The IRS Form 1040 is one of the most commonly used tax forms in the United States, used by individuals to report their annual income and pay their taxes. In this article, we will provide a comprehensive guide to help you understand the IRS Form 1040 for the 2019 tax year, including its components, filing requirements, and tips for a smooth filing process.

What is the IRS Form 1040?

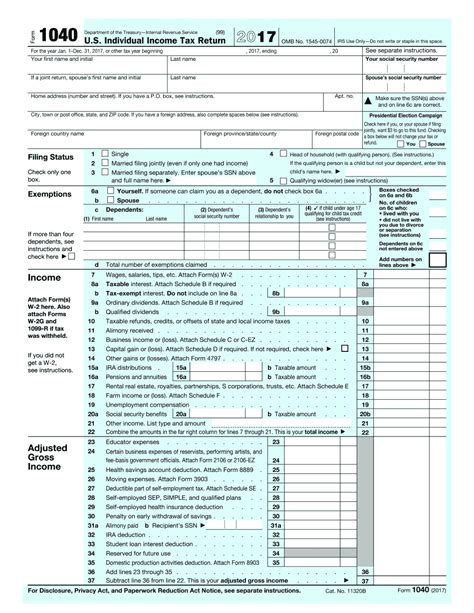

The IRS Form 1040 is a personal income tax return form used by individuals to report their annual income, claim deductions and credits, and pay their taxes. The form is used to calculate an individual's tax liability, which is the amount of taxes owed to the government. The IRS Form 1040 is typically filed on an annual basis, with the filing deadline usually falling on April 15th of each year.

Components of the IRS Form 1040

The IRS Form 1040 consists of several components, including:

- Form 1040: The main form used to report income, claim deductions and credits, and calculate tax liability.

- Schedule 1: Additional income and adjustments to income, such as capital gains and losses.

- Schedule 2: Tax credits, such as the earned income tax credit and the child tax credit.

- Schedule 3: Additional taxes, such as self-employment tax and unreported tips.

- Schedule 4: Other taxes, such as the alternative minimum tax and the net investment income tax.

- Form 8941: The Small Business Health Care Tax Credit.

- Form 8962: The Premium Tax Credit.

Filing Status

When filing the IRS Form 1040, you will need to select a filing status, which determines the tax rates and deductions you are eligible for. The five filing statuses are:

- Single: Unmarried individuals or those who are considered unmarried for tax purposes.

- Married Filing Jointly: Married couples who file their taxes together.

- Married Filing Separately: Married couples who file their taxes separately.

- Head of Household: Unmarried individuals who support dependents and meet certain requirements.

- Qualifying Widow(er): Widows or widowers who meet certain requirements.

Filing Requirements for the IRS Form 1040

To determine if you need to file the IRS Form 1040, you will need to meet certain income requirements. For the 2019 tax year, you are required to file a tax return if your gross income meets the following thresholds:

- Single: $12,200 or more

- Married Filing Jointly: $24,400 or more

- Married Filing Separately: $5 or more

- Head of Household: $18,350 or more

- Qualifying Widow(er): $25,000 or more

Who Should File the IRS Form 1040?

Even if you are not required to file a tax return, you may still want to file the IRS Form 1040 if:

- You have taxes withheld from your paycheck and want to claim a refund.

- You are eligible for a tax credit, such as the earned income tax credit.

- You want to report income from self-employment or freelance work.

- You have investments or capital gains and losses.

Tips for Filing the IRS Form 1040

Here are some tips to help you file the IRS Form 1040 successfully:

- Gather all necessary documents: Make sure you have all the necessary documents, including W-2s, 1099s, and receipts for deductions.

- Use tax software or a tax professional: Consider using tax software or hiring a tax professional to help you file your taxes.

- Take advantage of tax credits and deductions: Claim all eligible tax credits and deductions to reduce your tax liability.

- File electronically: Filing electronically can help reduce errors and speed up the refund process.

- Keep records: Keep records of your tax return and supporting documents in case of an audit.

<h3/Common Mistakes to Avoid

When filing the IRS Form 1040, it's essential to avoid common mistakes that can delay your refund or result in penalties. Some common mistakes to avoid include:

- Math errors: Double-check your math to ensure accuracy.

- Incorrect filing status: Make sure you select the correct filing status.

- Missing or incorrect information: Ensure all information is complete and accurate.

- Not reporting all income: Report all income, including income from self-employment or freelance work.

Conclusion

Filing the IRS Form 1040 can seem overwhelming, but with the right guidance and preparation, you can ensure a smooth filing process. Remember to gather all necessary documents, take advantage of tax credits and deductions, and avoid common mistakes. If you're unsure about any aspect of the filing process, consider consulting a tax professional or using tax software.

We hope this comprehensive guide has helped you understand the IRS Form 1040 for the 2019 tax year. If you have any questions or comments, please feel free to share them below.

What is the deadline for filing the IRS Form 1040?

+The deadline for filing the IRS Form 1040 is typically April 15th of each year.

Do I need to file the IRS Form 1040 if I don't owe taxes?

+Even if you don't owe taxes, you may still want to file the IRS Form 1040 if you have taxes withheld from your paycheck and want to claim a refund.

Can I file the IRS Form 1040 electronically?

+Yes, you can file the IRS Form 1040 electronically through the IRS website or using tax software.