Filing your Manitoba TD1 form accurately and on time is essential to ensure you're not overpaying taxes or facing any penalties. As a resident of Manitoba, understanding the TD1 form and how to file it correctly is crucial for your financial well-being. In this article, we'll provide you with five valuable tips to help you navigate the process of filing your Manitoba TD1 form.

Understanding the TD1 Form

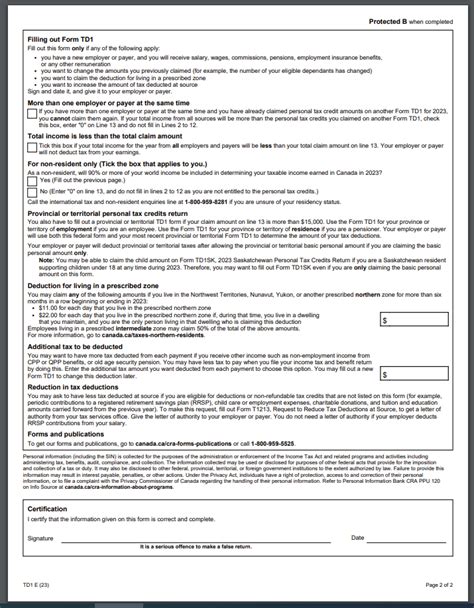

Before we dive into the tips, let's briefly discuss what the TD1 form is and its significance. The TD1 form, also known as the Personal Tax Credits Return, is a document that allows you to claim personal tax credits and deductions on your income tax return. It's a vital form that helps you reduce your taxable income, resulting in lower taxes owed.

Why is the TD1 Form Important?

Filing the TD1 form accurately and on time is crucial because it directly affects the amount of taxes you pay. By claiming the correct personal tax credits and deductions, you can minimize your tax liability and avoid any potential penalties.

Tips for Filing Your Manitoba TD1 Form

Now that we've covered the basics, let's move on to the five tips for filing your Manitoba TD1 form:

Tip 1: Gather Required Documents

Before starting the filing process, ensure you have all the necessary documents. You'll need:

- Your Social Insurance Number (SIN)

- Your Manitoba Health Insurance Card

- Information about your dependents (if applicable)

- Details about your residence (if you're a new resident or have moved)

Having these documents ready will help you fill out the form accurately and efficiently.

Tip 2: Claim All Eligible Credits and Deductions

The TD1 form allows you to claim various personal tax credits and deductions. Make sure to claim all the credits and deductions you're eligible for, including:

- Basic personal amount

- Spousal amount

- Dependent amount

- Tuition credits

- Medical expenses

Claiming these credits and deductions can significantly reduce your taxable income, resulting in lower taxes owed.

Tip 3: Update Your Form Annually

It's essential to review and update your TD1 form annually to ensure you're taking advantage of all the credits and deductions available to you. Your personal circumstances may have changed, and updating your form will help you reflect these changes.

Tip 4: Seek Professional Help if Needed

If you're unsure about how to fill out the TD1 form or have complex tax situations, consider seeking professional help from a tax consultant or accountant. They can guide you through the process and ensure you're taking advantage of all the credits and deductions available to you.

Tip 5: File Your Form On Time

Finally, make sure to file your TD1 form on time to avoid any penalties or interest. The deadline for filing the TD1 form is typically January 31st of each year. If you're unsure about the deadline or have any questions, contact the Canada Revenue Agency (CRA) for guidance.

Conclusion and Next Steps

Filing your Manitoba TD1 form accurately and on time is crucial for minimizing your tax liability and avoiding any penalties. By following the five tips outlined in this article, you'll be well on your way to ensuring a smooth and efficient filing process. Remember to gather required documents, claim all eligible credits and deductions, update your form annually, seek professional help if needed, and file your form on time.

If you have any questions or concerns about filing your Manitoba TD1 form, don't hesitate to reach out to the CRA or a tax professional for guidance. Stay informed, and happy filing!

What is the deadline for filing the Manitoba TD1 form?

+The deadline for filing the Manitoba TD1 form is typically January 31st of each year.

Can I file my TD1 form electronically?

+Do I need to file a separate TD1 form for each province?

+No, you only need to file one TD1 form, which will apply to all provinces.