In the world of business and finance, accuracy and attention to detail are crucial when filling out important documents. One such document is the TC 40 form, which is used by employers in the state of Utah to report wages and taxes withheld from their employees. Filling out the TC 40 form correctly is essential to avoid penalties, fines, and other complications. In this article, we will guide you through the process of filling out the TC 40 form correctly, highlighting the key information you need to provide and the common mistakes to avoid.

Understanding the TC 40 Form

Before we dive into the nitty-gritty of filling out the TC 40 form, let's take a brief look at what it is and why it's important. The TC 40 form is used by employers in Utah to report wages and taxes withheld from their employees to the Utah State Tax Commission. The form is used to calculate the employer's tax liability and to report any taxes withheld from employee wages.

Step 1: Gathering the Required Information

To fill out the TC 40 form correctly, you will need to gather the following information:

- Your employer identification number (EIN)

- The names and Social Security numbers of all employees who worked for you during the quarter

- The total wages paid to each employee during the quarter

- The total taxes withheld from each employee's wages during the quarter

- The total amount of taxes withheld from all employees during the quarter

Step 2: Filling Out the Form

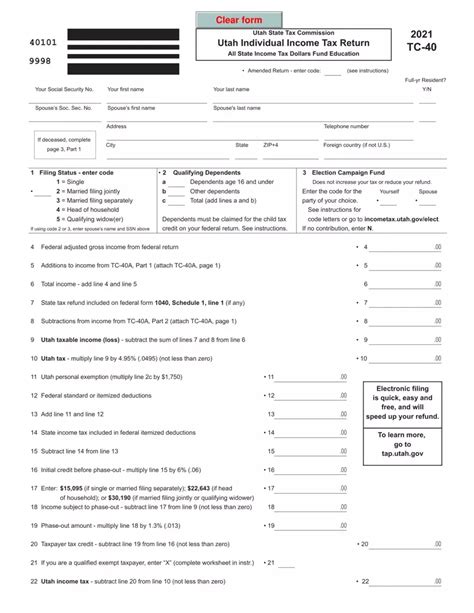

Once you have gathered all the required information, you can begin filling out the TC 40 form. Here are the key sections you need to complete:

- Section 1: Employer Information: Enter your employer identification number (EIN), business name, and address.

- Section 2: Employee Information: Enter the names and Social Security numbers of all employees who worked for you during the quarter.

- Section 3: Wages and Taxes Withheld: Enter the total wages paid to each employee during the quarter and the total taxes withheld from each employee's wages.

- Section 4: Total Taxes Withheld: Enter the total amount of taxes withheld from all employees during the quarter.

Common Mistakes to Avoid

When filling out the TC 40 form, there are several common mistakes to avoid. These include:

- Inaccurate or incomplete information: Make sure to double-check all the information you enter on the form to ensure it is accurate and complete.

- Failure to report all employees: Make sure to report all employees who worked for you during the quarter, including part-time and seasonal workers.

- Failure to report all wages and taxes withheld: Make sure to report all wages and taxes withheld from employee wages during the quarter.

Step 3: Calculating the Tax Liability

Once you have completed the TC 40 form, you will need to calculate your tax liability. This involves multiplying the total wages paid to all employees during the quarter by the applicable tax rate.

Example of Calculating Tax Liability

For example, let's say you paid a total of $100,000 in wages to all employees during the quarter and the applicable tax rate is 5%. Your tax liability would be:

$100,000 x 5% = $5,000

Step 4: Filing the Form

Once you have completed the TC 40 form and calculated your tax liability, you will need to file the form with the Utah State Tax Commission. You can file the form electronically or by mail.

Electronic Filing

To file the form electronically, you will need to use the Utah State Tax Commission's online filing system. You can access the system by visiting the commission's website and following the instructions.

Step 5: Paying the Tax Liability

Once you have filed the TC 40 form, you will need to pay your tax liability. You can pay by check, money order, or electronic funds transfer.

Conclusion

Filling out the TC 40 form correctly is essential to avoid penalties, fines, and other complications. By following the steps outlined in this article, you can ensure that you provide the required information accurately and complete the form correctly. Remember to gather all the required information, fill out the form carefully, calculate your tax liability, file the form, and pay your tax liability on time.

What is the TC 40 form used for?

+The TC 40 form is used by employers in Utah to report wages and taxes withheld from their employees to the Utah State Tax Commission.

What information do I need to provide on the TC 40 form?

+You will need to provide your employer identification number (EIN), the names and Social Security numbers of all employees who worked for you during the quarter, the total wages paid to each employee during the quarter, and the total taxes withheld from each employee's wages during the quarter.

How do I calculate my tax liability?

+You can calculate your tax liability by multiplying the total wages paid to all employees during the quarter by the applicable tax rate.