As a business owner or individual, dealing with the sale or exchange of certain types of property can be a complex and overwhelming experience, especially when it comes to tax implications. The IRS Form 4797 is a crucial document that helps taxpayers report the sale, exchange, or other disposition of certain types of property, including business property, depreciable property, and section 1231 property. In this article, we will provide a step-by-step guide to help you navigate the Form 4797 instructions and ensure accurate reporting of your transactions.

Understanding the Purpose of Form 4797

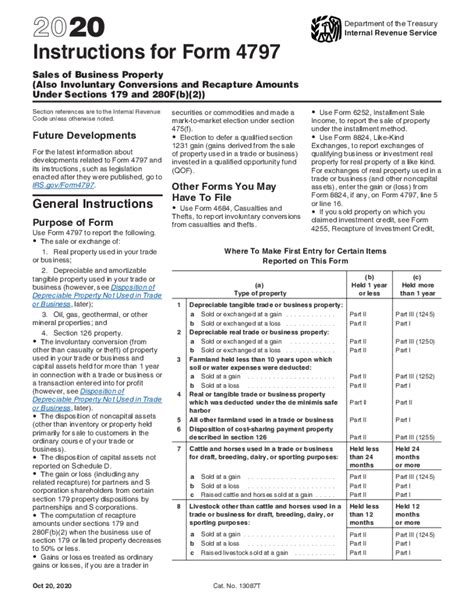

Form 4797, also known as the Sales of Business Property form, is used to report the sale, exchange, or other disposition of business property, including depreciable property, section 1231 property, and other types of property. The form is used to calculate the gain or loss from these transactions, which is then reported on the taxpayer's income tax return.

Who Needs to File Form 4797?

Form 4797 is required for taxpayers who have sold, exchanged, or otherwise disposed of business property, including:

- Depreciable property, such as equipment, machinery, or buildings

- Section 1231 property, such as real estate, copyrights, or patents

- Other types of property, such as inventory or securities

Taxpayers who have engaged in these types of transactions must file Form 4797, regardless of whether they have a gain or loss from the transaction.

Step 1: Gather Required Information

Before starting the Form 4797, gather all required information, including:

- Date of sale or exchange

- Description of property sold or exchanged

- Original cost or basis of property

- Depreciation allowed or allowable

- Selling price or exchange value

- Gain or loss from the transaction

Step 2: Complete Part I - Section 1231 Transactions

Part I of Form 4797 is used to report section 1231 transactions, which include the sale or exchange of real estate, copyrights, or patents. Complete the following lines:

- Line 1: Date of sale or exchange

- Line 2: Description of property sold or exchanged

- Line 3: Original cost or basis of property

- Line 4: Depreciation allowed or allowable

- Line 5: Selling price or exchange value

- Line 6: Gain or loss from the transaction

Step 3: Complete Part II - Ordinary Gains and Losses

Part II of Form 4797 is used to report ordinary gains and losses from the sale or exchange of business property. Complete the following lines:

- Line 7: Date of sale or exchange

- Line 8: Description of property sold or exchanged

- Line 9: Original cost or basis of property

- Line 10: Depreciation allowed or allowable

- Line 11: Selling price or exchange value

- Line 12: Gain or loss from the transaction

Step 4: Complete Part III - Recapture Amounts

Part III of Form 4797 is used to report recapture amounts, which are amounts previously deducted as depreciation or amortization that must be recaptured as ordinary income. Complete the following lines:

- Line 13: Date of sale or exchange

- Line 14: Description of property sold or exchanged

- Line 15: Recapture amount

Step 5: Calculate Net Gain or Loss

Calculate the net gain or loss from the transactions reported on Form 4797. This is done by adding up the gains and losses from each transaction and subtracting the total losses from the total gains.

Step 6: Report Net Gain or Loss on Income Tax Return

Report the net gain or loss from Form 4797 on the taxpayer's income tax return. This is typically done on Schedule D (Capital Gains and Losses) or Form 8824 (Like-Kind Exchanges).

Common Mistakes to Avoid

When completing Form 4797, avoid the following common mistakes:

- Failing to report all transactions, including those with a gain or loss

- Incorrectly calculating depreciation or amortization

- Failing to recapture amounts previously deducted as depreciation or amortization

- Incorrectly reporting the net gain or loss on the income tax return

Conclusion

Completing Form 4797 can be a complex and overwhelming task, but by following these step-by-step instructions, taxpayers can ensure accurate reporting of their transactions. Remember to gather all required information, complete each part of the form carefully, and calculate the net gain or loss correctly. By avoiding common mistakes and seeking professional help when needed, taxpayers can ensure compliance with IRS regulations and minimize potential penalties.

What is the purpose of Form 4797?

+Form 4797 is used to report the sale, exchange, or other disposition of business property, including depreciable property, section 1231 property, and other types of property.

Who needs to file Form 4797?

+Taxpayers who have sold, exchanged, or otherwise disposed of business property, including depreciable property, section 1231 property, and other types of property.

What information is required to complete Form 4797?

+Taxpayers will need to gather information, including date of sale or exchange, description of property sold or exchanged, original cost or basis of property, depreciation allowed or allowable, selling price or exchange value, and gain or loss from the transaction.