpayer Information

- Enter your name, address, and Social Security number or Employer Identification Number (EIN)

- Provide your spouse's name and Social Security number (if applicable)

- Section 2: Tax Liability Information

- Enter the tax year(s) for which you owe taxes

- Provide the total amount of taxes owed

- Section 3: Financial Information

- List your income, including wages, tips, and self-employment income

- List your expenses, including rent/mortgage, utilities, and food

- List your assets, including cash, savings, and investments

- Section 4: Proposed Payment Plan

- Enter the proposed monthly payment amount

- Provide the date you can start making payments

Common Mistakes to Avoid

When filling out Form 433-D, taxpayers should avoid common mistakes, such as:

- Providing incomplete or inaccurate financial information

- Failing to include all necessary documentation

- Not signing and dating the form

After Submitting IRS Form 433-D

After submitting Form 433-D, taxpayers can expect the IRS to review their application and determine whether to approve or deny the installment agreement. If approved, taxpayers will receive a notice outlining the terms of the agreement, including the monthly payment amount and due date.

FAQs

Here are some frequently asked questions about IRS Form 433-D:

- Q: How long does it take to process Form 433-D? A: The processing time for Form 433-D can vary, but it typically takes 2-6 weeks for the IRS to review and respond to the application.

- Q: Can I submit Form 433-D online? A: No, Form 433-D must be submitted by mail or fax.

- Q: Can I appeal a denied installment agreement? A: Yes, taxpayers can appeal a denied installment agreement by submitting a written request to the IRS.

What is the phone number for the IRS to ask about Form 433-D?

+The phone number for the IRS to ask about Form 433-D is 1-800-829-1040.

Can I use Form 433-D to pay off multiple tax liabilities?

+No, Form 433-D can only be used to pay off one tax liability at a time.

What happens if I miss a payment on my installment agreement?

+If you miss a payment on your installment agreement, you may be subject to penalties and interest. Contact the IRS immediately to discuss your options.

By following the steps outlined in this article, taxpayers can successfully fill out and submit IRS Form 433-D, establishing an installment agreement with the IRS and avoiding additional penalties and interest on their unpaid taxes. If you have any questions or concerns about Form 433-D, don't hesitate to reach out to the IRS or a qualified tax professional. Share this article with friends and family who may be struggling with tax debt, and encourage them to take the first step towards resolving their tax liability.