In the world of California taxes, few forms are as mysterious as the SOS Form 807. While it may seem like just another piece of paperwork, understanding this form is crucial for businesses operating in the state. From what it's used for to how it's filed, here are five essential facts about the SOS Form 807.

What is the SOS Form 807?

The SOS Form 807, also known as the Statement of Information, is a California Secretary of State (SOS) form used by corporations, limited liability companies (LLCs), and other business entities to provide up-to-date information about their organization. This includes details such as the company's name, address, names of officers and directors, and other essential facts.

Why is the SOS Form 807 Important?

The SOS Form 807 is important because it helps the California Secretary of State maintain accurate records about businesses operating in the state. By providing this information, companies can ensure compliance with state regulations and avoid potential penalties.

Who Needs to File the SOS Form 807?

In California, most business entities, including:

- Corporations (profit and non-profit)

- Limited Liability Companies (LLCs)

- Limited Partnerships (LPs)

- Limited Liability Partnerships (LLPs)

- Cooperative corporations

need to file the SOS Form 807 with the Secretary of State.

What Information is Required on the SOS Form 807?

The SOS Form 807 requires businesses to provide the following information:

- Company name and address

- Names and addresses of officers and directors

- Names and addresses of managers (for LLCs and LPs)

- A brief description of the company's business purpose

- The name and address of the company's agent for service of process

How to File the SOS Form 807

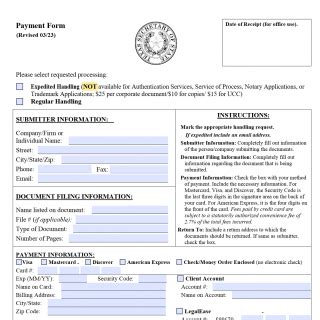

To file the SOS Form 807, businesses can submit the form online or by mail. The form must be signed by an authorized representative of the company, and the filing fee (currently $25) must be paid. Filings can be made online through the California Secretary of State's website or by mail to the address listed on the form.

What are the Penalties for Not Filing the SOS Form 807?

Failure to file the SOS Form 807 can result in penalties and fines, including:

- Late filing fees (up to $250)

- Suspension or revocation of the company's business license

- Loss of business name and trademark protection

Common Mistakes to Avoid When Filing the SOS Form 807

To avoid common mistakes when filing the SOS Form 807, businesses should:

- Verify the accuracy of the information provided

- Ensure the form is signed by an authorized representative

- Pay the correct filing fee

- Submit the form on time (every 2 years for most businesses)

By following these tips and understanding the essential facts about the SOS Form 807, businesses can ensure compliance with California regulations and avoid potential penalties.

Best Practices for Maintaining Compliance

To maintain compliance with California regulations, businesses should:

- Review and update their records regularly

- Ensure accurate and complete information on the SOS Form 807

- File the form on time (every 2 years for most businesses)

- Keep records of filings and payments

By following these best practices, businesses can maintain compliance and avoid potential penalties.

What is the purpose of the SOS Form 807?

+The SOS Form 807 is used to provide up-to-date information about a business entity to the California Secretary of State.

Who needs to file the SOS Form 807?

+Most business entities in California, including corporations, LLCs, LPs, and LLPs, need to file the SOS Form 807.

What are the penalties for not filing the SOS Form 807?

+Failure to file the SOS Form 807 can result in late filing fees, suspension or revocation of the business license, and loss of business name and trademark protection.