When it comes to filing for a quick refund of overpaid taxes, Form 1045 is the go-to document. However, completing it correctly can be a daunting task, especially for those who are new to tax filing. In this article, we will break down the process into five manageable steps, making it easier for you to fill out Form 1045 accurately.

Why is Form 1045 Important?

Before we dive into the steps, let's quickly discuss the significance of Form 1045. This form allows individuals and businesses to claim a quick refund of overpaid taxes, which can be a significant financial boost. By filling out the form correctly, you can ensure that you receive your refund promptly and avoid any potential delays or penalties.

Step 1: Gather Required Information

To start filling out Form 1045, you'll need to gather the necessary information. This includes:

- Your name, address, and taxpayer identification number (TIN)

- The tax year for which you're claiming a refund

- The amount of overpaid taxes you're claiming

- The reason for the overpayment (e.g., due to a mistake in tax calculation or a change in income)

Make sure you have all the required documents and information before proceeding to the next step.

Step 2: Determine Your Eligibility

Who Can File Form 1045?

Not everyone is eligible to file Form 1045. To qualify, you must have overpaid your taxes for the tax year in question. This can occur due to various reasons, such as:

- Overreporting income

- Claiming too many deductions or credits

- Making a mistake in tax calculation

- Receiving a larger-than-expected refund

If you're unsure about your eligibility, consult with a tax professional or contact the IRS directly.

Step 3: Fill Out the Form

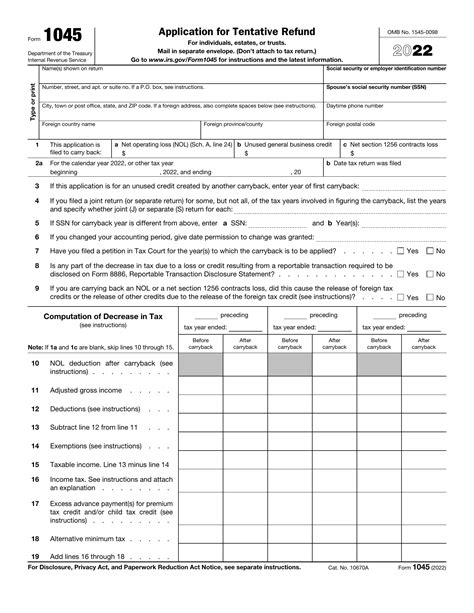

Now it's time to fill out the form. Here's a brief overview of the sections you'll need to complete:

- Part I: General Information

- Part II: Claim for Quick Refund of Overpayment

- Part III: Explanation of Overpayment

Make sure to follow the instructions carefully and fill out each section accurately. If you're unsure about any part of the form, consider consulting with a tax professional.

Step 4: Attach Supporting Documents

What Documents Do I Need to Attach?

To support your claim, you'll need to attach certain documents to Form 1045. These may include:

- A copy of your tax return (Form 1040 or Form 1120)

- A statement explaining the reason for the overpayment

- Supporting documentation for any deductions or credits claimed

Make sure to attach all required documents to avoid delays in processing your refund.

Step 5: Submit the Form

Once you've completed the form and attached all supporting documents, it's time to submit it to the IRS. You can do this by:

- Mailing the form to the address listed in the instructions

- Filing electronically through the IRS website

- Using a tax professional or tax preparation software

Make sure to keep a copy of the form and supporting documents for your records.

Get Your Refund Quickly and Accurately

By following these five steps, you can ensure that you fill out Form 1045 correctly and receive your quick refund promptly. Remember to gather all required information, determine your eligibility, fill out the form accurately, attach supporting documents, and submit the form correctly.

If you have any questions or concerns about filling out Form 1045, don't hesitate to reach out to a tax professional or contact the IRS directly.

What is the purpose of Form 1045?

+Form 1045 is used to claim a quick refund of overpaid taxes.

Who is eligible to file Form 1045?

+Individuals and businesses who have overpaid their taxes for the tax year in question are eligible to file Form 1045.

What documents do I need to attach to Form 1045?

+You'll need to attach a copy of your tax return, a statement explaining the reason for the overpayment, and supporting documentation for any deductions or credits claimed.

We hope this article has been helpful in guiding you through the process of filling out Form 1045. If you have any further questions or concerns, please don't hesitate to reach out.