As an independent contractor on Upwork, managing your finances and taxes can be a daunting task. One of the most important aspects of being a freelancer is understanding your tax obligations, including filing the necessary tax forms. In this article, we will provide you with 5 essential Upwork tax form filing tips to help you navigate the process with ease.

Why Tax Form Filing is Important for Upwork Freelancers

As a freelancer on Upwork, you are considered self-employed and are required to report your income and expenses on your tax return. Filing the correct tax forms is crucial to avoid any penalties or fines from the IRS. Moreover, accurate tax form filing can help you take advantage of deductions and credits that can reduce your tax liability.

Tip 1: Understand Your Tax Classification

Before you start filing your tax forms, it's essential to understand your tax classification. As an Upwork freelancer, you are likely to be classified as a sole proprietor or a single-member limited liability company (LLC). This classification will determine the tax forms you need to file and the deductions you can claim.

Tip 2: Gather All Necessary Documents

Essential Documents for Tax Form Filing

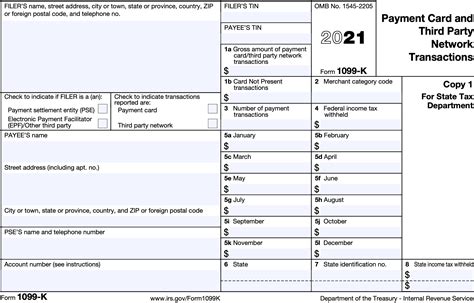

- 1099-MISC form from Upwork

- Invoices and receipts for business expenses

- Bank statements and records of business income

- Business use percentage of home office expenses

- Business use percentage of car expenses

To file your tax forms accurately, you need to gather all necessary documents. This includes your 1099-MISC form from Upwork, invoices and receipts for business expenses, bank statements, and records of business income. Additionally, if you use your home office or car for business purposes, you need to calculate the business use percentage to claim deductions.

Tip 3: Choose the Right Tax Forms

Common Tax Forms for Upwork Freelancers

- Form 1040: Personal Income Tax Return

- Schedule C: Business Income and Expenses

- Schedule SE: Self-Employment Tax

- Form 8829: Expenses for Business Use of Your Home

As an Upwork freelancer, you need to file the correct tax forms to report your income and expenses. The most common tax forms for freelancers include Form 1040, Schedule C, Schedule SE, and Form 8829. Schedule C is used to report business income and expenses, while Schedule SE is used to report self-employment tax. Form 8829 is used to claim home office deductions.

Tip 4: Claim Business Expenses and Deductions

Common Business Expenses and Deductions for Upwork Freelancers

- Home office expenses

- Business use of car expenses

- Business travel expenses

- Equipment and software expenses

- Professional fees and insurance premiums

Claiming business expenses and deductions can help reduce your tax liability. As an Upwork freelancer, you can claim home office expenses, business use of car expenses, business travel expenses, equipment and software expenses, and professional fees and insurance premiums. Make sure to keep accurate records and calculate the business use percentage to claim deductions.

Tip 5: Seek Professional Help if Needed

Benefits of Seeking Professional Help

- Accurate tax form filing

- Maximizing deductions and credits

- Avoiding penalties and fines

- Saving time and reducing stress

If you're unsure about the tax form filing process or need help with complex tax issues, consider seeking professional help. A tax professional can help you file your tax forms accurately, maximize deductions and credits, and avoid penalties and fines. They can also save you time and reduce stress during the tax filing process.

Staying Ahead of the Game

Filing tax forms as an Upwork freelancer requires attention to detail and a good understanding of tax laws and regulations. By following these 5 essential Upwork tax form filing tips, you can ensure accurate and timely filing, maximize deductions and credits, and avoid penalties and fines. Remember to stay organized, keep accurate records, and seek professional help if needed.

Share Your Thoughts

Have you had any experience with filing tax forms as an Upwork freelancer? Share your thoughts and tips in the comments below. If you found this article helpful, please share it with your fellow freelancers.

FAQ Section

What is the deadline for filing tax forms as an Upwork freelancer?

+The deadline for filing tax forms as an Upwork freelancer is typically April 15th of each year.

Do I need to file a tax return if I earned less than $600 on Upwork?

+Yes, you are required to file a tax return if you earned more than $400 on Upwork, regardless of whether you received a 1099-MISC form.

Can I deduct business expenses on my tax return?

+Yes, you can deduct business expenses on your tax return, but you must keep accurate records and calculate the business use percentage to claim deductions.