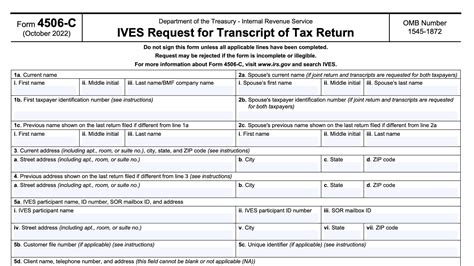

The IRS Form 4506-C, also known as the IVES Request for Transcript of Tax Return, is a crucial document that allows taxpayers to request a transcript of their tax return information from the Internal Revenue Service (IRS). With the increasing demand for online services, getting your IRS Form 4506-C instantly has become a convenient and time-saving option. In this article, we will delve into the world of IRS Form 4506-C, its importance, benefits, and the steps to obtain it instantly.

The Importance of IRS Form 4506-C

The IRS Form 4506-C is an essential document for taxpayers who need to access their tax return information. This form allows taxpayers to request a transcript of their tax return, which can be used for various purposes, such as:

- Verifying income and employment status

- Applying for loans or credit

- Preparing tax returns

- Responding to IRS audits or inquiries

Benefits of Getting Your IRS Form 4506-C Instantly

With the advent of online services, getting your IRS Form 4506-C instantly has become a convenient and efficient option. Some of the benefits of getting your IRS Form 4506-C instantly include:

- Time-saving: Requesting your IRS Form 4506-C online saves time and effort compared to traditional mail or phone requests.

- Convenience: Online services allow taxpayers to request their IRS Form 4506-C from the comfort of their own homes, 24/7.

- Faster processing: Online requests are typically processed faster than traditional requests, ensuring that taxpayers receive their transcripts quickly.

How to Get Your IRS Form 4506-C Instantly

To get your IRS Form 4506-C instantly, follow these steps:

Step 1: Gather Required Information

Before requesting your IRS Form 4506-C, gather the required information, including:

- Your name and Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your date of birth

- Your tax filing status

- The tax year(s) you are requesting transcripts for

Step 2: Choose an Online Service Provider

There are several online service providers that offer instant IRS Form 4506-C services. Choose a reputable provider that is authorized by the IRS to provide transcript services.

Step 3: Fill Out the Online Request Form

Fill out the online request form, providing the required information. Make sure to double-check your information for accuracy.

Step 4: Submit Your Request

Submit your request, and the online service provider will process it instantly.

Step 5: Receive Your Transcript

Once your request is processed, you will receive your IRS Form 4506-C transcript via email or mail, depending on the service provider's delivery options.

Tips for Requesting Your IRS Form 4506-C Instantly

When requesting your IRS Form 4506-C instantly, keep the following tips in mind:

- Verify the service provider's credentials: Ensure that the online service provider is authorized by the IRS to provide transcript services.

- Double-check your information: Accurate information is crucial for processing your request quickly and efficiently.

- Choose a secure service provider: Opt for a service provider that uses secure encryption and protects your sensitive information.

Common Errors to Avoid When Requesting Your IRS Form 4506-C

When requesting your IRS Form 4506-C, avoid the following common errors:

- Inaccurate information: Double-check your information to ensure accuracy.

- Incomplete information: Provide all required information to avoid delays.

- Choosing an unauthorized service provider: Verify the service provider's credentials before submitting your request.

Frequently Asked Questions

Q: What is the IRS Form 4506-C?

A: The IRS Form 4506-C is a document that allows taxpayers to request a transcript of their tax return information from the IRS.

Q: How do I request my IRS Form 4506-C instantly?

A: You can request your IRS Form 4506-C instantly by using an online service provider authorized by the IRS.

Q: What information do I need to provide to request my IRS Form 4506-C?

A: You will need to provide your name, Social Security number or ITIN, date of birth, tax filing status, and the tax year(s) you are requesting transcripts for.

Get Your IRS Form 4506-C Instantly Today

Don't wait any longer to get your IRS Form 4506-C. With instant online services, you can request your transcript quickly and efficiently. Follow the steps outlined in this article, and you'll be on your way to getting your IRS Form 4506-C instantly.

What is the purpose of the IRS Form 4506-C?

+The IRS Form 4506-C allows taxpayers to request a transcript of their tax return information from the IRS.

How long does it take to process an IRS Form 4506-C request?

+Online requests are typically processed instantly, while traditional requests may take several days or weeks to process.

Can I request my IRS Form 4506-C by phone or mail?

+Yes, you can request your IRS Form 4506-C by phone or mail, but online requests are typically faster and more convenient.