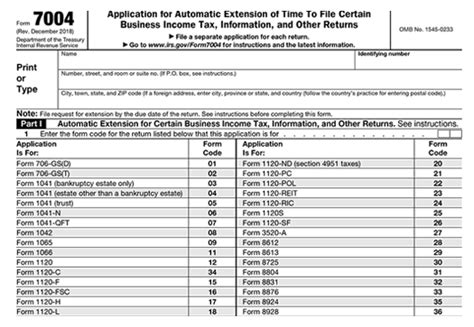

Filing for an LLC tax extension can be a lifesaver for businesses that need more time to prepare and submit their tax returns. The IRS Form 7004 is the form used to request an automatic six-month extension of time to file certain business income tax, information, and other returns. In this article, we will explore five ways to file LLC tax extension Form 7004, including the benefits, steps, and tips to keep in mind.

Why File for an LLC Tax Extension?

Before we dive into the ways to file Form 7004, let's discuss the benefits of filing for an LLC tax extension. The main reason businesses file for an extension is to avoid penalties and interest on late tax payments. The IRS imposes significant penalties and interest on businesses that fail to file or pay taxes on time. By filing for an extension, businesses can avoid these penalties and have more time to prepare and submit their tax returns accurately.

1. E-File Form 7004 through the IRS Website

The IRS offers an e-file option for businesses to file Form 7004 electronically. To e-file Form 7004, businesses will need to:

- Create an account on the IRS website

- Fill out Form 7004 online

- Submit the form electronically

The IRS will process the form and provide an electronic confirmation of receipt.

Benefits of E-Filing:

- Faster processing time

- Reduced errors

- Electronic confirmation of receipt

2. Mail Form 7004 to the IRS

Businesses can also file Form 7004 by mail. To mail Form 7004, businesses will need to:

- Download and complete Form 7004 from the IRS website

- Sign and date the form

- Mail the form to the IRS address listed in the instructions

Tips for Mailing Form 7004:

- Use certified mail with return receipt requested

- Keep a copy of the form and proof of mailing

- Allow sufficient time for the IRS to receive the form

3. Use Tax Software to File Form 7004

Tax software, such as TurboTax or H&R Block, offers an easy and convenient way to file Form 7004. These programs will guide businesses through the filing process and ensure that the form is completed accurately.

Benefits of Using Tax Software:

- Easy to use and navigate

- Accurate calculations and completion

- Fast processing time

4. Hire a Tax Professional to File Form 7004

Businesses can also hire a tax professional to file Form 7004 on their behalf. Tax professionals, such as CPAs or Enrolled Agents, have the expertise and knowledge to complete the form accurately and ensure that it is filed on time.

Benefits of Hiring a Tax Professional:

- Expertise and knowledge of tax laws and regulations

- Accurate completion and filing of the form

- Time-saving and reduced stress

5. Use a Tax Filing Service to File Form 7004

Tax filing services, such as TaxExtension.com or ExtensionTax.com, offer a convenient and affordable way to file Form 7004. These services will guide businesses through the filing process and ensure that the form is completed accurately.

Benefits of Using a Tax Filing Service:

- Easy to use and navigate

- Accurate calculations and completion

- Fast processing time

Final Thoughts

Filing for an LLC tax extension can be a lifesaver for businesses that need more time to prepare and submit their tax returns. By using one of the five methods outlined above, businesses can avoid penalties and interest on late tax payments and ensure that their tax returns are filed accurately and on time. Remember to keep a copy of the form and proof of filing, and to follow up with the IRS to ensure that the form was received and processed correctly.

Share Your Thoughts

Have you ever filed for an LLC tax extension? What method did you use, and what was your experience like? Share your thoughts and comments below!

FAQ Section

What is the deadline for filing Form 7004?

+The deadline for filing Form 7004 is the original due date of the tax return, which is typically March 15th for LLCs.

How long is the extension period?

+The extension period is six months from the original due date of the tax return.

Can I file for an extension if I owe taxes?

+Yes, you can file for an extension even if you owe taxes. However, you will still need to pay any taxes owed by the original due date to avoid penalties and interest.